Unveiling the Growth: Understanding the Interest Rate for I Bonds

The Dual Nature of I Bonds Rate Structure

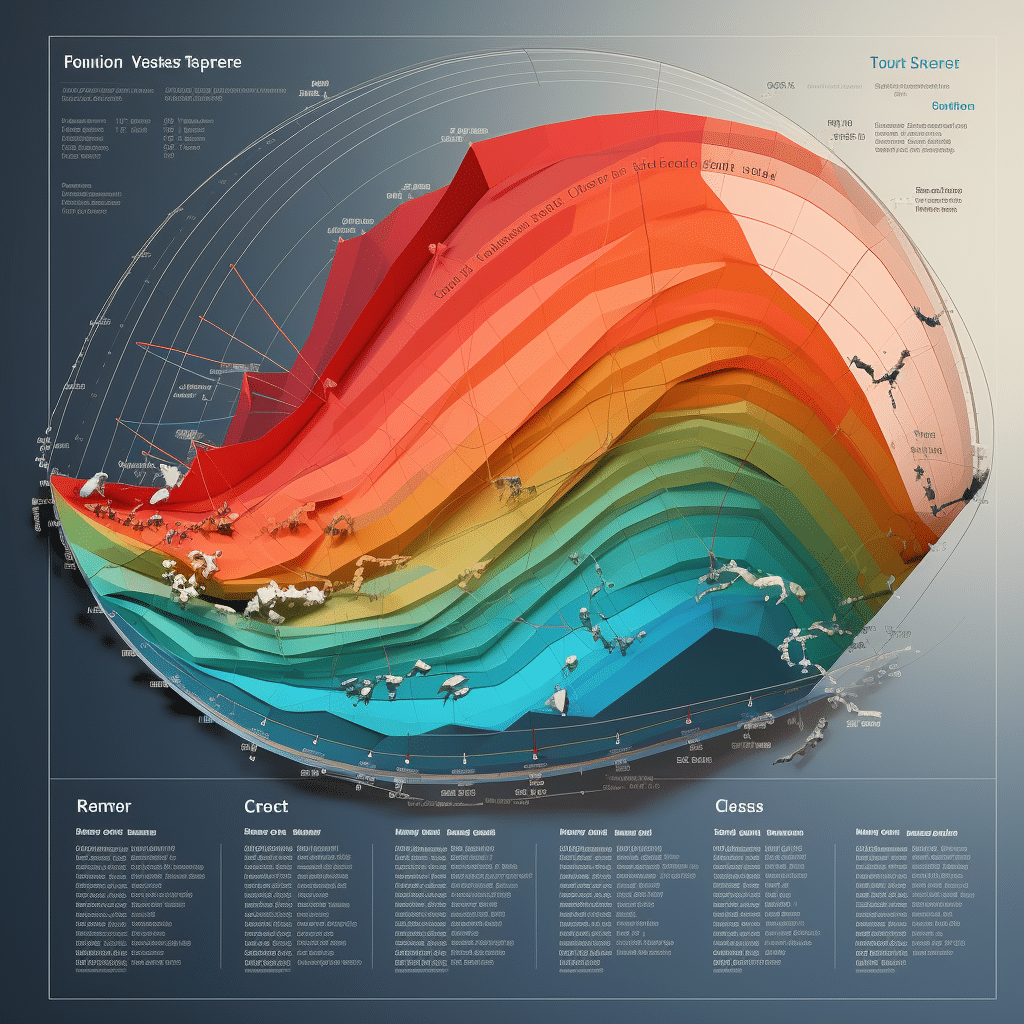

When it comes to I Bonds, there’s a bit of a tango dance between two distinct rates: the fixed rate and the inflation rate. These two step in together to set the stage for the total interest rate for I bonds. Look at it this way: the fixed rate is the reliable partner that never changes once you’ve got your bond, while the inflation rate is like the extroverted dance partner, bringing a new move to the floor every six months based on the Consumer Price Index for Urban Consumers (CPI-U).

The Treasury’s got the fixed rate set in stone when you purchase your bond, but the inflation rate is not shy about changing its rhythm semiannually. Peeking into the historical data, we notice an interesting trend. It’s like watching reruns of financial history, observing how these fixed rates have fluctuated.

