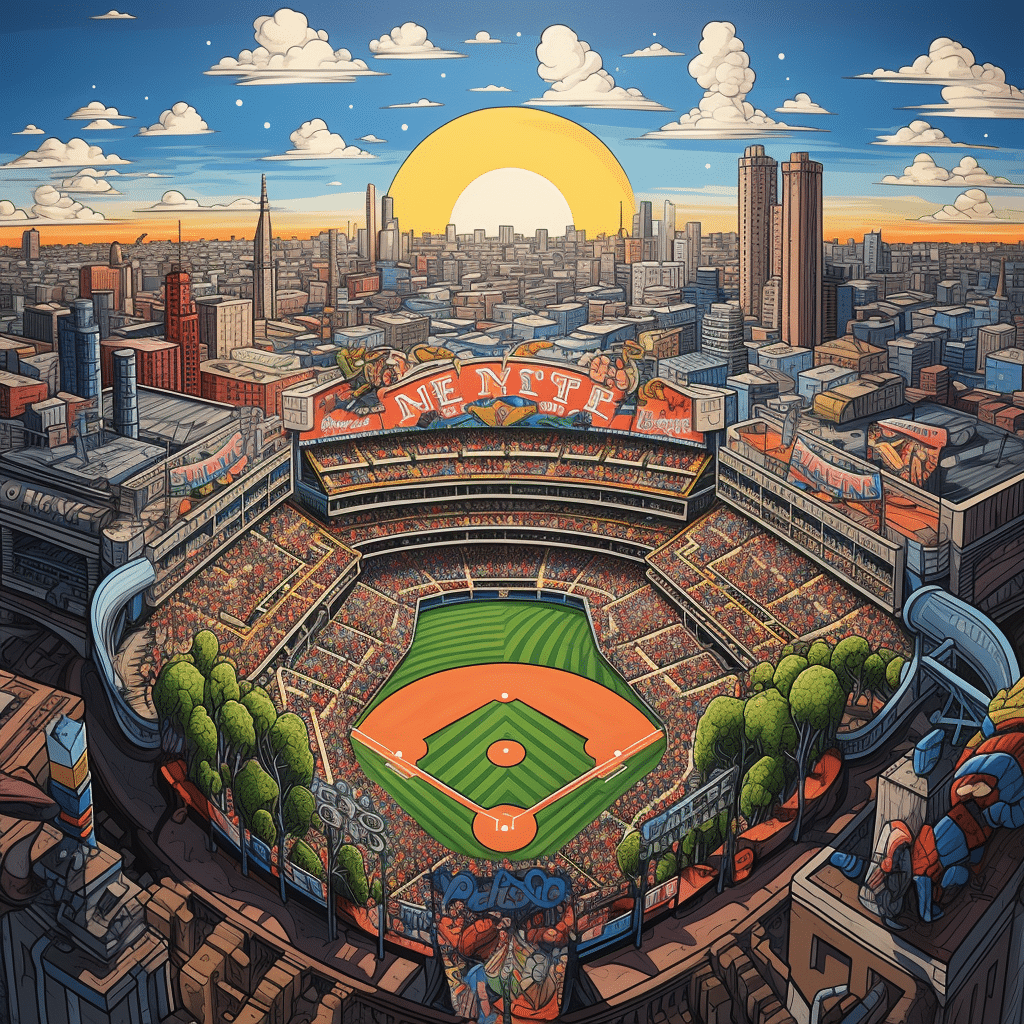

I. Jumping into the Bullpen: Getting Ready to Unleash the Investment Power of the Mets

Welcome, Mets fans! Buckle in for an exciting journey through the world of investments, inspired by our beloved New York Mets. As die-hard fans, we’re going to unveil how this passion for the Mets can turn into a profitable venture. So, before we dart to the pitcher’s mound, let’s understand how the Mets-fan fever can turn into a money-making machine. First things first, fandom isn’t a hobby for us; it’s a lifestyle. We eat, breathe, and sleep Mets. But have you ever considered linking our passion for the Mets to the world of investments? Let’s get set, Mets.

