When it comes to navigating the intricate world of health insurance, Highmark Blue Shield has proven itself a formidable contender. Ranked the second-best health insurer in the U.S. for 2024 by Insure.com, this company’s strategic initiatives have firmly established it among the leading players in the field. Just like a knight of the Seven Kingdoms, Highmark skillfully balances responsibility with service, making it a trusted ally for many seeking health coverage.

Highmark Blue Shield is known for its dedication to customer service and innovation, proving time and again that it can keep up with the demands of an ever-changing healthcare landscape. With offerings ranging from flexible PPO plans to indemnity health insurance programs for those without group health coverage, Highmark serves a varied clientele, demonstrating adaptability akin to a knight’s unwavering loyalty to king and country.

This impressive rise in ranks isn’t merely a stroke of luck. It’s a result of well-planned strategies focused on community health initiatives. With an unwavering commitment to improving overall health outcomes, Highmark Blue Shield sets itself apart in a highly competitive market.

1. The Rise of Highmark Blue Shield: Where It Stands Among Top Health Insurers

Highmark Blue Shield has not reached this pinnacle overnight. It boasts a solid history rooted in community focus and member satisfaction. The company’s commitment goes far beyond policy numbers; it’s about creating a supportive ecosystem for its members and ensuring that quality healthcare is accessible.

The latest Insure.com ranking has put Highmark in the spotlight, allowing customers to see just how well it caters to their needs. Highmark’s policies are particularly appealing to various demographic groups, showcasing its embrace of diverse health needs. Whether it’s through innovative technology or comprehensive insurance solutions, all signs point to a bright future for Highmark Blue Shield.

Many customers have noticed a transformation in their healthcare experience—the ease of accessing services and the guarantee of quality care exudes confidence in Highmark’s capabilities. Plus, with its ongoing growth as the fourth-largest Blue Cross and Blue Shield-affiliated organization based on capital, the future looks even brighter for Highmark.