How Inflation Impacts the Interest Rate for I Bonds

Oh, inflation – the boogeyman of the economy that makes the purchasing power of your hard-earned cash play hide and seek. I Bonds, being the savvy investments they are, come with a built-in shield against this sneaky beast with adjustable interest rates based on inflation. Picture it as a financial thermostat that adjusts the heat to keep your investment toasty.

Given our current economic twists and turns, it’s crucial to have a finger on the pulse of inflation forecasts. Like that one time, when the actions of the hawkish central bank sent shivers down the market’s spine, the change in ibonds rate mirrored these economic shenanigans. Just imagine a scenario where the interest rate for I Bonds echoed the inflationary chorus of the past – it’s like déjà vu with a dollar sign.

Maximizing Returns: Strategies Around I Bonds Rate Fluctuations

Optimal Timing for I Bond Investment

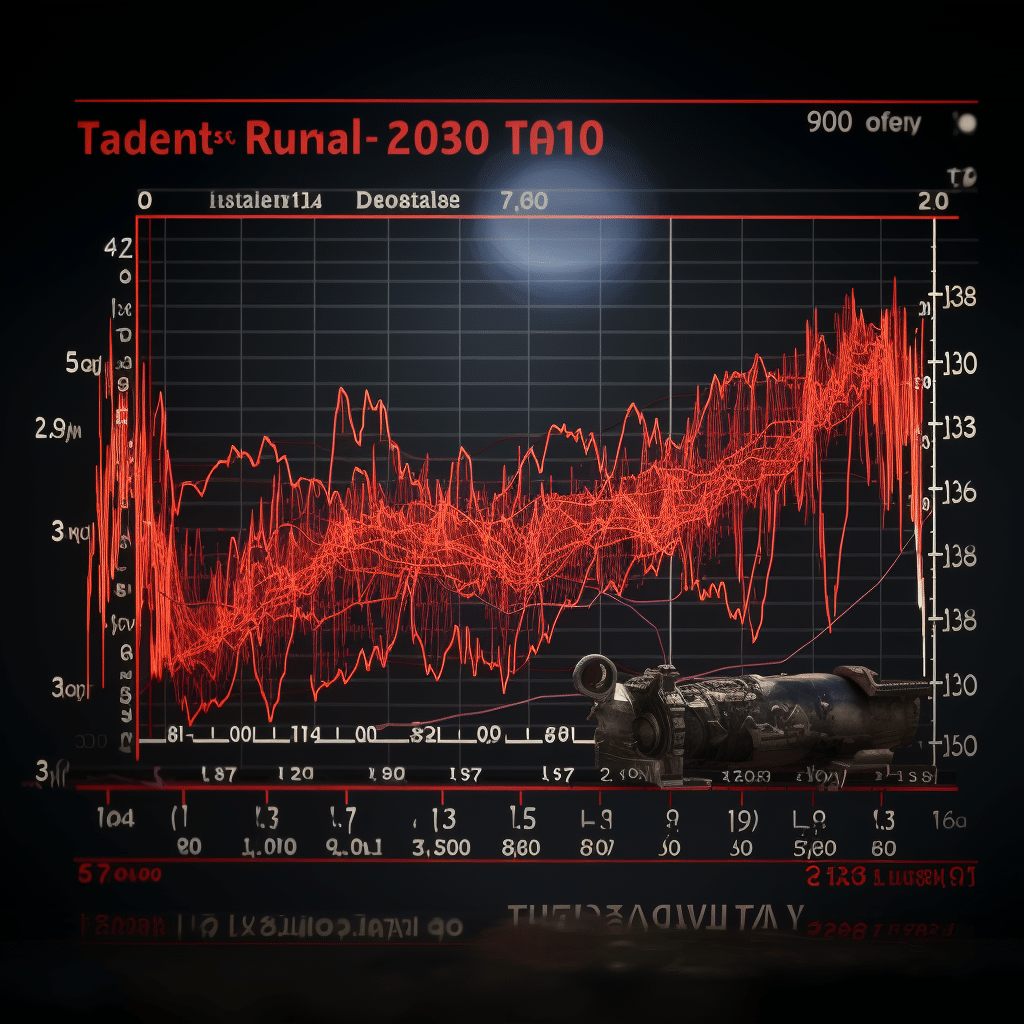

Timing isn’t just everything in comedy; it’s crucial in the world of I Bonds too! This financial instrument updates its interest rates every April and October, so some investors might get ants in their pants trying to hit that sweet spot. Think of it as trying to jump on a moving train – it’s all about the timing.

