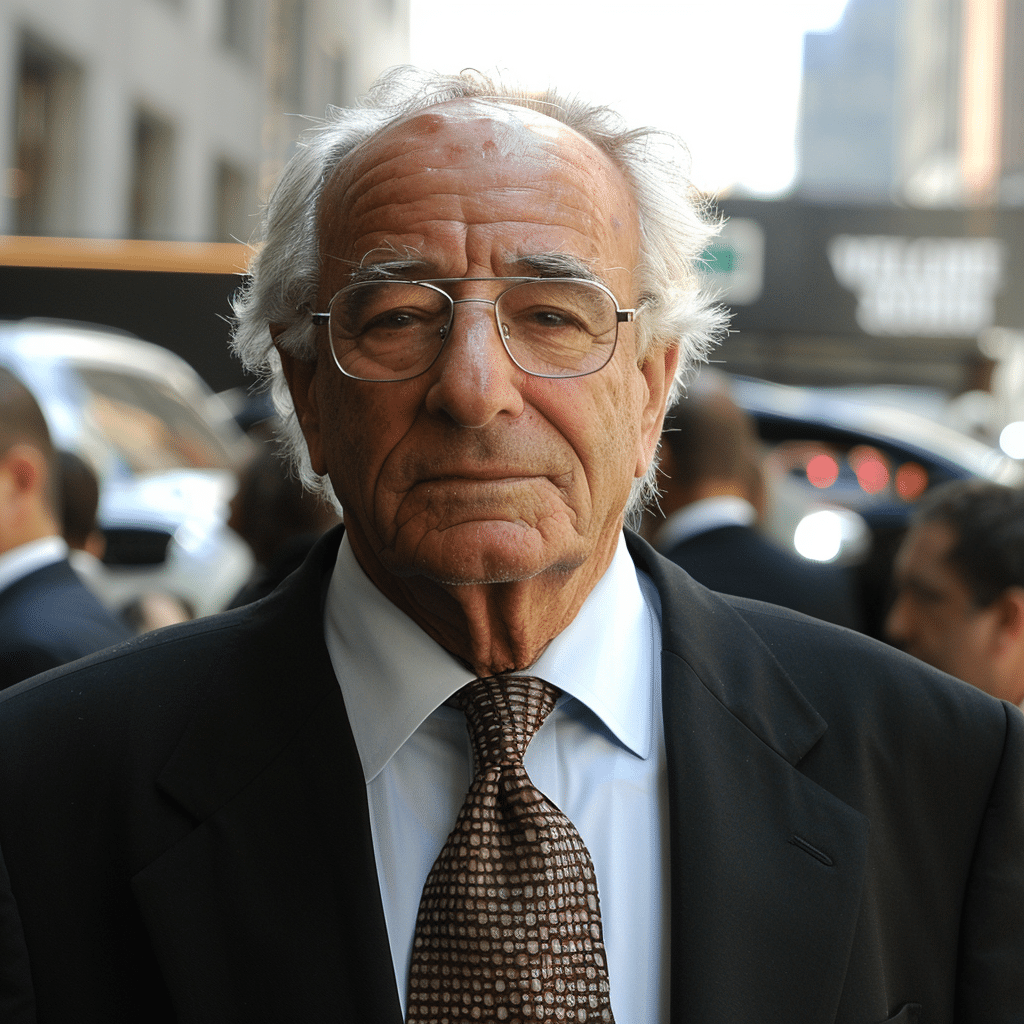

Bernie Madoff is a name that echoes infamy in the financial world. His strategy, deceitful yet devastatingly effective, led to one of the most perplexing questions of the modern financial era: How did he pull off the largest Ponzi scheme in history? With the bernie madoff death casting a stark shadow over the landscape of investment fraud, the end of Madoff’s life at 82 symbolizes the closure of a scandalous chapter that forever changed the course of financial regulation and investor psyche.

Bernie Madoff Death: The Final Chapter of a Notorious Financial Saga

When news of Bernie Madoff’s death broke, it stirred a maelstrom of emotions ranging from relief to rekindled anger from the countless people affected by his actions. Madoff’s passing due to hypertension, atherosclerotic cardiovascular disease, and chronic kidney disease marked the definitive end to a saga that had gripped the world for over a decade. Madoff’s operation, exposed in the midst of the 2008 financial crisis, swindled billions from unsuspecting investors and shook the foundations of trust within the financial industry.

