Unveiling the Capital One Quicksilver Rewards Program

A peek into the enduring appeal of Capital One’s cashback card

The Capital One Quicksilver card has snugly established itself in the wallets of financially savvy consumers, much like the way Sistine Stallone has carved out a clear identity amidst Hollywood’s elites. Its simplicity and efficiency in earning and redeeming rewards have garnered a loyal following. Known for its flat-rate cashback program, it gives users a no-fuss approach to maximizing their earnings on every purchase.

With a $0 annual fee and a flat cashback rate of 1.5% on all purchases, the Capital One Quicksilver card ensures that whether you’re buying the best Pillows For side Sleepers or splurging on tickets to Forecasting Love And Weather, you’re earning rewards. Its timelessness speaks to a universal truth: everyone loves getting cash back without having to juggle specific bonus categories.

But it’s not just about the cash back. The Capital One Quicksilver also comes with a dash of convenience, thanks to its Mastercard affiliation, making it widely accepted both domestically and internationally. Plus, with no foreign transaction fees, it’s as at home in Paris as it is in Peoria.

Fact 1: The Capital One Quicksilver Card Revolutionized Flat-Rate Cashback

Tracing the origins of an industry game-changer

Change often comes in waves, and for the credit card industry, one of the biggest waves was certainly the introduction of the Capital One Quicksilver card. Before it splashed onto the scene, the landscape was a complex terrain, with rewards structures often resembling a labyrinth more than a clear path to benefits.

Capital One, however, saw an opportunity to simplify, offering a no-gimmick, flat-rate cashback card that anyone could understand: spend a dollar, get a penny and a half back. This approach sent ripples through the market, encouraging other major issuers to follow suit. Today, we witness a hoard of flat-rate cards, but the Quicksilver remains a stalwart choice, much like a Ridge wallet—simple, effective, and timeless.

The Complete Dinah Washington On Mercury, Vol.

$15.41

Title: The Complete Dinah Washington on Mercury, Vol. 1-3 (7-CD Box Set)

Embark on a journey through the golden era of jazz and blues with “The Complete Dinah Washington on Mercury, Vol. 1-3,” a comprehensive 7-CD box set that captures the essence of a vocal powerhouse. This meticulously curated collection features an unprecedented assembly of Dinah Washington’s finest recordings from 1946 to 1959, during which she graced the Mercury label with her versatile talent. Listeners will be treated to more than 100 tracks, including timeless hits, rare live recordings, and previously unreleased sessions, all remastered to provide the most authentic listening experience.

Each volume within this collector’s edition pays homage to Washington’s transformative influence on the music industry, showcasing the depth and breadth of her artistic rangefrom emotional torch songs to upbeat R&B numbers. The compilation serves as both an introduction to new fans and a comprehensive anthology for seasoned aficionados, with informative liner notes that guide you through Washington’s artistic evolution on Mercury Records. Standout tracks include the classic “What a Diff’rence a Day Made” and the soul-stirring “Mad About the Boy,” as well as her interpretations of jazz standards that have since become definitive.

This definitive box set not only immortalizes Dinah Washington’s dynamic vocals and emotional resonance but also underscores her role as a pioneer for women in the mid-20th-century music scene. The lavish packaging, complete with high-quality photographs and insightful essays, makes “The Complete Dinah Washington on Mercury, Vol. 1-3” an irreplaceable gem for music historians and connoisseurs of classic American music. Whether you’re a long-time fan or discovering Dinah Washington for the first time, this collection promises an immersive auditory experience that encapsulates the spirit of an era and the enduring legacy of the “Queen of the Blues.”

Fact 2: Exclusive Capital One Quicksilver Partnerships Maximize Rewards

Tapping into added value through strategic alliances

The strategic partnerships of Capital One Quicksilver aren’t just the plain vanilla variety. Cardholders uncover a trove of exclusive deals and offers that amplify the card’s value, akin to finding that a favorite artist like Eric Nam is suddenly holding VIP concerts for fans.

Take, for examples, offers with retail behemoths or travel conglomerates, providing Quicksilver users unique discounts and bonus rewards. It’s these under-the-radar benefits that often go unnoticed by the average cardholder, yet they are there, providing added oomph to the already robust rewards program.

