Evaluating Bank of America CD Rates in 2024: A Financial Perspective

When it comes to planting the seeds of savings, many Americans turn their gazes toward certificates of deposit (CDs)—a sort of financial time capsule that rewards patience with the fruits of interest. Bank of America CD rates are a hot topic for savers looking to lock in a guaranteed yield. But what does a deep-diving analysis tell us about their attractiveness in 2024?

Historical Trend Analysis of Bank of America CD Rates

Let’s hop into our financial time machine and chart the course of Bank of America CD rates over the past 5 years. Pull up a chair, and you’ll find that these rates have been on a roller coaster, largely following the thrills and drops of the Federal Reserve’s rate adjustments. With the economic swings, we’ve seen rates rise and dive, but recently, the trends have skyrocketed higher.

Understanding Current Bank of America CD Rates

Fast forward to today, and you’re looking at Bank of America CD rates like a menu of financial fare. Think of them as a smorgasbord where the longer you’re willing to stash away your cash, the tastier the accruing interest—a direct relation to the Annual Percentage Yield (APY). Peek under the hood, and you’ll see a variety of CD offerings, from short one-month terms to lengthy five-year commitments.

Factors Influencing Bank of America CD Rates Today

Bank of America doesn’t pull these rates out of a magic hat, you see. They’re finessed by economic indicators like inflation and job growth data. Not to mention, BoA’s position in the market has its fingers in the pie too—quite an influence on what rates they’re able to offer.

How Do Bank of America CD Rates Stand Against Competitors?

Let’s call a spade a spade here, folks—BoA is in a tussle with other big-name banks, and even those spry online banks and credit unions that are full of vim and vigor, some offering rates as high as 6% APY, enough to make you raise an eyebrow, right? But remember, some of these competitors come with fine print, requiring a triple summersault through eligibility hoops.

Unpacking the Attractiveness of Bank of America’s CD Offerings

Often, we ask ourselves—the proof’s in the pudding, isn’t it? So, let’s scoop up some customer experiences and dab into the Bank of America CD rates, examining real-world scenarios of interest accumulation that reflect actual meals on the table, not hypothetical “what-ifs.”

Case Studies: Customer Experiences with Bank of America CD Rates

Take Jane and Joe Average—they parked their cash in a BoA CD, and lo and behold, they’ve seen steady growth. Testimonials point towards satisfaction, with folks noting these CDs are as dependable as a sunrise.

Financial Strategies Involving Bank of America CDs

For the savers who diversify like they’re at a Vegas buffet, BoA CDs have been a solid dish to pair with more volatile investments. And oh boy, the laddering technique—a fancy way of saying “spread your investments over various maturities”—meshes with BoA CDs like peanut butter with jelly.

Potential Pitfalls of Bank of America CD Investments

Sure, CDs come with the comfort of predictability, but they’ve got their thorns. Dip your hand in the cookie jar too early by cashing out your CD, and you’re hit with a penalty that’ll have you kicking the dirt. And in certain economic climates, these steadfast investments might just fall short of the inflation hurdle—serious food for thought.