Let’s unfold some anecdotes from the trenches of investment. There’s Jane Doe, who snagged her I Bonds just before a rate hike – talk about lucky! And then there’s John Smith, whose crystal ball (or financial advisor) told him to wait it out, leading to a comfy investment after a rate drop. Emulating these success stories requires a keen eye on the ibonds rate cycle.

Interest Rate Comparisons: I Bonds vs Other Savings Instruments

So, let’s get down to the brass tacks here: how do I Bonds stack up against other kiddos on the savings block? Well, it’s like comparing a stable stew to flash-in-the-pan culinary fads. Sure, government and private savings options have their own zest, but I Bonds deliver a consistent flavor with a dash of inflation protection.

Data over the decades reveal that I Bonds often outperform Grandma’s savings account. In a portfolio, these bonds are the mashed potatoes – maybe not the star of the show, but they bring the comfort and stability you crave over time.

| **Characteristic** | **Detail** |

|---|---|

| Current Composite Rate | 5.27% |

| Issue Period | November 2023 – April 2024 |

| Prior Rate (Previous 6 mos.) | 4.30% |

| Rate Effective Duration | 6 months from the issue date |

| Purchase Limit (Electronic) | $10,000 per year |

| Additional Purchase Option | Up to $5,000 with tax refund (in paper I-bonds) |

| Investment Flexibility | Spouse purchase, trusts, and other entities can be used to circumvent the individual purchase limit |

| Frequency of Rate Change | Every six months (May and November) |

| Interest Accumulation | Monthly |

| Interest Compounding | Semiannually |

| Minimum Purchase | $25 for electronic I-bonds (through TreasuryDirect); $50 for paper I-bonds (with tax refund) |

| Maximum Purchase (Paper) | $5,000 per year with tax refund |

| Redemption Rules | No redemption within the first year; 3-month interest penalty if redeemed within 5 years |

| Tax Advantages | Interest is exempt from state and local taxes; Federal tax can be deferred until redemption or maturity |

| Use for Education | Interest may be tax-free if used for qualified educational expenses |

The Future of I Bonds Rate and Economic Predictions

Expert Forecasts on the Interest Rate for I Bonds

As any soothsayer worth their salt, financial bigwigs of the world use crystal balls (and complex models) to predict where the interest rate for I bonds might be heading. These forecasts are marinated in economic indicators, fiscal policies, and global events, creating a spicy stew of opinions.

Currently, with the composite rate for I bonds issued from November 2023 through April 2024 sitting pretty at 5.27%, the investment community is buzzing. The previous annualized rate chillaxed at 4.30%, so that’s a jump worth noting – like discovering an unexpected bonus track on your favorite album.

Legislative Changes and Their Influence on I Bond Rates

When the government waves its legislative wand, the echoes can be felt in the realm of I Bonds. Recent murmurs in the corridors of power hint at tweaks and transformations that may steer the sails of the ibonds rate. Keeping an ear to the ground for these changes can mean the difference between a portfolio that floats and one that soars.

Shifting through the legislative leaves, we find changes as constant as the tides. Navigating these waters requires an astute understanding of how each bill and amendment could serve as a tailwind or a headwind to your I Bond investment ambitions.

Practical Guide to Investing in I Bonds

Step-by-Step Walkthrough on Purchasing I Bonds

Purchasing I Bonds isn’t like getting lost in the supermarket; it’s more of a ‘follow the yellow brick road’ scenario, and I’ll be your trusty Tinman guide. There’s no wizardry here – just a clear path lined with necessary platforms and documentation.

Begin by laying the bricks: a trip to TreasuryDirect.gov is your Kansas. From there, it’s a matter of setting up an account, adding your financial details, and just like ordering party Dresses for a gala event, selecting the I Bonds you wish to grace your investment wardrobe.

Tips for Managing the Interest Rate for I Bonds in Your Portfolio

If your portfolio is a garden, then I Bonds are the hardy perennials. They don’t require daily watering, but they do need pruning – or in financial speak, rebalancing – to ensure they continue to thrive.

Investment gurus, channeling the wisdom of Warren Buffett with the strategic finesse of Ray Dalio, offer pearls of wisdom. They advise on minding the interest rate for I bonds and dusting off your holdings like you would an old bookshelf. Keeping the balance prevents any one investment from dancing out of line and leading your portfolio astray.