Madoff’s façade of success, his esteemed reputation on Wall Street, crumbled when he confessed to operating the largest Ponzi scheme in history. His death came after serving only 12 years of what was essentially a life sentence, leaving a trail of destruction that had already claimed the lives of his sons; Mark Madoff to suicide and Andrew Madoff to cancer.

Unpacking the Bernie Madoff Ponzi Scheme: From Meteoric Rise to Disastrous Fall

Madoff’s rise to prominence was a classic tale of Wall Street success turned sinister. The investment empire he built, Bernard L. Madoff Investment Securities LLC, garnered respect and attracted a global clientele. However, beneath the veneer of legitimacy, Madoff was orchestrating a massive Ponzi scheme—one that would later serve as a masterclass in financial fraud.

The scheme hinged on using new investment funds to pay returns to earlier investors, creating the illusion of legitimate profits while in reality, no tangible returns were being generated. Madoff’s meticulous attention to detail and his exploitation of trust led to an ecosystem where even seasoned investors were blindsided. The sustainability of his scheme relied on an uninterrupted flow of money and an economic environment that discouraged the prying eyes of regulators. Yet, like all financial illusions, the mirage eventually dissipated, exposing the dire reality underneath.

| Subject | Details |

|---|---|

| Name | Bernard “Bernie” Madoff |

| Date of Death | April 14, 2021 |

| Age at Death | 82 |

| Cause of Death | Hypertension, Atherosclerotic Cardiovascular Disease, Chronic Kidney Disease |

| Location at Time of Death | Federal Medical Center, Butner, North Carolina |

| Sentence Served | 12 years of a 150-year sentence |

| Cremation | Cremated in Durham, North Carolina |

| Notoriety | Orchestrated the largest Ponzi scheme in history |

| Family | Widow: Ruth Madoff; Sons: Mark Madoff (deceased), Andrew Madoff (deceased) |

| Current Status of Spouse | Ruth Madoff resides in Old Greenwich, Connecticut; home owned by Susan Elkin |

| Legacy | Marked by financial fraud; affected countless investors |

| Sentence Commenced | December 2008 (arrested), June 2009 (sentenced) |

| Infamy | Bernie Madoff’s Ponzi scheme is estimated to have cost investors $65 billion |

| Family Tragedy | Mark Madoff died by suicide in 2010; Andrew Madoff died of cancer in 2014 |

The Victims of Madoff’s Scheme: A Closer Look at the Impact of His Crimes

From Hollywood elites such as Cynthia Watros to ordinary retirees hoping to secure their financial futures, Madoff’s devastating reach cut across all demographics. The scorch of financial ruin left by Madoff was indistinctive; charitable organizations, pensioners, and even those savvy in finance found their fortunes eradicated overnight. Each story served as a poignant reminder that behind the numbers were real people, grappling with a reality they hadn’t signed up for.

Harrowing tales from investors, like a couple who had saved every penny only to see it vanish, or a non-profit forced to shutter its doors, were indicative of the indiscriminate wrath of Madoff’s deception. Ultimately, the loss extended beyond mere dollars; it eroded the cherished peace of mind that individuals seek in their financial endeavors.

The Legal Aftermath: Proceedings and Penalties Following the Scheme’s Collapse

The exposure of Madoff’s Ponzi scheme triggered a landslide of legal repercussions. Amidst trials and public outcry, Madoff himself was sentenced to 150 years in prison. His confession did little to placate the victims who clamored for justice and restitution. The unraveling of the scheme illuminated sidekicks and accomplices, some unknowing and others complicit, who all faced their day in court.

Efforts to recover the squandered funds ensued, with institutions clawing back assets and setting up compensation mechanisms. Organizations such as the Securities Investor Protection Corporation (SIPC) worked diligently to mitigate the financial hemorrhage, yet they could only recoup a fraction of the lost wealth. Regardless, each cent returned was a small victory in the battle to mend what Madoff had torn asunder.

Prison Life and Bernie Madoff Death: Countdown to the End

Behind bars, Madoff became a shadow of his former self. No longer the mastermind in a bespoke suit, he was reduced to just another inmate, contending with the monotonies and hardships of prison life. Rumors circulated of his interactions with fellow detainees—many who had heard of the Madoff name but whose astonished reactions barely registered on his dulled façade. He reportedly maintained that family members had been kept in the dark about his fraudulent activities, a point contentious among those who scrutinized his empire’s operations.