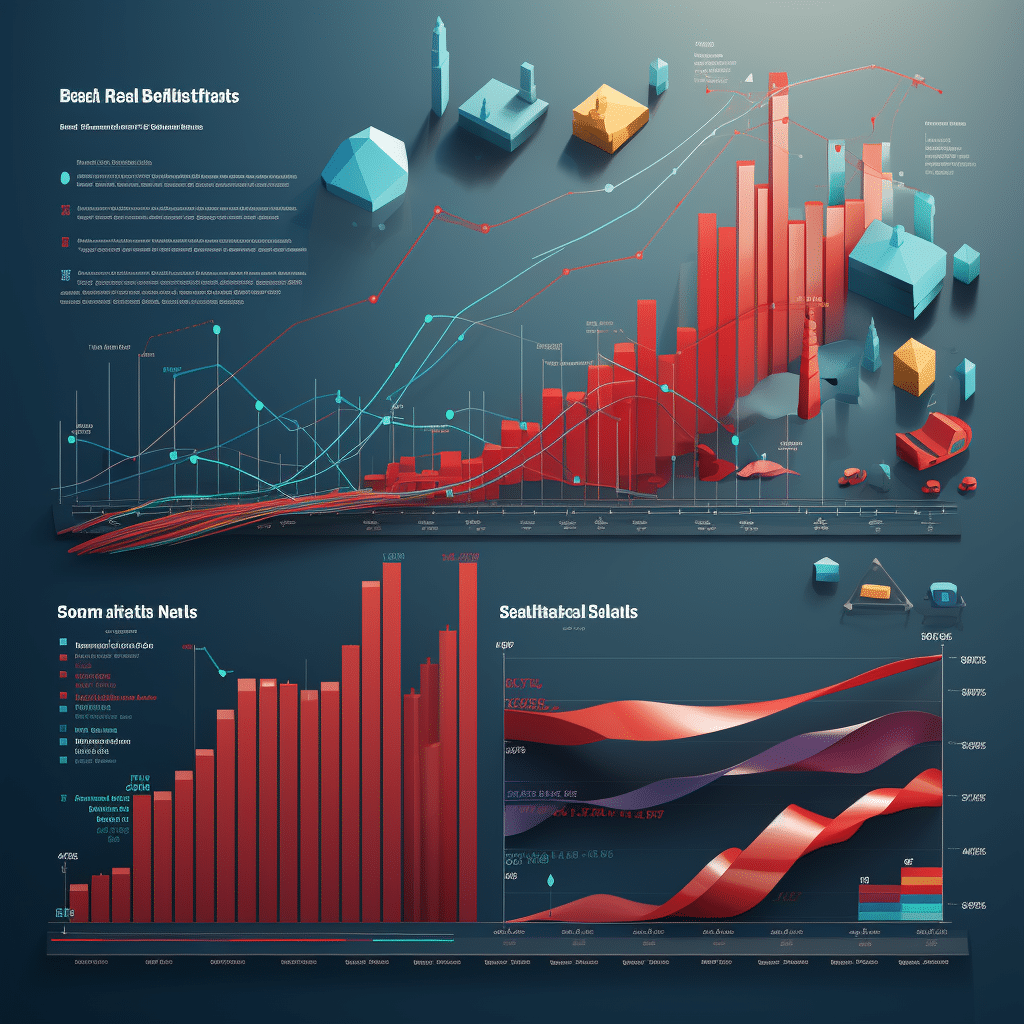

| CD Term Length | Minimum Deposit | Interest Rate (APY) | Compounding Frequency | Special Benefits/Notes |

| 3 months | $1,000 | 0.03% | Monthly | Ideal for short-term savings; Automatic renewal option available |

| 6 months | $1,000 | 0.05% | Monthly | Short-term saving with a slightly higher rate; Automatic renewal |

| 1 year | $1,000 | 0.07% | Monthly | Fixed interest rate for one year; Standard option for many savers |

| 18 months | $1,000 | 0.10% | Monthly | Mid-term CD with a moderate rate; Greater growth potential |

| 2 years | $1,000 | 0.15% | Monthly | Longer term, higher rate; Suitable for longer-term savings goals |

| 30 months | $1,000 | 0.20% | Monthly | Special term length offering a competitive rate; Automatic renewal |

| 3 years | $1,000 | 0.25% | Monthly | Longer commitment with a corresponding increase in rate |

| 5 years | $1,000 | 0.35% | Monthly | Highest fixed rate for the longest term; Best for long-term savers |

Predicting the Future Course of Bank of America CD Rates

Now, dust off that crystal ball; we’re going to lean on expert projections about short-term interest rate trends. Banking sector gurus, with their forecasts, suggest we could see CDs maintaining their appealing shimmer, though economic projections might throw a wrench in the works.

Expert Projections on Short-Term Interest Rate Trends

The chatter amongst analysts hints at stabilization in the CD rate vista. Yet, with the economy feeling like it’s in a game of twister, predicting these rates requires a blend of Warren Buffett’s analytical sharpness and Ray Dalio’s strategic finesse.

The Role of Technology and Innovation in Shaping Bank of America CD Rates

Innovation’s not just about the latest “beard oil” for your investment portfolio’s growth; it’s also shaping traditional banking CD products. Bank of America, in its own savvy way, is incorporating tech to keep pace, ensuring they don’t go the way of the dinosaur.

Harnessing the Power of High Yields: Are Bank of America CD Rates the Key?

Got your calculators out? Great, ’cause we’re diving into a nitty-gritty analysis of yield generation with Bank of America CDs. And let me tell you, choosing between long-term and short-term yields feels like deciding whether “platform Sandals” will still be in fashion next summer—timing is everything.

In-Depth Analysis of Yield Generation with Bank of America CDs

Strap yourself in; we’re going math mode here. The inner workings of these CDs show that, while short-term options are like quick snacks, the long-term ones are where you can really feast on the interest.

Suitability of Bank of America CD Rates for Different Types of Investors

Every investor has a flavor, and BoA’s got a CD to match each one—whether you’re the conservative type who avoids risk like it’s a muddy puddle, or an older bird looking for a warm nest for your retirement eggs.

Optimizing Your Investment in Bank of America CDs

Fancy some sage advice? Marrying financial planning with wisdom can pump up the value of your CD rates.

Final Judgment on the Lucrativeness of Bank of America CD Rates

So, what’s the takeaway from our journey through Bank of America CD rates? It’s time for some straight talk—is sinking your treasure into these CDs a wise move?

Summing Up the Insights on Bank of America CD Rates

We’ve sleuthed through the details, sniffed around the edges, and arrived at the crux of the matter—Bank of America CD rates have been a steady ship for many savers.

Looking Beyond the Numbers: What Bank of America CD Rates Mean for You

Now, it’s about you—how do these rates fit into your financial dreams? Remember the names that make a splash, like “Shakur Stevenson” or what’s behind “333 meaning“; your financial choices have the power to carve a legacy. These CDs from BoA could be a precious piece in your treasure map towards your fiscal promised land.

