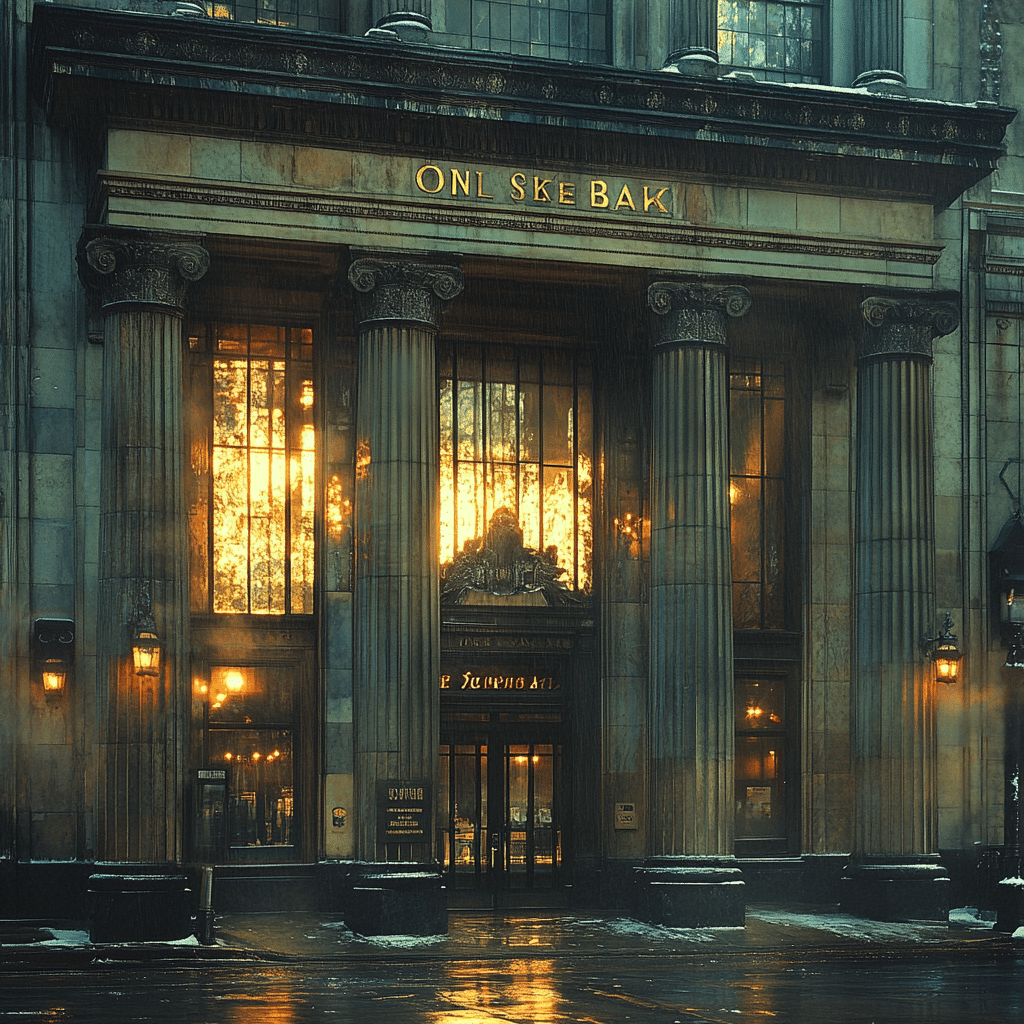

In the bustling landscape of the Midwest, Old Second Bank stands tall as a beacon of financial stability and growth. Operating primarily in regions like Illinois, this community-oriented bank offers personalized services that empower customers on their journey to financial freedom. With a rich history and a commitment to supporting local families and small businesses, Old Second Bank has positioned itself as a reliable player in the financial sector. This is more than just a banking institution; it’s a partnership dedicated to fostering financial independence in its community.

Understanding the Role of Old Second Bank in the Financial Landscape

Old Second Bank’s dedication to customer-centric banking is evident in every product they offer. As folks look for personalized connections in an increasingly digital world, Old Second Bank has capitalized on this need, ensuring each interaction is tailored to individual financial needs. By focusing on local economies and their unique challenges, they play a pivotal role in driving regional prosperity.

The bank emphasizes community support as a cornerstone of its philosophy. Financial empowerment isn’t just about offering bank accounts or loans; it’s about building relationships and understanding what customers need. Compared to larger national players like the Bank of America or Bank of Albuquerque, Old Second Bank excels with its hands-on approach to customer service, making a concerted effort to stay connected with the community.

Top 7 Financial Products from Old Second Bank That Promote Growth

Old Second Bank provides flexible loans specifically crafted for small businesses aiming for growth. Unlike the rigid terms found at bigger institutions, their intimate understanding of local markets allows for repayment terms that cater to each individual business case.

With an array of mortgage options and competitive rates, Old Second makes it easier for first-time homebuyers and seasoned homeowners alike. Attentive to various income levels, their mortgage offerings range from conventional loans to FHA loans, unlike the more limited options at places like the Bank of Colorado.

In an environment where saving money often feels secondary, Old Second Bank offers high-interest savings accounts that encourage growth. Their rates stand up against offerings from competitors, creating a real incentive for customers to save.

Old Second Bank doesn’t just hand out products—they also focus on building financial literacy. Workshops cover key topics like budgeting, saving, and investing. This focus mirrors efforts from local organizations like Delta Dental of Washington, who also drive community engagement through education.