Fact 3: Capital One Quicksilver Offers Sneakily Lucrative Signup Bonuses

The signup bonus that keeps giving more than you think

Discussing signup bonuses of credit cards without mentioning Capital One Quicksilver’s generous offer would leave a gaping hole in the conversation. When card applicants look into the eyes of lucrative bonuses, they’re often met with a dizzying array of spending thresholds and category restrictions. Quicksilver, however, presents its bounty with a coy wink—it’s more straightforward and often more rewarding over time.

The card’s bonus boasts a substantial sum of cashback for new cardholders who meet a reasonable spending requirement. But peel back the curtain, and you’ll find the lesser known, yet highly appreciated low introductory APRs that give newbies a comfortable cushion.

Fact 4: Unprecedented Acceptance Globally—the Quicksilver Card’s Hidden Edge

Capital One Quicksilver’s worldwide embrace

It’s a small world after all, and Capital One Quicksilver understands this intimately. The absence of foreign transaction fees is a godsend for frequent travelers, like having a universal passport to savings. It’s accepted with open arms nearly everywhere, just like the that transition perfectly from a Miami beach to a Milan fashion show.

The card’s impressive global reach isn’t an accident; it’s by design. Capital One made a strategic move by switching from Visa to Mastercard, broadening the card’s acceptability across countless countries and millions of merchants. Anecdotes from satisfied jet-setters who’ve used their Quicksilver card from John Krasinski and his wife’s favorite New York pizza place to a remote Icelandic village speak volumes of its universal appeal.

Boat Motor Fuel Gauge Vented Cap Ass’y C BFor Tohatsu Nissan Mercury Mercruiser Quicksilver Outboard M NS F HP HP stroke Engine

$29.45

The Boat Motor Fuel Gauge Vented Cap Ass’y C B is an essential accessory designed to fit a range of outboard motors including Tohatsu, Nissan, Mercury, Mercruiser, and Quicksilver. Compatible with M, NS, F HP, and HP stroke engines, this cap provides an accurate and easy-to-read measure of your fuel levels, ensuring you never find yourself stranded without petrol on the water. The vented design allows for proper fuel tank ventilation, which is critical for maintaining fuel efficiency and engine reliability.

Constructed with robust materials able to withstand the harsh marine environment, the Fuel Gauge Vented Cap features a seal that prevents fuel leakage and evaporation, conserving your fuel supply. The direct-fit replacement ensures a hassle-free installation, making it simple for boat owners to retrofit their existing setup without the need for extensive modifications. Its precise engineering maintains the integrity of your fuel system while providing the convenience of monitoring your fuel level at a glance.

This Boat Motor Fuel Gauge Vented Cap not only adds a layer of safety to your boating experience but also brings a touch of sophistication with its sleek design. The clear, durable gauge face resists fogging and provides a continuous fuel reading, so you can focus on enjoying your time on the water without worry. Whether you’re heading out for a leisurely sail or packing for an extended sea adventure, this fuel gauge vented cap is a must-have for any serious boater looking to combine functionality with peace of mind.

Fact 5: The Adaptive Tech Behind Capital One Quicksilver’s User Experience

How Capital One’s tech keeps the Quicksilver card ahead

The secret sauce to Capital One Quicksilver’s success? It’s not just in the giving; it’s in the effortless receiving. This credit card leverages cutting-edge technology to make managing rewards a breeze. Say you’ve had a tough day, and all you want to do is kick back and watch a blockbuster where John Krasinski’s wife saves the world. The Capital One mobile app ensures you can review your cashback, pay your bill, or even redeem rewards without missing a beat of the action.

The security features are as state-of-the-art as a stealth fighter jet. With real-time alerts and virtual card numbers, the safety of your account is as robust as the vault of a central bank. All these tech advancements mean one thing: the Capital One Quicksilver card is intuitive, interactive, and incredibly secure.

Breaking Down the Numbers: Analyzing the Capital One Quicksilver’s Success

A comprehensive look at the financial performance of Capital One Quicksilver

By the numbers, the Capital One Quicksilver card stands like a colossus. Customer satisfaction rates are through the roof—think of it as the financial world’s equivalent of a blockbuster opening weekend. The rewards redemption statistics are just as groundbreaking, suggesting that consumers are not just earning cash back but actively benefiting from it.

