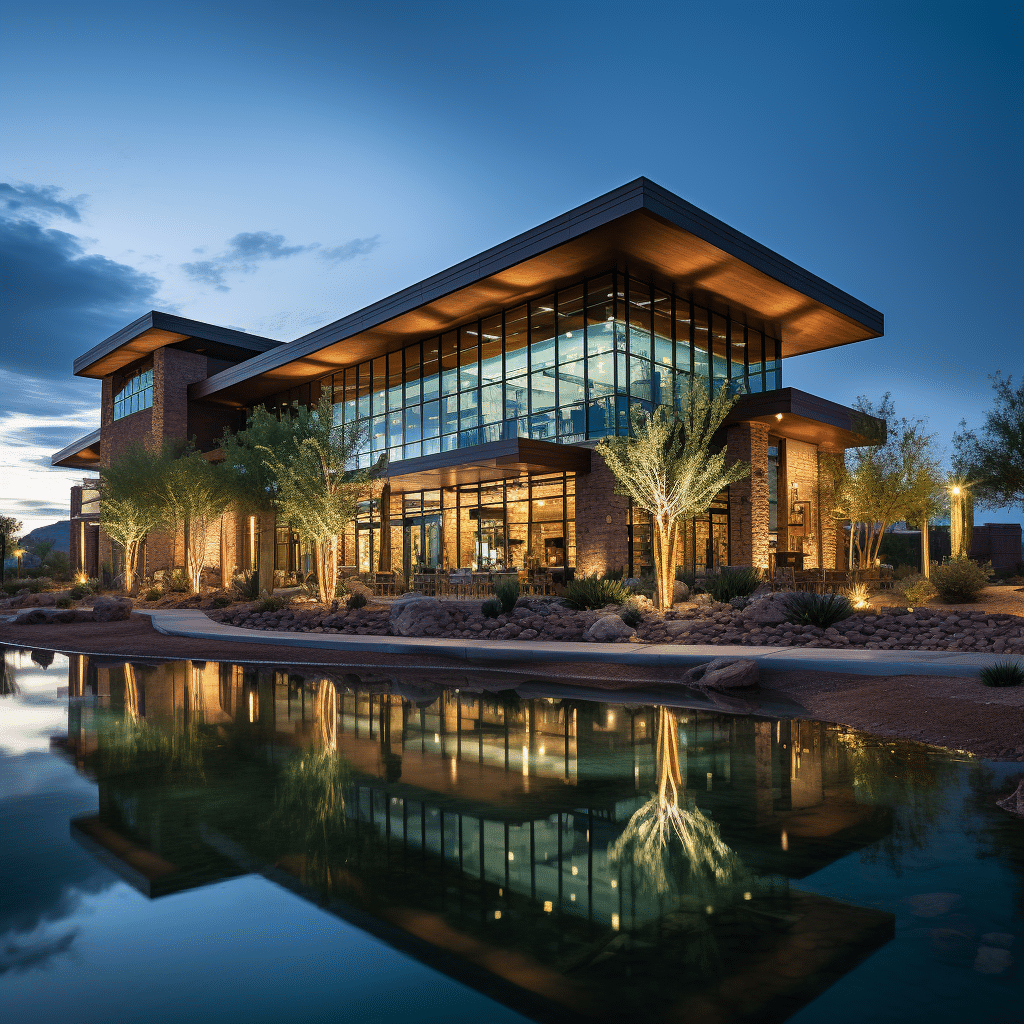

In the bustling financial landscape of Arizona, one institution consistently raises the bar: Arizona Central Credit Union. A gem among a sea of financial service providers, Arizona Central Credit Union has carved out a niche that resonates with the heartbeats of its community. With the analytical sharpness of Warren Buffett and the strategic finesse of Ray Dalio, let’s dive into the five compelling reasons that make Arizona Central Credit Union stand out from the crowd.