The Interest Rate for I Bonds: A Look at Global Context and Competitiveness

Benchmarking US I Bonds Against Global Savings Instruments

It’s a big world out there, and I Bonds are America’s financial contribution to the global mixtape of savings options. But how does this track play on the world stage? It’s time for a comparative analysis, sizing up these bonds against their international cousins.

From the streets of London to the markets of Tokyo, every nation has its own financial flavor. Yet, US I Bonds bring something special to the table: a stable interest rate backed by Uncle Sam. This stability often makes them more appealing than a surprise set by Marshmello at your local music festival – their reliability is just music to investors’ ears.

Technological Advancements and Their Impact on Bond Management

The world spins faster with every tick of the technological clock, and bond management is catching the beat. Innovations in fintech are revolutionizing the I Bonds scene like a hot new trend. It’s making the process of tracking and managing the interest rates for I Bonds slicker than your average.

The potential for digital enhancements to I Bonds is like the early days of smartphones – it’s bursting with possibilities. Just imagine handling your bonds with a flick and a tap on your device, making investment management as much a part of your routine as checking the Culvers menu for your next meal.

Conclusion: Interest Rate for I Bonds – Weathering Economic Seasons

To wrap this up, let’s tie a bow on what we’ve learned about the interest rate for I bonds. These steady-Eddie investments are the tortoises in the race, unfazed by the hares of inflation and interest rates sprinting around them. With their dual-rate structure and protection against inflation, they’re like a cozy cabin in the volatile wilderness of the financial markets.

For personal and institutional investors alike, it’s clear that I Bonds have a part to play both today and in the investment strategies of the future. Navigating the ebbs and flows of the economy requires staying informed – keeping your ear to the ground like you’re tracking the premiere of your favorite show’s new season.

In an era where change is the only constant, an investment in I Bonds is like a vow to weather the storms – a promise to hold steady and secure in an ever-shifting economic landscape.

Unraveling the Mystery: Interest Rate for I Bonds

Ever felt like the world of finance has its own beat? Well, folks, it’s time to tune into the rhythm of savings with some nifty beats on the interest rate for I bonds. These little financial instruments might not be as catchy as a Marshmello track, but they sure can be music to your savings account!

The Heartbeat of Your Investment

Just as angioplasty can give a new lease of life to clogged arteries, understanding the interest rate for I bonds can pump new vigour into your investment strategy. These bonds are a safe way to let your money grow because the rate changes with inflation twice a year – kind of like a financial pacemaker keeping the buying power of your cash in tip-top shape.

Tracking the Rates like a Hawk… Or a Mouse?

When it comes to savings, you don’t want to be caught like a mouse in a trap of low-interest rates. The interest rate for I bonds is one critter that can help you dodge that scenario. It’s a blend of a fixed rate and an inflation rate, recalculated semi-annually, turning your savings journey into a game of cat-and-mouse where, luckily, you’re the cat!

Bonds and Losses: A Bittersweet Symphony

Talking about interest rates can’t gloss over the tough times. For many, investing in savings bonds is part of coping with loss and planning for a more secure future, like a mother investing after the loss Of a son. I bonds can stand as a testament to resilience, a secure financial beacon amidst life’s tumultuous waves.

Breaking Free from Bad Credit’s Ankle Monitor

We’ve all had that ‘oh, snap!’ moment when bad credit scores feel like wearing an ankle monitor – you can’t seem to shake it off! Well, rejoice in the sweet knowledge that the interest rate for I bonds doesn’t discriminate. Whether you’re looking for bad credit Loans Guaranteed approval or just a solid investment, I bonds are blind to credit histories, offering the same rate to all.

The Encore: I Bonds Cast a Spell!

Much like the unexpected delight of a hidden gem in a show’s cast, the interest rate for I bonds can be that show-stopping number in your financial portfolio. So, why not let your savings take center stage and enjoy the standing ovation as your financial security strengthens with every calculated move?

Investing in I bonds is no laughing matter, but hey, it doesn’t have to be as dry as a day-old baguette either. Keep your savings strategy versatile and in tune with the symphony of interest rates. As the interest rate for I bonds changes, dance to its tune and watch your financial wellness flourish.

What is the current interest rate on an I bond?