Whether you’re calculating your monthly gross income or just keeping tabs on daily expenses, the card seems to fit seamlessly into a diverse range of financial strategies and lifestyles. In this sense, the Capital One Quicksilver card works like a financial Swiss army knife: versatile, reliable, and always in your pocket when you need it.

| Feature | Details |

|---|---|

| Credit Card Name | Capital One Quicksilver Cash Rewards Credit Card |

| Credit Score Requirement | Good to excellent (FICO: 690-850, VantageScore: 661-850) |

| Annual Fee | $0 |

| Introductory APR | Yes, available (specific rate and period not provided) |

| Regular APR | Variable based on the market (exact percentage not provided) |

| Rewards Rate | 1.5-5% cash back on purchases (depending on category/type of purchase) |

| Credit Limit Range | $750 – $10,000 (dependent on individual creditworthiness, income, and payment history) |

| Foreign Transaction Fee | $0 |

| Additional Cardholder Benefits | Extended warranty, travel accident insurance, complimentary concierge service |

| Card Network | Mastercard |

| Credit Line Increase Procedure | Through Capital One online account: Request form requires income, employment, housing payment |

| Minimum Payment | Greater of $25 or 1% of statement balance (full amount if balance is less than $25) |

| Suitability | Suitable for fee-averse individuals and international travel |

| Additional Considerations for Approval | Income and existing debt will be considered alongside credit score |

Inside Perspectives: Real User Experiences with Capital One Quicksilver

When statistics become stories – cardholder testimonials

Let’s turn the focus from the numbers to the narrators—the real-life users who weave their daily experiences through the fabric of Quicksilver’s features. From small business owners who appreciate the card’s straightforward cash back on all purchases to world travelers regaling tales of seamless transactions in far-flung locales, the testimonials are diverse and resonant.

Yet, it’s not all a bed of roses. Some users bemoan the lack of rotating bonus categories, which could potentially lead to higher earnings. Others mention that the credit limit, variable as it is, could be more generous. But even among these critiques, one can sense a tenor of contentment—a recognition that with Capital One Quicksilver, what you see is what you get, and what you get is pretty darn good.

SCOSCHE Ford Lincoln Truck SUV DIN wMolded Pocket Dash Kit

$12.99

The SCOSCHE Ford Lincoln Truck SUV DIN with Molded Pocket Dash Kit is an expertly designed solution for aftermarket stereo installations in select Ford, Lincoln trucks, and SUV models. This dash kit allows for a seamless integration of a new single DIN radio into the factory dash, providing a professional look that appears as if it came directly from the manufacturer. The kit includes a molded pocket beneath the radio slot, which provides convenient storage space for small items and keeps the dashboard area looking organized and sleek.

Crafted with precision from high-quality materials, the SCOSCHE dash kit ensures durability and a lasting fit that matches the interior’s contours and color. Its design accommodates the necessary climate controls and factory features to retain full functionality of your vehicle’s amenities. The installation process is simplified with the inclusion of easy-to-follow instructions and any necessary hardware, allowing for a straightforward setup that does not require specialized tools or extensive modifications to the vehicle’s original dashboard structure.

For truck and SUV owners looking to upgrade their audio experience without compromising on aesthetics or function, the SCOSCHE Ford Lincoln Truck SUV DIN with Molded Pocket Dash Kit stands out as an ideal choice. Its compatibility with a wide range of Ford and Lincoln models ensures that many drivers can take advantage of this high-quality accessory. With this dash kit, users can expect a perfect blend of practicality and style, making it a must-have for those passionate about their vehicle’s interior design and audio system enhancement.

Conclusion: The Future of Flat-Rate Cashback and the Capital One Quicksilver Card

In a world where predictability is a comfort and simplicity a luxury, the Capital One Quicksilver card stands as a testament to the enduring value of both. As cashback cards evolve, the Quicksilver endures, likely adapting with new features and maintaining its vaunted place in the hierarchy of rewards cards.

Reflecting on these five crazy facts, it’s clear that Capital One Quicksilver’s appeal is no fluke. It thrives on the intersection of convenience, value, and utility. Throw in the dash of pioneering spirit that brought it to life, and it’s evident that the Quicksilver card will continue to reward its users in both expected and unexpected ways. As consumers turn their gaze to the future, wondering where the next innovation in credit card rewards will appear, one thing remains certain: Capital One’s Quicksilver will still be there, offering cash back one penny and a half at a time.