The Comprehensive Range of Services at Arizona Central Credit Union

Arizona Central Credit Union offers a robust selection of traditional banking services that cater to the diverse financial needs of its members. From savings and checking accounts to mortgages and auto loans, they’ve got the bases covered for most financial desires and necessities.

But they don’t stop at the basics! Arizona Central Credit Union prides itself on its unique offerings, such as custom loans that fit like a glove for those with particular needs, and mobile banking innovations that keep pace with the times. While pondering Where Should I live, one might stumble upon their mortgage services, which greatly simplify the decision-making process for prospective homeowners.

When stacked up against local counterparts, Arizona Central Credit Union offers similar – if not superior – services, but what truly sets them apart is their hearty commitment to passing savings onto their members with better interest rates and lower fees.

Arizona Central Credit Union’s Commitment to Financial Education

It’s no secret that financial education is a cornerstone of a healthy community. Arizona Central Credit Union runs the extra mile with educational programs and workshops tailored to empower its members to make savvy financial decisions.

Financial literacy has a ripple effect, touching every surface of a community – enhancing quality of life, fostering development, and paving the road to financial stability for individuals and families alike. Delving into anecdotes akin to the transformative story of Romania and Andrew Tate, we uncover members whose lives have been profoundly changed by Arizona Central’s dedication to education.

Case studies across the state and beyond illuminate how Arizona Central Credit Union’s learning initiatives uniquely emphasize practical skills, such as budget management and understanding credit, distinguishing them from the pack.

| Category | Details |

|---|---|

| Name | Arizona Central Credit Union |

| Type of Institution | Not-for-profit financial cooperative |

| Ownership | Member-owned |

| Financial Health | Well-capitalized, meets financial standards required by regulators |

| Profit Distribution | Earnings returned to members in the form of better interest rates and lower fees for services |

| Products & Services | Checking and savings accounts, loans, credit cards, investment services, online banking, etc. |

