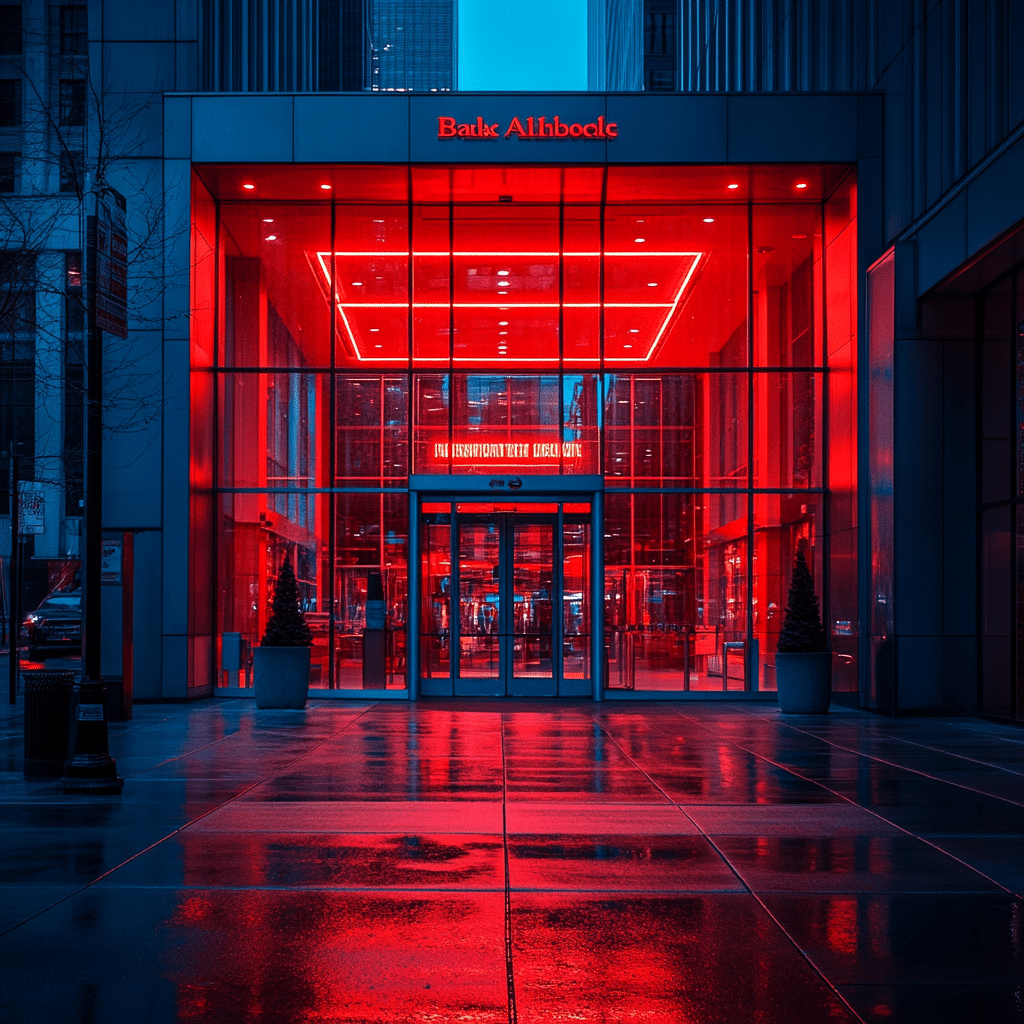

In early March 2024, millions of customers faced a Bank of America outage that shook their financial foundations. This significant computer outage locked users out of their online banking, prevented transactions, and even blocked cash withdrawals from ATMs. As we increasingly rely on technology in every aspect of our financial interactions, this incident begs crucial questions about the strength and reliability of our banking systems in the face of sudden failures.

The Ripple Effect of the Bank of America Outage

When the Bank of America outage occurred, the consequences cascaded through various sectors. Customers were left in the lurch, raising fears not just about their immediate financial access but also about the overall reliability of digital banking systems. It’s the kind of disruption that makes you realize how intertwined our lives have become with banking technology.

This outage threw a wrench into daily activities. Imagine heading to the grocery store, doing your best to stick to a budget, only to find out that your debit card won’t work at the register. Such a situation isn’t just inconvenient; it can create significant stress and financial chaos.

Moreover, the outage raised concerns about the preparedness of financial institutions for unexpected crises like a nationwide cell phone outage today. This makes us ponder: How can banks fortify their systems to prevent similar issues in the future?

7 Immediate Consequences of the Bank of America Outage on Customers

Quite a number of customers discovered their accounts were frozen. This dire situation left them frustrated, especially during emergencies. Reports rolled in of ATM transactions failing, meaning customers couldn’t access cash at critical times.