2. Top 5 Reasons Highmark Blue Shield Ranks Second

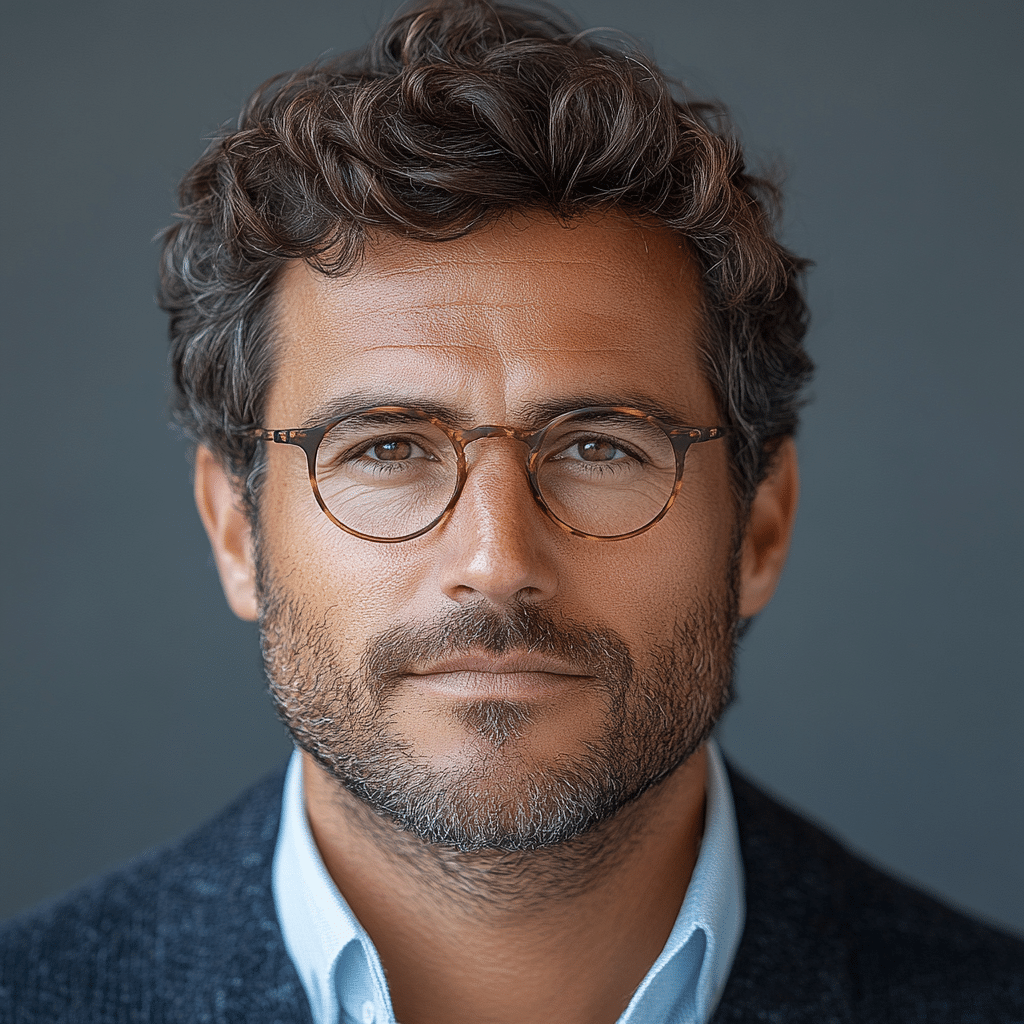

Highmark Blue Shield embodies the qualities of the Queen of Cups. The company prioritizes empathy, understanding each member’s unique healthcare journey. With telehealth options and 24/7 customer service, Highmark Ensures personalized care, which leads to exceptional satisfaction rates among clients. This commitment to transparency and availability makes it a beloved choice for many.

Highmark offers an extensive range of plans, effectively addressing the needs of individuals, families, and businesses alike. Its offerings span from essential health benefits to specialized plans, catering to every member’s unique requirements. In a competitive landscape, Highmark’s flexibility resembles that of a loyal knight, defending its customers’ health with honor.

Technology integration is another area where Highmark excels. By making use of data analytics and artificial intelligence, it steadily improves patient outcomes while streamlining claims processes. This helps foster a smooth customer experience, ensuring that policyholders feel supported every step of the way.