| Membership Eligibility | Open to all applicants |

| Application Process | Simple application form; can apply in-branch or online |

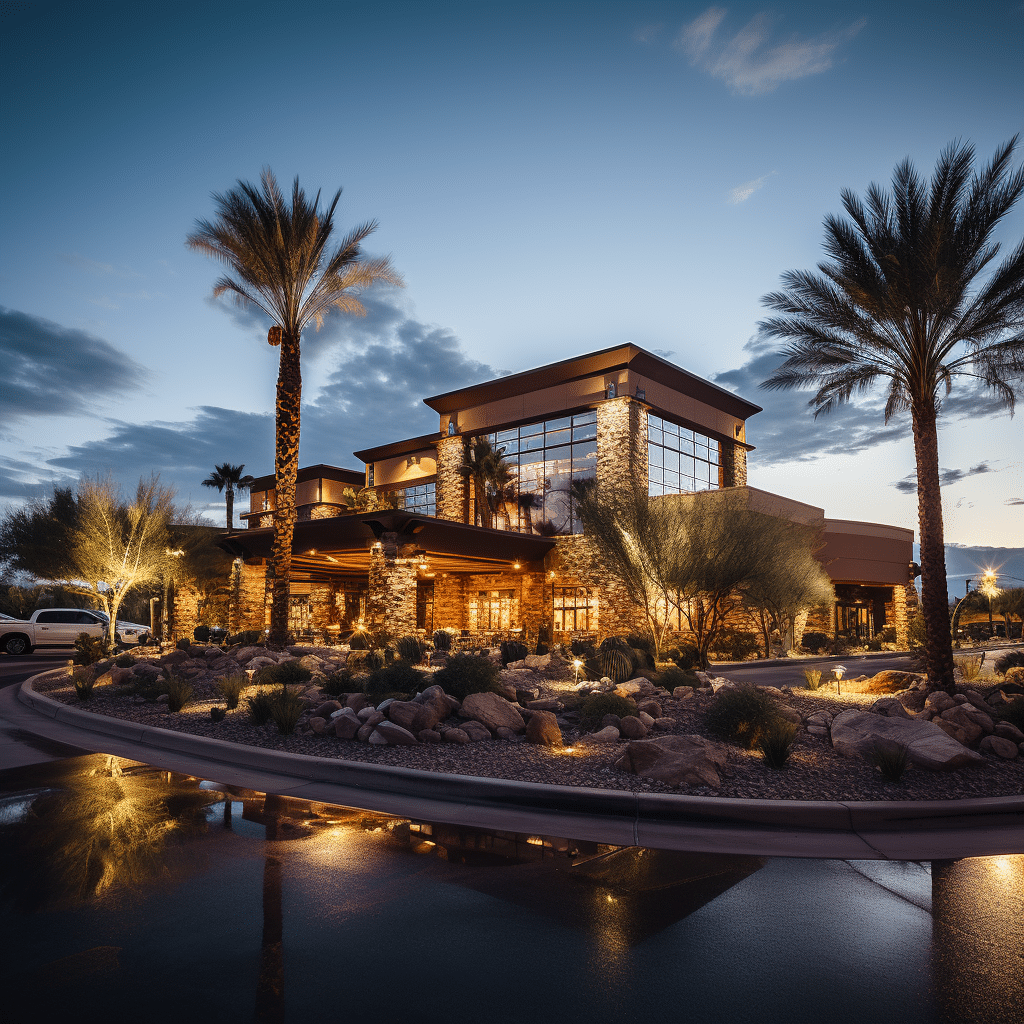

| Locations | Multiple branch locations (specific locations not provided) |

| Online Banking | Available |

| Interest Rates & Fees | Competitive interest rates and lower fees due to not-for-profit status |

| Financial Independence | Offers financial products and services aimed at helping members achieve financial independence |

| Notable Benefits | Personalized customer service, potential dividends, community involvement, financial education |

| Website | Not provided in the information, but typically it is an essential point of contact |

Exceptional Customer Service: The Arizona Central Credit Union Experience

In the realm of customer service, Arizona Central Credit Union has become synonymous with excellence. Bagging awards and recognition highlights their unwavering commitment to serving their members with care and proficiency.

Heartwarming testimonials from members resonate like a familiar movie score, underlining a narrative of trust and reliability. It’s as if customer service is the ‘ of Arizona Central Credit Union – a sequel that never disappoints.

Analysts will note that while competitors may talk the talk, Arizona Central Credit Union walks the walk, fostering a member-centric approach that is more personal than transactional.