II. From the 7 Line Army to Financial Victory: How Fans are Turning Passion into Profit

Remember the day you joined the 7 Line Army? The same level of enthusiasm and strategy can be streamlined into our investment game. Just as Darren Meenan led a group of Mets enthusiasts in 2012, fostering a sense of community and connection, we too can leverage the camaraderie to grow our financial standing. Being a Mets fan is more than wearing team colors and cheering; it’s about applying hustles and strategic victories in our financial world too.

III. The Mets and the Metabolic Equivalent of Task: Investing in Your Financial Fitness with the Strategy of METs

A. What are METs and how do they apply to investments?

The hardcore Mets fanatics among us would know how METland works! For others, let me educate. MET stands for the Metabolic Equivalent of Task. In much simpler terms, it’s the energy one uses while sitting quietly, say, as quiet as watching Mets’ game. However, unlike the Mets’ game that may get your heart racing, leading to several METs, sensible investments involve a more measured, calibrated approach.

B. Understanding the correlation between METs and smart investing

Investing, similar to METs, involves a certain level of intensity too. It’s not about reading or running; it’s about balanced energy expenditure. As experienced Mets fans have seen through the games, success is often a blend of highs and lows. The same holds for investments. Sensible investing isn’t about one home run; it’s a marathon of multiple games over a lengthened period, just like a series of Mets matches.

IV. The Scoreboard Does not Lie: The Historic Wins and Losses of the Mets and Their Impact on Investments

A. How do historical no-hitters define smart investments?

The no-hitters the Mets have faced put forward a crucial lesson: even the most remarkable teams have their days of defeat. The New York Mets didn’t get their first no-hitter until 2012, and have been the receiving end of eight throughout their existence. It’s a bit like those unpredictable market movements. One might question How tall Is Danny devito relative to the towering Mets players, but remember, it’s not always the tall ones who score the home runs.

B. Drawing parallels between Mets’ game strategies and financial investments

For those clever Mets fans who have analyzed the team’s strategies, there’s a lot to learn and apply in investing. For instance, did you anticipate that the Mets would be so strategic in those “nail-biter” games, just like the curveballs and sliders you must dodge in investing? The point is, like the unpredictable nail Designs you get at your nail bar, investing is a game of unpredictability, but with strategy, you can steer clear of many pitfalls.

V. Playing Hardball: Top 5 Shocking Investment Secrets of Crazy-Successful Mets Fans

Ready for the adrenaline rush folks? Let’s get on the rollercoaster as we delve deep into the top 5 shocking investment secrets. The same Fogo de Chao feeling while watching the match as the intensity heightens will be matched in this financial ride. So grab your Mets cap and hold onto it as we reveal the secrets adopted by the most successful fans.

VI. The Financial Homerun: Continuing the Legacy of Smart Investing and Mets Fandom

As Mets fans, we’re all part of a legacy of smart strategies, unforgettable victories, and lessons in resilience. The same applies to our finances. Like the Mets work on perfecting their lineup, your portfolio needs regular checkups and adjustments. The joy of seeing your investments grow is indeed comparative to the thrill of seeing the Mets score a homerun aligned with a foreseeable successful Easter season favoring corporation’s earning, as we discussed here.

VII. 7th-Inning Stretch: Stepping Back and Looking at Your Mets-Inspired Portfolio

Taking a pause, reflecting, and adjusting strategy based on the results is as crucial in investing as it is during the 7th-Inning time in a game. The Mets have been known to switch tactics during this break to get back into the game stronger. Similarly, investors too need to take a step back occasionally to reassess their investment strategy. Regularly reviewing your portfolio ensures it’s performing and is in line with your financial goals.

VIII. Pitching the Last Ball: Benchmarking Success and Preparing for Future Financial Home Runs

Before we usher in the closing, let’s not forget the last pitch is as vital as any other ball in the game. Celebrating each small accomplishment, just like the wins and losses during the season right before the sideline swap finally happens, an investor too needs to acknowledge progress and anchor for more. Stay attached to the stories and strategies that make the Mets utterly fascinating, and let those fuel your drive for financial success.

So Mets fans, it’s time to apply the same passion and strategy that we bring to watching our beloved team to our investments. Remember, it’s not just about cheering; it’s about triumphing too! So make it count, for the Mets and your wallet.