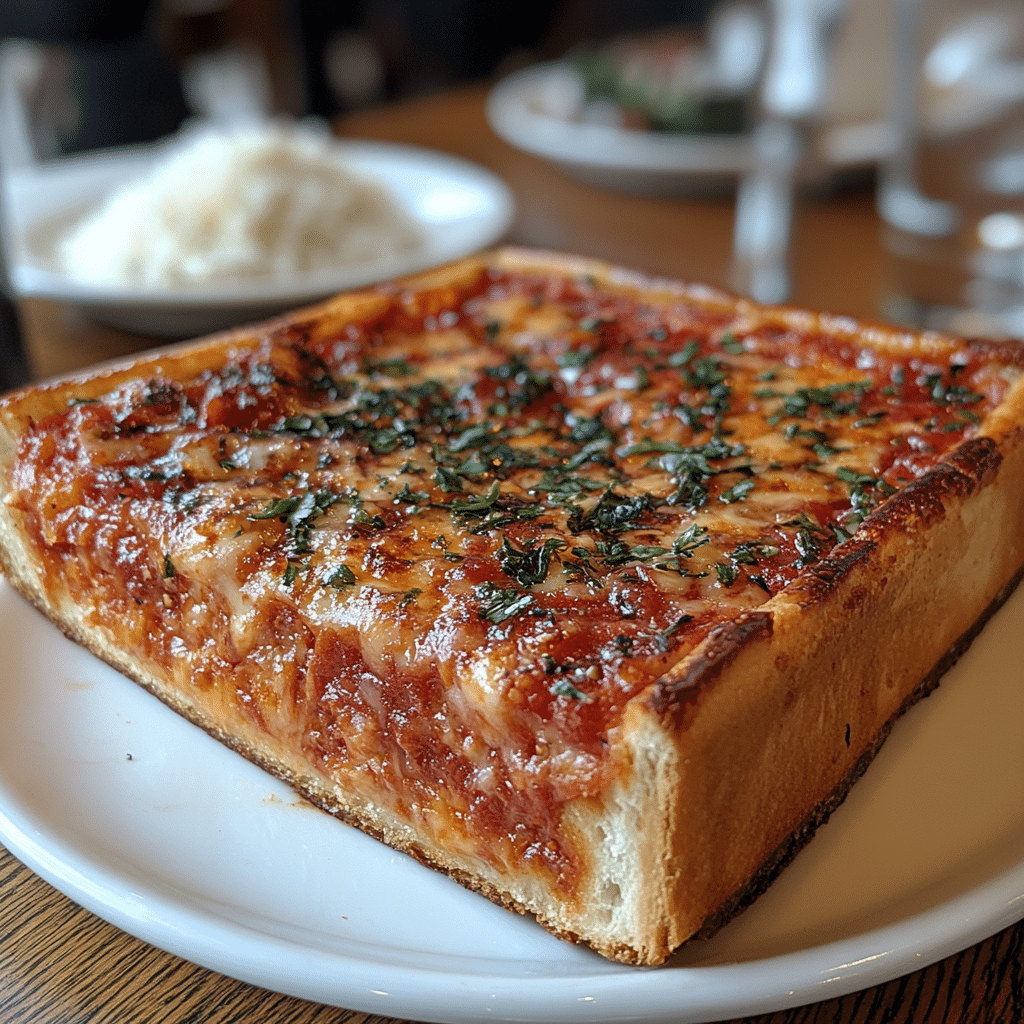

Highmark doesn’t just operate as a health insurer; it deeply invests in community welfare through sponsorships, health initiatives, and wellness programs. This approach creates an atmosphere of well-being reminiscent of enjoying fine wine and good spirits—healthy communities thrive when everyone contributes to the collective good.

Finally, Highmark Blue Shield stands out for its impressive financial ratings and operational transparency. Customers feel reassured; they know their insurer will uphold its end of the bargain when it comes to providing coverage. This is a crucial advantage, enabling Highmark to maintain a loyal customer base amidst stiff competition.

3. Comparing Highmark Blue Shield with Its Competitors

In the competitive health insurance market, Highmark Blue Shield stands shoulder to shoulder with significant competitors like Anthem and Aetna. By comparing their strategies, some key differences emerge.

While both companies have their strong suits, Highmark shines through in its customer service excellence and commitment to community engagement. Its innovative strategies and holistic approach grant it a loyal customer base, evident in its second-place ranking.

4. Member Testimonials: Voices from the Field

The true testament to Highmark Blue Shield’s success lies in the real-life experiences of its members. Testimonials highlight the responsive customer service, seamless access to healthcare providers, and an impressive range of services available.

Take, for example, John, a 35-year-old small business owner. He recently shared, “The telehealth services have been a game changer. I can consult with specialists without long wait times.” Feedback like John’s showcases why many are drawn to Highmark over its competitors.

Conversely, feedback for Anthem and Aetna is more mixed. While these companies earn praise for their expansive coverage options, several customers report challenges with customer service responsiveness. This aspect further pulls members towards Highmark Blue Shield as a reliable choice.

5. The Future of Highmark Blue Shield: What’s Next?

Looking ahead, it’s clear that Highmark Blue Shield is poised for continued growth and evolution in response to the shifting healthcare landscape. Personalization of healthcare solutions is gaining traction, and Highmark’s commitment to refining its offerings will be crucial.

With trends like telemedicine and advancements in artificial intelligence shaping service delivery, Highmark is adapting accordingly. The company has the means to maintain its second-place ranking or even rise to the top as a favorite among health insurers.

By staying true to its core values and forging ahead with initiatives that prioritize community health and member satisfaction, Highmark Blue Shield remains a knight in the healthcare kingdom. With a bright future in sight, it’s set to lead the charge toward a healthier society for everyone.

Highmark Blue Shield has proven itself as a valuable player in the health insurance arena, demonstrating that it’s about more than just policies—it’s about people. So whether you’re seeking options for yourself or want to support your community, taking a closer look at Highmark may just be your best bet.

Highmark Blue Shield: Fun Trivia and Interesting Facts

Did You Know?

When people think of health insurance, Highmark Blue Shield is often a frontrunner! Did you know that they provide coverage to nearly 5 million members across several states? That’s like the entire population of Ireland being insured under one roof! This extensive reach is part of what makes Highmark Blue Shield a titan in the insurance sector. Notably, they excel in affordability. In fact, they’re consistently recognized for providing some of the best value on the market, which is great news for folks looking to keep their expenses in check. And speaking of value, if you’re grappling with the definition of operating expenses, you might want to check out what Op definition really means!

Another interesting tidbit: Highmark Blue Shield has a strong commitment to community health. They actively collaborate with Hispanic Serving Institutions to improve access to healthcare for diverse populations. This initiative has significantly expanded the reach of medical services to underrepresented groups, demonstrating how health insurance can play a crucial role in supporting communities. Speaking of communities, did you hear about the quaint village of Barnt Green? Just like the initiatives there, engaging communities is key to improving healthcare understanding and outreach!