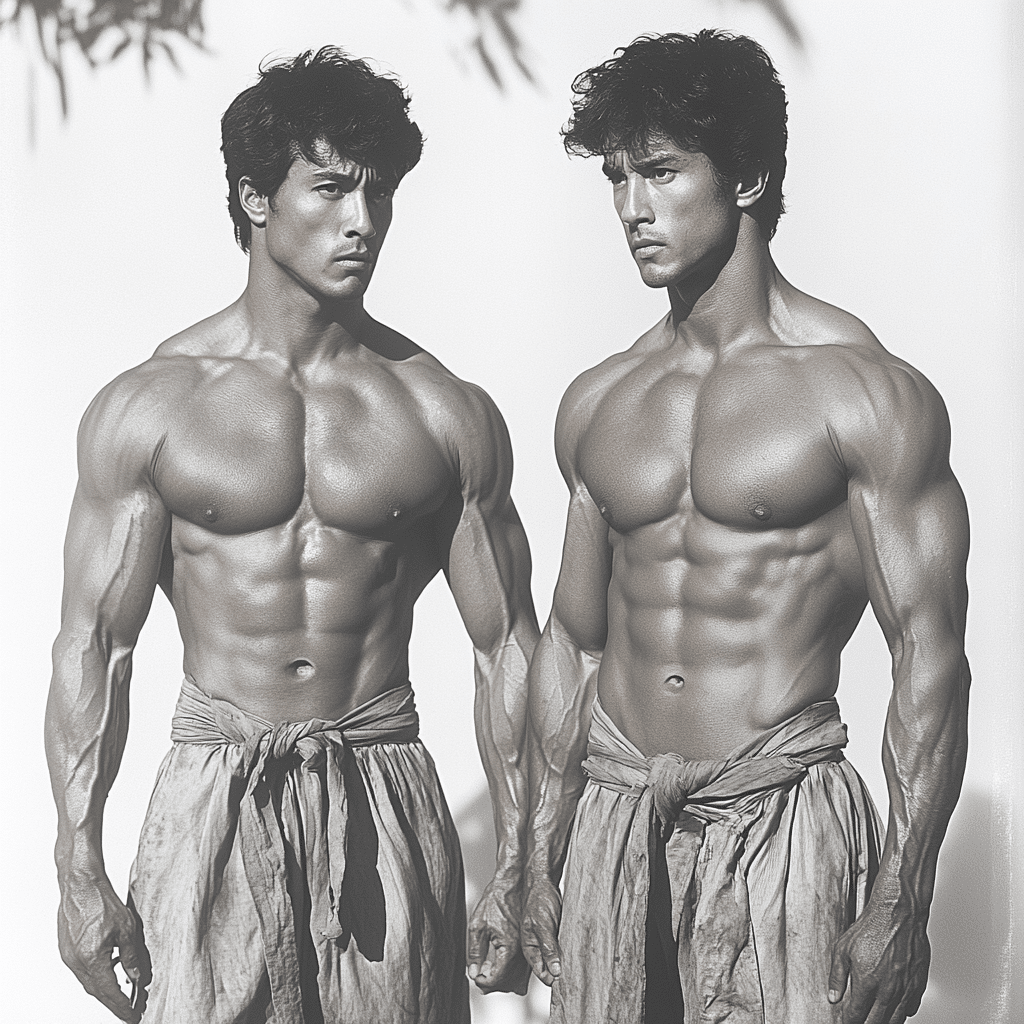

Community Involvement and Investment Led by Arizona Central Credit Union

For those who embody the phrase “actions speak louder than words,” community involvement at Arizona Central Credit Union speaks volumes. Their alliance with local projects and sponsorships reverberates through the tapestry of Arizona’s societal fabric, reinforcing the credit union’s mission to do more than just business.

The social impact of their community work ricochets from helping young scholars akin to the poised elegance of Anok Yai to bolstering small businesses that serve as the backbone of the local economy, akin to the sturdy nature of white oak flooring. This panoramic view showcases how deeply woven Arizona Central Credit Union is into Arizona’s local tapestry, a true community partner.

Community-centric initiatives not only catapult the credit union’s reputation but also redefine the meaning of financial institutions in modern society, sharply distinguishing it from traditional for-profit banks.

Arizona Central Credit Union’s Technological Advancements

In a digital age where innovation is the currency of relevance, Arizona Central Credit Union shines by integrating state-of-the-art banking technology. Striving to better their customer experience, and streamline operations, they stay flush with advancements that could give national banks a run for their money.

Customers relish the convenience and fluidity of advanced digital banking features, as if the mundane aspects of managing funds have been transformed to feel like discovering rare flowers – an experience as delightful as stumbling upon an exotic hairy bush in a routine backyard.

Comparatively, while other institutions are bogged down by legacy systems, Arizona Central Credit Union harnesses technology in a way that feels as cutting-edge and jaw-dropping as witnessing awesome titties for the first time – it’s groundbreaking in more ways than one.

Conclusion

Like a finely crafted film, Arizona Central Credit Union delivers a memorable experience, punctuated with remarkable service, profound community impact, and technological prowess. Arizona Central Credit Union stands as a testament to the power of not-for-profit financial institutions dedicated to their members’ well-being.