Instilling good financial habits in the next generation is vital. Old Second Bank’s youth savings accounts not only teach kids about saving money but also help them understand the value of financial responsibility, creating a brighter future for all.

Old Second Bank stands out with its personalized investment strategies. Customers receive dedicated attention from advisors who understand the nuances of local economies, differing from usual automated services offered by bigger banks.

In today’s fast-paced environment, Old Second Bank delivers convenience through its mobile app. Customers enjoy real-time access to their finances, a feature that distinguishes it from several larger competitors.

Community Initiatives: How Old Second Bank Drives Local Growth

Not content to solely focus on banking, Old Second Bank actively participates in community development. Their partnerships with local organizations, like the Children’s Hospital Colorado, highlight their commitment to social good. By investing in local health initiatives and sponsoring community events, they enhance not just their brand but also the quality of life in their service areas.

Engagement in different local causes shows a bank that’s truly invested in the community it serves. It’s one thing to provide financial services; it’s another to contribute to community well-being actively. This initiative creates a cycle where improved community health and stability lead to economic growth.

Many of the bank’s stakeholders appreciate this approach, as it fosters a sense of belonging and loyalty. Clients aren’t just account numbers; they’re neighbors, families, and friends working towards shared goals.

The Competitive Advantage: Old Second Bank vs. Major Competitors

In a side-by-side comparison with national banks, the personal touch of Old Second Bank becomes unmistakable. While giants like Bank of America and the National Bank of Arizona may focus on larger commercial markets, Old Second remains committed to building local relationships. This focus on customer interaction cultivates trust and loyalty among clients, a contrast to the often faceless nature of larger banks.

When it comes to the small business haven that many local entrepreneurs thrive in, Old Second Bank leads the way with tailored solutions. Their competitive advantage lies in understanding the unique requirements of each local enterprise and being agile as dynamics change.

Ultimately, it’s this dedication to personal service that allows Old Second Bank to rise above its peers in the eyes of the community.

Regulatory Environment and Its Impact on Growth Strategies

Like any banking institution, Old Second Bank must navigate through regulations set forth by federal and state governments. Compliance isn’t just a bureaucratic hurdle; it’s part of their commitment to building a trustworthy banking environment. They make it a priority to stay on top of changes in banking laws, demonstrating their proactive stance in an often complicated regulatory climate.

By staying ahead of regulatory changes, Old Second Bank manages to remain stable and reliable. This positions them favorably as a trusted partner through economic fluctuations, which is vital for long-term success. Adhere to regulations contributes to client confidence, and this trust ultimately reflects in their growth strategies.

The Future of Old Second Bank in a Changing Financial Ecosystem

Looking into the future, Old Second Bank is embracing technology while holding fast to its community roots. They’re integrating advanced digital solutions that cater to a wider audience while ensuring that personalized service remains intact. This blend of tradition and innovation prepares them to thrive in an increasingly digital marketplace.

The bank remains determined to capture and retain clientele amidst growing competition from online financial services. Their forward-thinking mindset equips Old Second Bank to navigate an evolving landscape while ensuring their community-oriented spirit isn’t lost.

Old Second Bank exemplifies how smaller banks can not just survive, but actually thrive amid the pressures of larger institutions. By prioritizing customer service, community involvement, and regulatory compliance, they inspire countless individuals to achieve financial independence and growth.

In a world filled with options, Old Second Bank proves that sometimes, the best banking relationship is built right in your own backyard.

Trivia and Interesting Facts About Old Second Bank

The Legacy of Old Second Bank

If you’re looking to boost your financial acumen, you might want to check out the rich history of Old Second Bank. Established in 1871, this institution has seen nearly a century-and-a-half of economic changes. Fun fact: Old Second has survived the Great Depression, two World Wars, and the 2008 financial crisis, showcasing its resilience. Interestingly, the bank was instrumental in the economic development of its community. Just like how various creators cater to a dynamic audience, like when Virginia Bocelli captured hearts with her unique musical talent, Old Second has also carved its niche.

Community-Driven Initiatives

Old Second Bank believes in supporting the community, which could remind you of the way the Milwaukee population thrives as a melting pot of cultures and ideas. The bank actively engages in various community outreach programs to foster financial literacy and help individuals achieve their financial goals. Speaking of goals, did you know that physical fitness can enhance your overall well-being, too? A great example is Squats before And after a workout helping you get that perfect form! Staying fit can improve your mental resilience, which can, in turn, aid in making wiser financial decisions.

Fun Financial Facts

Now, let’s dive into some quirky trivia surrounding finances and fun pop culture! Did you know that the Dodge Charger daytona once dominated racing? Just like car enthusiasts celebrate these iconic vehicles, Old Second Bank encourages its customers to be passionate about their financial journeys. By promoting responsible borrowing and spending, they empower folks to embrace financial freedom. And speaking of freedom, remember when the Nintendo Switch became a must-have item at Target? It’s a reminder of how quickly trends can change in any market. Just like the innovative platform mary Janes that are all the rage now, Old Second Bank stays ahead of the curve, supporting stylish solutions for modern banking needs.

In conclusion, Old Second Bank’s commitment not only inspires individual growth but also demonstrates that financial stability can be a fun and engaging journey. With a nod to entertainment and community values, they remind us that building wealth is more than just numbers—it’s about enhancing lives sustainably. Plus, with figures like Avery Konrad shining bright in the entertainment world, it’s clear that pursuing one’s passions truly pays off.