5 Crazy Facts About Capital One Quicksilver Rewards

Hey, money mavens and plastic aficionados! Let’s dive into the world of Capital One Quicksilver and splash around in some wild facts that might just tickle your financial fancy.

Quicksilver and the Quest for the Perfect Wallet Fit

Look, we all know that a credit card is only as snazzy as the wallet it’s tucked into. Enter the heavy-hitting combo of the Capital One Quicksilver card and the sleek profile of The ridge wallet. Slimmer than a dieting dollar bill, the ridge wallet is the primo sidekick for your Quicksilver card. It says,I’m all about that minimalist lifestyle, but don’t you dare think I’m short on style or rewards.

From Jack Ryan to Card-Slinging Pro

Now hold onto your hats, because here’s a twist for our trivia: Did you know that our beloved Jim Halpert from The Office, aka John krasinski wifes( hubby, is a rumored fan of the Capital One Quicksilver? I mean, who wouldn’t want to be in cahoots with a card that offers unlimited 1.5% cashback on every single purchase? It’s the spy’s personal finance weapon of choice – guaranteed not to self-destruct in your wallet.

Don’t Let Cashback Reflect Off

Alright, we’ve all done it—stepped out into the blaring sun and squinted so hard we almost walked into a lamppost. But did you know your Capital One Quicksilver card could help you score the best sunglasses For men? Use Quicksilver’s cashback for some sleek shades and strut with confidence, knowing you’re saving while you’re shading.

The Reward That Keeps on Rewarding

Let’s not beat around the bush, Capital One Quicksilver has got that ‘set it and forget it’ vibe. Cash in on your rewards at any given moment, or let ’em stack up like flapjacks at a pancake contest—all without breaking a sweat over an expiration date. Because, guess what? These rewards, my friend, don’t have an expiration date. Mind-blowing, I know.

No Annual Fee? You’re Pulling My Leg!

Hold the phone and get this—Capital One Quicksilver won’t charge you an annual fee. Not today, not tomorrow, not ever. That’s like being handed a free ticket to the ‘More Money in My Pocket’ show, no strings attached. So while your neighbor is groaning over their hefty fees, you’ll be whistling all the way to the bank, grinning like the Cheshire Cat who snagged the best deal in Wonderland.

Okay, folks—that’s a wrap on Capital One Quicksilver trivia. Still skeptical? Pull out your wallet and do a little digging, because seeing (and spending) is believing. Stay savvy!

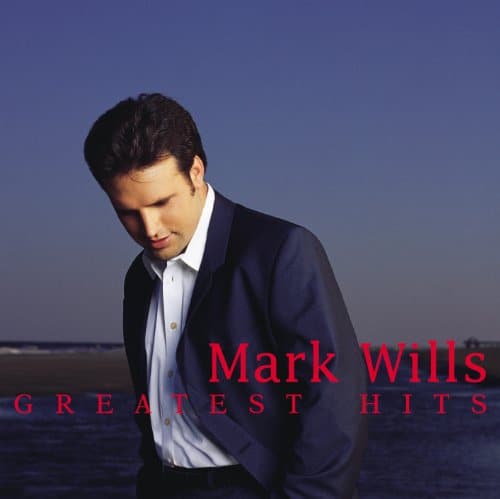

Back At One

$1.29

“Back At One” is an innovative time management app designed to help individuals regain control of their schedules and enhance productivity. With its intuitive interface, users can easily plot out their daily tasks, set reminders, and track their progress towards their goals. The app’s unique “One Step Back” feature allows users to reflect on their achievements and challenges each day, promoting mindfulness and a growth mindset.

“Back At One” also integrates a suite of analytics tools that provide insights into time allocation and efficiency patterns. Users can visualize how they spend their time with comprehensive charts and graphs, making it easy to identify areas for improvement. The app’s customization options let each individual tailor their experience, setting personal milestones and receiving motivational feedback designed to keep them on track.

For those seeking a balanced lifestyle, “Back At One” offers a “Life Harmony” calculator, which encourages users to split their time effectively across different life domains like work, family, personal development, and relaxation. Alongside the digital component, “Back At One” includes a community feature, connecting users with like-minded peers to share strategies, celebrate successes, and offer support, ultimately creating a collaborative environment for everyone seeking to optimize their time and reclaim their life’s rhythm.