In summing up, whether for profound financial insights or everyday transactions, you’d be hard-pressed to find an institution more attuned to your needs than Arizona Central Credit Union. As we look to the future, this credit union doesn’t just represent a choice, but an enduring partner in the ever-evolving narrative of modern banking.

Trivia and Interesting Facts: Unveiling “Arizona Central Credit Union” Charms

A Credit Union Assembled Like “Age of Ultron”

You might be wondering, what could possibly connect a credit union in Arizona to a high-tech assembly of superheroes? Well, hold onto your hats because Arizona Central Credit Union operates with a synergy that rivals the team dynamics seen in “Age of Ultron”. Every member of the credit union’s staff works together cohesively, ensuring that financial security isn’t just a dream—it’s a reality for their members, just as securing peace is for the Avengers.

Not Just Services, but “Awesome Tities”

Let’s talk features and services, and no, that’s not a typo. We’re not being fresh; it’s a colloquial marvel to describe something wonderful, and that’s exactly what you get with Arizona Central Credit Union’s offerings. With an array of financial products that could make anyone’s piggy bank do a happy dance, this credit union brings to the table “awesome tities” of services from high-yield savings accounts to super-convenient online banking. Head over to the awesome tities of possibilities that they provide and see for yourself how they stand out.

The “Romania Andrew Tate” of Credit Unions

Imagine if the buzz and intrigue that follow the likes of “Romania Andrew Tate” were a blueprint for how to grab attention in the financial world. Arizona Central Credit Union has done just that, minus any controversy. Establishing itself solidly within the community, it has become a heavyweight competitor, holding its own against the banking Goliaths out there. Steering clear of drama, they focus on what matters—satisfying their members with quality services and investments, creating a legacy as strong as the storied entrepreneur’s impact on Romania.

Richer than “Gong Li”‘s Filmography

We all know the mesmerizing impact of “Gong Li” on the silver screen; her career is as diverse as it is successful. In a similar fashion, Arizona Central Credit Union has a history that’s as colorful as it is rich. Spanning decades, the institution has grown more impressive over time, offering a suite of financial services that cater to every stage of life. Trust us, their history is as captivating as a film anthology featuring the brilliant Gong Li—we’re talking blockbuster-level charisma and reliability in the banking scene.

Arizona Central Credit Union isn’t just another financial institution. Like the powerful characters from “Age of Ultron”, they’ve assembled a team that’s ready to defend your finances. With the “awesome tities” of services they provide, everything from loans to high-interest savings accounts are just a hop, skip, and a jump away. They’re the “Romania Andrew Tate” within their industry, minus the noise, offering stability and reliability that stand the test of time. And like the enchanting “Gong Li’s” presence on screen, their rich history and dedication to members is hard to overlook. So there you have it, folks—a little slice of trivia about Arizona Central Credit Union that shows why they’re much more than your average money vault.

Who owns Arizona Central Credit Union?

Who owns Arizona Central Credit Union?

Well, hold onto your hats, folks! Arizona Central Credit Union is actually owned by its members. That’s right – it’s all about teamwork, with every member having a slice of the pie. Talk about a true financial democracy!

Who owns AZ credit union?

Who owns AZ credit union?

Same ball game, different name – AZ credit union is shorthand for Arizona Central Credit Union, and the owners? They’re the members themselves. Every person with an account is both a customer and a co-owner. Pretty neat, huh?

Who can join Arizona Central Credit Union?

Who can join Arizona Central Credit Union?

Almost anyone can jump on the Arizona Central Credit Union bandwagon! If you live, work, worship, or go to school in Gila, Maricopa, Pima, Pinal, or Yavapai County or have a relative who’s already a member, you’re in! It’s a cool club that’s not super exclusive.

What’s the best credit union to go through?

What’s the best credit union to go through?