Madoff’s ill health had been an ongoing concern, and the dying man’s requests for early release were repeatedly denied. When he finally succumbed to his ailments in the Federal Medical Center, Butner, his remains were cremated in Durham, North Carolina, putting a physical end to the man but not to the myth that had formed around him. Public sentiment remained divided, with some seeing his death as just desserts and others reflecting on it as a reminder of regulatory failures and unchecked greed.

Financial Systems Post-Madoff: Reforms and Regulations Enacted

Madoff’s dark legacy prompted a wake-up call throughout the financial industry. Regulatory bodies went back to the drawing board, fortifying systems with checks designed to prevent future Madoffs from emerging. The Dodd-Frank Wall Street Reform and Consumer Protection Act, among other reforms, sought to plug the gaps that had allowed such schemes to flourish unchecked.

These changes were akin to an organizational immune response, adapting to the ailments uncovered by the Madoff scandal. While subsequent high-profile frauds like Gautam Adani evidenced that the threat of deception never truly dissipates, the implementations post-Madoff did reinvigorate a culture of diligence and introduced a new generation of safeguards intended to protect investors from similar fates.

The Legacy of Bernie Madoff: How His Schemes Changed the Investment World

Madoff’s name has become synonymous with the ultimate breach of trust in the investment arena. His machinations solidified the narrative that incredulous returns should always be approached with skepticism and that transparency must be a cornerstone of financial dealings. The investment world, rocked by Madoff’s betrayal, had to grapple with the task of re-establishing confidence among a populace wary of opaque operations and too-good-to-be-true promises.

Financial advisors and fund managers now invoke Madoff’s tale as a stark warning to new cohorts of investors, reaffirming that due diligence and the critical appraisal of investment strategies are more than mere platitudes; they are the bulwarks against the allure of fraudulent designs.

Conclusion: Bernie Madoff Death – A Cautionary Tale for Investors and Regulators Alike

As the dust settles on the life and times of Bernie Madoff, the indelible mark he left on the world of finance acts as a continual admonishment. Bernie Madoff’s death might signal the end of one man’s dishonorable journey, but the repercussions of his actions persist as a potent reminder of what’s at stake when vigilance is relegated in favor of unexamined trust.

Madoff’s saga serves as a cautionary tale for investors and regulators alike, underscoring the importance of discernment and oversight in a landscape where the next Ponzi scheme could be lurking behind the most charming of facades. For Money Maker Magazine, tracking these developments and sharing invaluable insights remains critical in a world that, despite painful lessons learned, can never grow complacent against the specter of financial fraud.

It is our hope and ambition that as our readers move forward, the story of bernie madoff death not only steels them against future schemers but fosters an environment where such deceit finds no quarter to take root. In the meantime, let’s raise a toast to transparency and integrity over a Borg drink—simpler and far less likely to leave a bitter aftertaste.

The Intriguing and Controversial Tapestry of Bernie Madoff’s Death

Bernie Madoff, a name that became synonymous with one of the most notorious financial scandals in history, met a stark end at the age of 82. His demise was as dramatic as you’d expect from someone who pulled off such a grandiose scheme—quite the whirlwind, you could say, albeit without the literal helicopter crash.

A Swindle Larger Than Life

Oh boy, Bernie really took the world for a ride, didn’t he? His Ponzi scheme was the financial equivalent of nude in public—totally exposed and embarrassingly shocking. But unlike the spontaneous thrill of public exposure, Bernie’s scam left a lasting chill on his victims’ bank accounts.

The Numbers Game

Madoff’s deceptive dealings make trying to figure out the peso Colombiano a Dolar exchange seem like a walk in the park. Heck, his actions threw not just individuals but entire institutions into economic havoc. It’s like he baked up a batch of deceit, sprinkled with a generous helping of chaos; talk about needing a recipe for disaster—or should I say,How To make Donuts of doom.

The Aftermath of a Scandal

Post-scandal, picking up the pieces of Madoff’s shattered empire was about as complex as decoding an Elizabeth Debicki film plot. Investors scrambled to make sense of their financial futures as they watched Madoff’s legacy crumble, like watching a star fall from grace on the big screen.