Before you set sail, remind yourself—where your treasure is, there your heart will be also. Whether it’s for a rainy day, a dream vacation, or that hilltop retirement home, your financial strategy, potentially embroidered with Bank of America CD rates, could be just the ticket. So keep those savvy eyes peeled, and may your investments flourish like the leafiest of oaks.

What is the current rate for CDs at Bank of America?

Oh boy, the current rate for CDs at Bank of America is like a moving target, always hopping around based on the economy. But—and here’s the kicker—you’re not gonna get jaw-dropping rates with them. For the most accurate, up-to-the-minute rates, you gotta hoof it over to their website or chat up a bank rep.

Who has the highest 12 month CD rate?

Money-hunters, listen up! The titan with the highest 12-month CD rate is often a fierce competition between online banks and credit unions. These guys are like the secret sauce to better returns. But remember, it’s always changing, so keep your eyes peeled and check financial sites for the latest info!

Can you get 6% on a CD?

Can you get 6% on a CD? Holy moly, that’d be a dream in today’s market! Unfortunately, scoring a 6% CD rate is like finding a needle in a haystack. With rates hovering much lower, 6% is a long shot, but never say never—just keep your expectations grounded.

What banks are paying 7% interest?

What banks are paying 7% interest? Wowza, if you find one, you’re basically hitting the jackpot! The reality is, 7% interest rates are as rare as hens’ teeth in today’s economic climate. If you’re hearing rumors of such high rates, take it with a grain of salt and do your homework to avoid any pie-in-the-sky disappointments.

Does Bank of America have a good CD rate?

Does Bank of America have a good CD rate? Well, “good” is in the eye of the beholder, but compared to some high-flying online banks, Bank of America’s CD rates might seem a tad underwhelming. They’re reputable, sure, but for rate chasers, a good ol’ shopping around might lead you to greener pastures.

Does Bank of America have good CD?

How high will CDs go in 2023? Oh, if only we had a crystal ball, right? Predicting CD rates is like trying to guess the end of a mystery novel. Experts have their hunches that rates might climb a little as the economy does its dance, but as for specifics—your guess is as good as mine!

How high will CDs go in 2023?

Should I buy a CD now or wait? Ah, the age-old question—like deciding when to jump into double Dutch. Timing the market can be tricky, you know? If you’re feeling antsy about possible rate hikes, consider a short-term CD. That way, you’re not on the sidelines for too long.

Should I buy a CD now or wait?

Where can I earn 5% on a CD? Well, don’t we all wish for that! Sadly, a guaranteed 5% CD is like spotting a unicorn these days. But if you’re the persistent type, you might scour some smaller banks and credit unions for promotional gems or special deals. Just be prepared for a treasure hunt.

Where can I earn 5% on a CD?

Earning 7% on your money? Sheesh, in this economy? That’s like expecting to win the lottery. Nowadays, such rates are pretty much unheard of for traditional savings methods. If someone promises you 7%, grab your spectacles and read the fine print—it might be riskier than you’d want.

Where can I earn 7% on my money?

Can I earn 7% on my money? Phew, that’d be nice, huh? But I gotta tell ya, with today’s interest rates, earning 7% without taking some serious risks is like catching lightning in a bottle. Most folks are looking at significantly lower rates unless they dive into the deep end of the investment pool.

Can I earn 7% on my money?

What bank currently has the highest interest rate? That’s the million-dollar question! The top spot changes with the financial tides, but often, online banks are the ones throwing the biggest numbers. A quick internet search will tell you who’s king of the hill at this very moment, just remember to compare the fine print.

What bank currently has the highest interest rate?

What bank has the highest CD rate right now? Ready for a scavenger hunt? ‘Cause tracking down the highest CD rate is exactly that. Your best bet is to keep a close eye on online banks and credit unions—they tend to dangle the juiciest carrots. A few minutes of googling can lead you to today’s top contender.

What bank has the highest CD rate right now?

What bank is paying the highest interest rate on CDs? I’ll tell ya, it’s a merry-go-round with online banks often taking the lead. They’re duking it out to offer the most tempting rates to savvy savers like you. Check comparison sites frequently, because today’s hot deal may be tomorrow’s old news.

What bank is paying the highest interest rate on CDs?

What is the best CD rate for $100,000? Lookin’ to stash that cash, eh? Stacking up $100k opens doors to jumbo CD rates, which might be a smidgen higher than standard ones. Peek at online banks and credit unions’ jumbo CDs—somebody out there’s got a deal that’ll make you wanna high-five your banker.

What is the best CD rate for $100000?

And for the grand finale, what’s considered a good 6-month CD rate right now? It ain’t the Wild West of high rates anymore, but don’t you worry—there are still decent finds. A “good” rate is like the best slice of pizza—it varies by taste. Knock on the door of online banking or credit unions, and you might just find a tasty little rate that hits the spot.