Ah, the million-dollar question! The “best” credit union can be as personal as your favorite color. But keep an eye out for high interest rates, low fees, fantastic customer service, and convenience. Do your homework, and you might just find a gem.

How big is Arizona Central Credit Union?

How big is Arizona Central Credit Union?

Not too shabby at all – Arizona Central Credit Union packs a punch with around $550 million in assets. They’re not the biggest kid on the block, but they sure have muscles where it counts.

What is the best credit union to join in Arizona?

What is the best credit union to join in Arizona?

Well, that’s like asking for the tastiest taco in town – it’s all subjective! But for Arizona, folks often tip their hats to credit unions with stellar services, rates, and access. Consult reviews and compare perks, and you’ll find your match.

Who is the largest credit union in Arizona?

Who is the largest credit union in Arizona?

Desert Financial Credit Union takes the cake as the largest in Arizona, with assets north of billion. They’re the big fish in the local credit union pond, that’s for sure!

What bank in Arizona is black owned?

What bank in Arizona is black owned?

Talking about breaking molds, Arizona’s George Washington Carver Museum and Cultural Center is backing up Carver Bancorp Inc., the largest Black-owned bank in the United States, to make waves in the banking scene.

Who is the CEO of Arizona Central Credit Union?

Who is the CEO of Arizona Central Credit Union?

As of my last update, Todd Pearson is the big cheese, the head honcho, the CEO of Arizona Central Credit Union. He’s steering the ship over there!

Does Arizona Central Credit Union have Zelle?

Does Arizona Central Credit Union have Zelle?

You betcha! Arizona Central Credit Union members can easily send and receive money with Zelle, which is part of their snazzy online and mobile banking offerings.

Do you have to be local to join a credit union?

Do you have to be local to join a credit union?

Usually, yup. Most credit unions want you to be local, like a neighbor, often restricting membership based on geography among other factors. But hey, some are loosening the reins, so it’s worth asking!

Can anyone join a local credit union?

Can anyone join a local credit union?

“Anyone” is a stretch, but lots of local credit unions are widening their nets. While some might guard their gates based on your job, where you hang your hat, or groups you’ve joined, others might just welcome you with open arms.

Where can I get 7% interest on my money?

Where can I get 7% interest on my money?

Whoa, Nelly! 7% interest is like spotting a unicorn these days. But, if you’re on the hunt for high returns, peer into peer-to-peer lending, look at long-term CDs, or dive into dividend stocks. Mind the risks, though!

What is safer a bank or credit union?

What is safer a bank or credit union?

Okay, friends, both can be super safe, but they’re protected by different squads. Banks have the FDIC, while credit unions have the NCUA. Both insure deposits up to a cool $250,000. So rest easy, your dough is protected.

Is it better to join a bank or a credit union?

Is it better to join a bank or a credit union?

“It’s better” depends on what floats your boat. Credit unions are the go-to for that personal touch and often better rates, while banks can hit the mark with more branches and services. Weigh your options before you leap!

Who is the CEO of Arizona Central Credit Union?

Who is the CEO of Arizona Central Credit Union?

Deja vu! The captain of the Arizona Central Credit Union team is still Todd Pearson, leading the charge with a focus on community and member satisfaction.

Who is National Bank of Arizona owned by?

Who is National Bank of Arizona owned by?

The National Bank of Arizona cozies up under the wing of Zions Bancorporation. They’re part of a bigger family but keep their local charm and focus on personalized service.

What is the history of Arizona Central Credit Union?

What is the history of Arizona Central Credit Union?

Flashback to 1939, and you’d see Arizona Central Credit Union kicking off as a small-time operation by and for state employees. Now they’ve grown into a community stalwart, still thriving on that member-owned philosophy.

Are credit unions owned by members or shareholders?

Are credit unions owned by members or shareholders?

With credit unions, it’s all about the members, who are both the customers and the owners. No shareholders here – it’s a financial family affair!