Well, the current interest rate on an I bond can feel like it changes more often than the weather. But as of the last update, if you check the U.S. Treasury’s official site, you’ll find the most recent rate. Keep in mind it updates semiannually — that’s every May and November, folks!

What will the next I bond rate be 2023?

Ah, the next I bond rate for 2023 is like a wrapped gift — you can’t peek just yet! The rate’s a combo of fixed and inflation-based numbers, updated twice a year. So, keep your eyes peeled for the Treasury’s announcement closer to the date.

Is there a downside to I bonds?

Whoa, hold your horses! I bonds are generally a safe bet, but they’re not perfect. The downside? You’ve gotta hang tight for at least a year — no cashing out early. And if you ditch ’em before five years, you’ll say bye to the last three months of interest.

Can I buy $10000 worth of I bonds every year?

You betcha! You can indeed snag up to $10,000 in electronic I bonds every calendar year like clockwork. Plus, if you’re into old-school paper bonds, you can use your tax refund to grab up to another $5,000. Talk about a cherry on top!

What will the next I bond rate be November 2023?

As for the next I bond rate in November 2023, it’s kind of like trying to guess who’ll win the World Series. We’re all just speculating until the Treasury spills the beans with an official announcement in November.

Should I buy ibonds in 2023?

Hold on, should you buy I bonds in 2023? Well, if your crystal ball’s out of order, it’s tough to say for sure. I bonds are solid for beating inflation, but whether they’re right for you this year depends on your financial goals and the economic vibes.

What is a better investment than I bonds?

Looking for a better investment than I bonds? It’s a mixed bag, really. Stocks might hit a home run for you, or real estate could be your golden ticket. It all depends on your risk appetite and what you’re game for.

Do you pay taxes on I bonds?

Talking taxes and I bonds? Yup, you’ll owe Uncle Sam a piece of the pie eventually. You can pay as you go or wait until you cash in or they mature. But hey, you’ve got options.

Which is better EE or I savings bonds?

Choosing between EE and I savings bonds is like picking chocolate or vanilla. EE bonds offer a fixed rate, doubling in value in 20 years. I bonds adjust with inflation. So, it’s all about whether you prefer a steady ride or one that rolls with the punches.

Are I bonds better than CDS?

Comparing I bonds to CDs? I bonds could trounce CDs when inflation’s doing the cha-cha. But CDs might win out if you’re after a sure thing with set interest, even if it’s lower. It’s a game of trade-offs, really.

Why should I not buy an I bond?

Why not snag an I bond? It’s simple if you need quick cash because they’re locked up tighter than Fort Knox for at least a year. And if you’re allergic to losing any interest, duck out before five years and poof! There goes three months of interest.

How long should you hold Series I bonds?

Hanging onto Series I bonds? The sweet spot’s usually around five years — long enough to sidestep penalties but giving inflation a chance to boost your bucks. That said, they’re solid for up to 30 years if you’re playing the long game.

What is the loophole for Series I bonds?

The loophole with Series I bonds? Here’s the scoop: you can use ’em for education and dodge taxes on the interest if you play by the IRS rules. Sort of like finding a secret passage in a maze, right?

How much is a $100 savings bond worth after 30 years?

Pondering a $100 savings bond from 30 years ago? That little guy could be worth over $300 now — not too shabby for a piece of paper that’s been sitting around since MC Hammer pants were a thing.

Can married couples buy $20000 in I bonds?

And yep, married couples can double-dip and score up to $20,000 in I bonds each year — that’s combining $10,000 each in electronic bonds, and don’t forget the tax refund option for paper ones.

Are I bonds a good investment right now?

I bonds as a good investment right now? With inflation doing cartwheels, they’re looking pretty snazzy since they keep up with the inflation dance. But remember, investing’s never a one-size-fits-all hat.

Is now a good time to buy I bonds?

Is now the time to jump on I bonds? If you’re worried about your cash shrinking like a cheap t-shirt in the wash, then I bonds might be your inflation-fighting superhero cape right now.

How long do you need to hold an I bond?

The holding period for I bonds is a bit like baking bread — you gotta give it time. At a minimum, bake them for a year. For the full rise without losing any dough, leave ’em in the oven for five years.

Do you pay taxes on I bonds?

Do you pay taxes on I bonds? Oh, you bet! Like we said before, tax time comes for everyone, even your I bonds. But you get to call the shots on when to pay on the interest—yearly or when they mature. Now, isn’t that convenient?