Fun Facts and Milestones

Highmark Blue Shield also embraces technology to serve its members better. Their innovative Bondi 8 wellness program taps into digital solutions for managing health and wellness. Participants can access tailored health tips, meal plans, and fitness challenges right from their mobile devices. This combination of technology and health aims to keep members proactive about their well-being. And while talking about aspects of life that help to ensue prosperity, did you know that personalized health journeys can make a huge difference in motivation and outcomes?

Moreover, let’s not forget the people behind the curtain at Highmark Blue Shield. They employ a dedicated workforce that truly believes in advocating for patient care. One notable name you might come across is Michaela McManus, who has been influential in various health campaigns. Her work underlines the importance of having advocates who are not just focused on policy but genuinely care about patients’ lives. Now, with all this buzz surrounding health insurance, it’s vital to think about what’s at stake: Is The government shutting down? Such developments can drastically impact your healthcare options, making it essential to stay informed. And while you’re keeping your ear to the ground, it’s always wise to define your needs clearly—so take a moment to define exemplify and figure out what truly matters for you and your family!

Highmark Blue Shield’s innovative spirit and community involvement shows just how health insurance isn’t just about numbers; it’s about people and their well-being.

Is Highmark the same as Blue Cross Blue Shield?

Highmark is indeed a Blue Cross Blue Shield-affiliated organization, functioning as an independent licensee under the Blue Cross Blue Shield Association, but it operates separately and has its own programs.

Is Highmark Blue Cross Blue Shield good insurance?

Highmark Blue Cross Blue Shield has received high marks, ranking second on insure.com’s list of the best health insurance companies in the U.S. for 2024, which suggests that many folks think it’s a solid choice for insurance coverage.

What kind of insurance is Highmark?

Highmark offers various types of insurance, including individual and family indemnity health insurance programs, which are often called “fee-for-service” plans that pay fixed amounts per service provided.

What is the Highmark PPO plan?

A Highmark PPO plan gives you the freedom to see any provider you prefer without needing a referral, making it super flexible, but typically comes with higher monthly premiums compared to other plans.

What states does Highmark Blue Cross Blue Shield cover?

Highmark Blue Cross Blue Shield primarily covers Pennsylvania, West Virginia, and parts of Ohio, but their network can extend based on specific agreements with providers in other states.

What is Blue Cross Blue Shield called now?

Blue Cross Blue Shield still carries its name, but specific regions may market their services under different brand names, like Highmark in certain states.

What is the best health insurance company to go with?

As of 2024, Highmark has been ranked as the second-best health insurance company, suggesting it’s one of the top contenders for folks looking for reliable health coverage.

What is the difference between a PPO and a HMO?

The main difference between a PPO and an HMO is that PPOs offer more flexibility to see any healthcare provider without a referral, while HMOs typically require you to choose a primary care doctor and get referrals for specialists.

Is Highmark Blue Shield an HMO?

Highmark Blue Shield isn’t classified as an HMO; they have PPO plans and offer indemnity options, which are different from HMO structures.

Is Highmark Blue Cross Blue Shield Medicaid?

Highmark Blue Cross Blue Shield is not a Medicaid provider, but they may offer plans that work with various government programs in specific states.

How much is an MRI with Blue Cross Blue Shield?

The cost of an MRI with Blue Cross Blue Shield can vary widely based on your specific plan, deductibles, and in-network versus out-of-network providers.

Who owns Highmark Blue Cross?

Highmark Blue Cross Blue Shield is owned by Highmark Inc., which is a large health insurance organization.

Is Highmark PPO Blue a high deductible health plan?

Highmark PPO Blue can sometimes be classified as a high deductible health plan, but it depends on the specific policy terms and options available.

Is Highmark PPO Blue the same as BCBS?

Highmark PPO Blue is a type of plan under the larger Blue Cross Blue Shield umbrella, but each has its own specific offerings and benefits.

Does Highmark cover vision?

Highmark does offer some vision coverage, but it might not be included in all plans, so it’s a good idea to check the specifics of your policy.

When did BCBS become Highmark?

BCBS became Highmark in specific regions when the company started operating under the Highmark brand, although the national organization retains its original name.

Who is the parent company of Highmark?

The parent company of Highmark is Highmark Inc., which oversees its operations and various insurance products.

Is Highmark Blue Cross Blue Shield Medicaid?

Highmark Blue Cross Blue Shield is not classified under Medicaid, but they may provide insurance products that serve a similar population depending on state regulations.

Who owns Blue Cross and Blue Shield?

Blue Cross and Blue Shield are owned by a combination of independent licensees, with each operating their own plans and services under the national umbrella.