With online services malfunctioning, customers flooded call centers, resulting in long wait times that tested many people’s patience. Big retailers like Walmart and Target had to face checkout chaos, as shoppers couldn’t complete their purchases.

Businesses that relied heavily on Bank of America for payment processing felt the strain. Local eateries and shops experienced noticeable drops in foot traffic, prompting many operators to wonder how long this outage would linger.

The outages didn’t stop with Bank of America’s own services. Platforms like Venmo and Cash App, dependent on Bank of America’s infrastructure, crumbled under the pressure, adding chaos to an already stressed situation.

Through social media, a wave of complaints arose from bewildered customers expressing concerns about their bank’s reliability. Many shared their inner grievances, and some even pondered switching to competitors, fueling a broader conversation regarding customer loyalty.

As online banking services went dark, frustrated customers began flocking to local branches. This surge created congested environments, leading employees to scramble in order to assist the overwhelmed patrons.

Financial institutions across the board took this opportunity to reassess their contingency plans. Post-outage discussions emerged regarding how to prepare for potential major internet outages today, fostering a collective examination of contingency strategies in the banking sector.

Lessons from the Bank of America Outage: Ensuring System Resilience

The fallout from the Bank of America outage made it clear: financial institutions need stronger infrastructure and clearer communication strategies. This incident is a vital lesson in uncovering the technological vulnerabilities we face. With ever-increasing reliance on technology, having a solid plan isn’t just a luxury; it’s essential for survival.

In extreme cases, we saw how reliable communication can be paramount. Take the use of older methods during crises, such as how Hezbollah pagers explode into the conversation. It’s a distinct reminder of the need for alternative communication channels that remain reliable in times of upheaval.

Innovating Forward in Banking Technology

The 2024 Bank of America outage highlights just how fragile modern financial systems can be, especially when so heavily dependent on technology. As the banking landscape shifts, institutions must prioritize transparency and customer communication when crises strike. There’s a growing demand for systems that not only focus on efficiency but are also built to endure the unexpected.

Companies and banks should consider innovations like Ekster wallets, which emphasize secure transactions and user-friendly interfaces. Customers want their financial institutions to be trustworthy, and that trust can only come from a solid response to challenges like these outages.

As we head into a new era, it’s clear that customers will start demanding more from their financial institutions. The future of banking will likely see a sharper focus on resilience, ensuring customers have access to their funds no matter what storms come their way. This attitude isn’t only a proactive move; it’s vital for maintaining customer trust.

In a world where men in black cast movies are more plausible than we ever imagined, let’s keep banking innovations secure, reliable, and robust. After all, it’s not just about banking; it’s about peace of mind in our financial lives.

Bank of America Outage: Fun Trivia and Interesting Facts

The Ripple Effect of a Bank of America Outage

When the Bank of America outage hit, millions felt the ground shake beneath their feet—figuratively speaking, of course! Did you know that outages like this can have a significant financial impact? On average, when major banks face such disruptions, it can cost them millions in lost transactions and customer trust. Just imagine the numbers rolling in, much like the anticipation for The Rings Of Power season 2, where fans sit on the edge of their seats for the next big reveal.

Interestingly, this isn’t the first time a major bank has faced an outage. In fact, the online banking industry has faced challenges similar to a blocked drain—one moment everything’s flowing smoothly, the next you’re left scrambling. Take, for example, Kit Harington’s portrayal of Jon Snow; he navigated a plethora of battles and betrayals, but at the end of the day, a hiccup like a bank outage can feel like an epic tragedy for everyday customers.

What Goes Into Resolving Such Outages?

So, what does it take to fix an outage? It involves a bit of detective work, typically with tech teams analyzing data flow like watchdogs at the ready. With their expertise, it’s crucial for them to pinpoint the glitch without grinding to a halt—as a film crew does when transitioning from one scene to another. Speaking of behind the scenes, just as film enthusiasts explore productions like Tabooheat, banking technology also requires constant surveillance to keep everything running smoothly.

And let’s not forget about the paranoia that can accompany these outages. Without access to funds, people may feel like they’re waiting on the edge of a cliff, especially when you consider financial implications like NM unemployment benefits being delayed during such crises. It’s a touch of stress that many would rather avoid, akin to worrying about How long are Dogs pregnant when they just want to cuddle with their furry friends.

The Human Element in Banking

But beyond the financial aspects, there’s a human side to this chaos. Just as tennis star Grigor Dimitrov relies on his team to manage his game effectively, bank customers depend on financial institutions to safeguard their money and personal info. When outages occur, it often leads to a frustrating guessing game that drives people to contact customer service—a bit like reaching out for help when your favorite series leaves you hanging.

In the end, the Bank of America outage serves as a reminder that even giants can stumble. As customers breathe a sigh of relief once systems are back online, they’ll likely appreciate the service all the more. It’s a bit like waiting for your favorite movie to be released—you realize how much excitement it brings once it finally arrives!