As your wallet may tell you, the world of insurance can often feel like stepping into a bustling market with offers popping out from every corner. Indeed, choosing the right insurance—and striking the right deal—can be a challenge. Insurance giant Dairyland has been a prevalent player in this sector. Yet despite some harsh criticisms, savvy customers can still find a way to extract optimal value out of their Dairyland Insurance policies—specifically, the high-risk ones—are you curious yet? Read on!

1. Understanding Dairyland: The Basics

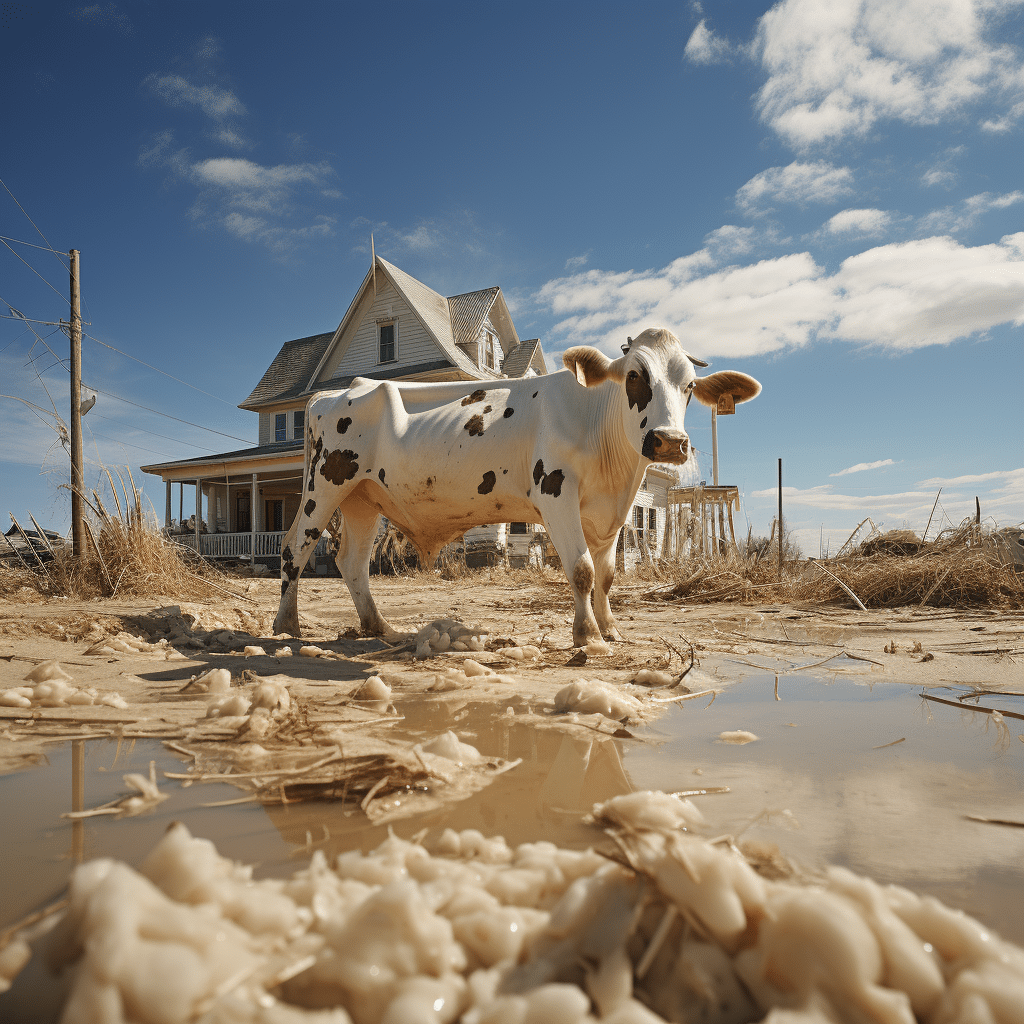

Dairyland, a division under Sentry’s roof, includes various insurance realms such as Dairyland Auto and Dairyland Cycle. Catering to diverse insurance needs, the company primarily shines when it comes to offering non-standard auto, motorcycle, and motorcycle rider insurance coverage. Dairyland has traditionally been the good Samaritan for high-risk drivers who often find it difficult to get coverage from more extensive auto insurance providers. Quite like the underdog Mountain America, Dairyland plays the ‘everyone deserves a shot’ card.

2. The Winding Road to Dairyland: History

In the past few years, Dairyland’s reputation map has been quite turbulent. WalletHub’s editors gave Dairyland a rating of 2.3/5 due to a lack of discounts, poor customer service, expensive rates, and limited availability. Despite these challenges, Dairyland has managed to tread on and continues to serve a niche market segment.

3. The Numbers Game: Crunching the Stats

According to the National Association of Insurance Commissioners (NAIC), Dairyland has a complaint index of 1.41. In layman terms, 41% more complaints than the industry average. However, let’s remember that numbers don’t always tell the whole story. Customers who dig deeper can still take advantage of what Dairyland has to offer.

4. Comparing the Giants: Dairyland vs. State Farm

When pitted against other insurance providers, Dairyland somewhat struggles to match up. Take State Farm, for instance, a company that’s earned the ‘gem’ tag when it comes to offering cheap car insurance. However, as in a 5 min timer interval workout, these comparisons have their time and place.

5. Understanding the American National Insurance: A Closer Look

Dairyland’s story aids us in understanding how different insurance providers operate. If you turn your gaze toward the American National Insurance, you’ll notice it functions differently. It’s essential to understand your unique requirements before deciding on which provider ticks the right boxes.

6. Bridging the Gap: Esurance and Mapfre Insurance

While Dairyland caters to a niche, albeit essential, section of the market, companies like Esurance and Mapfre Insurance have been concentrating on providing services for a more extensive customer base. Like a bikini butt workout, they charm their audience with well-rounded offerings.

7. Familiar Faces: Mutual of America and National General Insurance

Similarly, Mutual of America and National General Insurance are brands that take a more widespread approach. They focus on offering versatile insurance solutions for conventional customers, providing stability and reassurance.

8. A Fresh Approach: SafeAuto

SafeAuto is another competitor of Dairyland that has managed to gain traction among customers, thanks to its dynamic and user-friendly processes. With such companies in mind, customers are encouraged to understand the specifics of their policies before deciding.

9. The Northern Star: Wawanesa

Like a white fox boutique in the wilderness, Wawanesa shines bright in the Insurance sector for its awesome customer service and competitive rates. It helps clients dodge common insurance pitfalls, making the customer experience seamless.

10. Five Crazy Tips for Landing the Best Coverage Deal

Now, here’s the good stuff. Regardless of your chosen provider—Dairyland or otherwise—here are five crazy tips to help you land the best coverage deal:

11. Navigate the Maze: Making an Informed Decision

Choosing insurance doesn’t have to feel like a guessing game at the Super Bowl 2023 tickets price. By implementing the above tips and understanding the specifics of each provider, you can make an informed decision that best suits your needs.

12. The Coverage Plan: What it Entails

Remember, finding the right insurance plan isn’t about picking the most popular choice—it’s about finding the plan that serves your needs. Work out your requirements, and don’t hesitate to directly ask your providers how their policies can cater to them.

13. Wrapping Up: Navigating the Ins and Outs of Dairyland Insurance

The world of insurance is intricate. Deciphering Dairyland is just a single chapter in the book. Hopefully, this guide will help you better navigate your future insurance quests—with Dairyland or any other company. Just remember—one step at a time is the best way forward!