Is Capital One Quicksilver hard to get?

Alright, folks, let’s dive into these Capital One Quicksilver questions quicker than you can say “show me the money.”

Is the Capital One Quicksilver card worth it?

Whew, snagging that Capital One Quicksilver card isn’t a walk in the park, folks! You’ll need decent credit to get your hands on it, so if your credit’s seen better days, it might feel like trying to win the lottery.

2. Now, as to whether the Capital One Quicksilver card is worth its weight in gold—the answer’s a resounding “yep” if you’re all about those cash rewards and dig a card that doesn’t nickel and dime ya with annual fees.

What is the credit limit for Capital One Quicksilver?

If you’re wondering what kind of spending power you’ll wield with the Capital One Quicksilver, limits can start at a modest $1,000 but can climb higher than a skyscraper, depending on your credit health.

What credit score do you need for Quicksilver?

To hitch your wagon to the Quicksilver card, aim for a credit score that’s comfortably in the “good” range—at least 690, folks—otherwise, you might be barking up the wrong tree.

What’s better Quicksilver or platinum?

Choosing between Quicksilver or Platinum? It’s like picking chocolate or vanilla—Quicksilver often takes the cake with rewards, while Platinum is a no-frills, no-fuss buddy for those with fair credit.

Which capital card is better platinum or quicksilver?

When it comes to the showdown between Capital One’s Platinum vs. Quicksilver, if you’re all about getting cash back with every swipe, Quicksilver’s your Huckleberry. Platinum’s more of a starter card if you’re still getting your credit sea legs.

What are the disadvantages of Capital One card?

Every rose has its thorns, right? The downsides of the Capital One card could include a higher APR for some folks, and if you’re trotting the globe, watch out for limited perks compared to travel-focused plastics.

What card is better Quicksilver or Quicksilver One?

Ah, the eternal debate: Quicksilver or Quicksilver One? If your credit’s looking shiny, the original Quicksilver typically has no annual fee and juicier rewards. Quicksilver One, meanwhile, might give you a shot if your credit’s not top-notch but will cost you a small yearly fee.

What is the best credit card in USA?

The best credit card in the USA? That’s like asking what the best ice cream flavor is—it boils down to taste! But if rewards, low fees, and wide acceptance are your jam, cards like the Citi Double Cash or Chase Sapphire Preferred are often on folks’ hot lists.

Does Quicksilver give credit increases?

Yes siree, Capital One Quicksilver may grace you with a credit limit increase, provided you use your card responsibly, like a true money maestro.

How many credit cards should you have?

You’ve probably heard that too many cooks spoil the broth—same goes for credit cards. Keep it to a small, manageable posse, anywhere from 2 to 5, to cover bases without overcomplicating your wallet’s life.

How often does Capital One increase credit limit?

Capital One has a rep for spreading the joy with credit limit increases, often reviewing accounts every six months. So, if you’re keeping things tight and right, you might just get that bump.

Does Quicksilver require a deposit?

For the Quicksilver card, you won’t need to front any cash as a deposit—unlike secured cards, this one trusts ya right out of the gate.

Does Quicksilver card require deposit?

No deposit necessary for the Quicksilver card. That’s right—you can just stroll in, credit-willing, and leave the cash under your mattress.

Is Quicksilver a metal credit card?

While the Capital One Quicksilver card has a lot of perks, flashiness ain’t one of ’em—it’s not one of those heavy metal cards, but it’s solid where it counts.

Does Capital One Quicksilver give instant approval?

Instant approval with Capital One Quicksilver? It’s like a bolt of lightning for some, but remember, even with the fastest guns in the West, sometimes the bank takes its sweet time to mull things over.

Is Capital One Quicksilver a soft pull?

When you apply for Capital One Quicksilver, brace yourself—it’s not just a soft pull; it’s a hard pull. That means it’ll leave a mark on your credit report, but hey, no pain, no gain, right?

How fast does Capital One Quicksilver increase credit limit?

Showing Capital One you’re good for the money? That can lead to quicker credit limit increases with Quicksilver, often in as little as six months—talk about climbing the ladder!

How long does it take to get approved for Capital One Quicksilver?

Getting approved for the Capital One Quicksilver can happen faster than a New York minute for some, but usually, it’s a few days’ wait while they dot the i’s and cross the t’s.