Madoff’s Final Act

And so, Bernie Madoff’s death marks the end of an era—like the final curtain call in a long-running Broadway show. He exited stage left, leaving behind a legacy mired in deceit, a cautionary tale for the ages. Yet, for many, closure remains as elusive as the finale of a mystery-thriller. Bernie’s story is done and dusted, but for his victims, the reverberations of his actions continue to echo. It’s fair to say, in the grand scheme of things, the Madoff saga was one heck of a rollercoaster ride—one that many wish they had missed.

What caused Bernie Madoff death?

– Well, it’s no mystery; Bernie Madoff kicked the bucket due to a triple whammy of hypertension, atherosclerotic cardiovascular disease, and chronic kidney disease. He was 82 when he said his final goodbye at Federal Medical Center, Butner, which is basically a timeout corner for ailing inmates in North Carolina.

How long did Bernie Madoff serve before death?

– Bernie Madoff served a solid 12 years of his whopping 150-year sentence. He donned his prison jumpsuit in North Carolina and stayed in the clink until he passed away at the ripe old age of 82. Talk about a long haul cut short!

Where is Madoff’s wife now?

– Madoff’s other half, Ruth, has landed on her feet, living large in a swanky 4,000 square foot pad by the water in Old Greenwich, Connecticut. The place is actually in her daughter-in-law, Susan Elkin’s name – talk about keeping it in the family!

Did both of Bernie Madoff’s sons died?

– Yeah, it’s a real tragedy. Both of Bernie Madoff’s sons have passed away. Mark, the elder, tragically took his own life in 2010, and then, adding to the heartache, Andrew lost his battle with cancer in 2014. A rough hand for any parent to be dealt.

What did Madoff do with the money?

– Oh, Bernie Madoff? The guy was practically a human shredder when it came to cash. He pulled the wool over people’s eyes with his Ponzi scheme, pretending to invest their dough but really just using new investors’ money to pay the old ones. It was all smoke and mirrors until it spectacularly went up in flames!

Who did Bernie Madoff hurt?

– Bernie Madoff hurt a whole crowd of folks, from fat cats to average Joes. His Ponzi scheme was like a wrecking ball to many people’s bank accounts, crashing down on charities, celebs, and retirement funds. He left a trail of financial ruin in his wake that’s hard to wrap your head around.

Did Madoff go to his sons funeral?

– Now, here’s a heartbreaker—Madoff couldn’t even say his last goodbyes to his boys. Locked up, he missed out on attending both his sons’ funerals. That’s a gut punch no parent should have to bear, even if he did bring his troubles on himself.

How much is Ruth Madoff’s net worth?

– As for Ruth Madoff, she’s not exactly rolling in the dough these days. After the whole fiasco, she was left with a relatively modest sum to live on—a mere $2.5 million when the dust settled. It’s safe to say her days of champagne wishes and caviar dreams took a nosedive.

What is Bernie Madoff’s family doing now?

– After the scandal, Madoff’s family has been trying to lay low, but life goes on. Ruth’s camped out in Connecticut, living a quieter life in her daughter-in-law’s waterfront home. The rest of the clan, well, they’ve gotta carry on with the family name that’s seen better days.

Did Ruth Madoff go to Mark’s funeral?

– Ruth Madoff had to endure a real-life Greek tragedy but she did attend her son Mark’s funeral. Despite being knee-deep in a world of scandal, she found the strength to show up and pay her respects, standing by her son in his final farewell.

How much money did Madoff steal?

– Brace yourself: Bernie Madoff’s heist clocked in at an eye-watering $65 billion. That’s billion with a ‘B’—pretty much the Mt. Everest of swindles. His phony-baloney investing made off with a lot of moola, leaving countless folks with empty pockets.

Why didn t Madoff flee?

– You’d think with all that stolen loot, Bernie Madoff would’ve vamoosed to a tropical island, right? Not quite. Seems like he didn’t make a run for it because he was convinced his financial wizard act would never crumble. Plus, with a lavish lifestyle and a rep to uphold, he probably thought he’d never get caught. Oops.

Who died in the Madoff family?

– The Grim Reaper paid a few too many visits to the Madoff clan. Bernie’s gone after a few health problems did him in, and both of his sons, Mark and Andrew, have left this mortal coil—Mark from suicide in 2010, and Andrew from cancer in 2014.

Did Ruth Madoff win Maryland lottery?

– Now, wouldn’t that be a plot twist? But nah, Ruth Madoff didn’t hit the jackpot with the Maryland lottery. Life after Bernie’s scandal’s been more about penny-pinching than winning any windfall—no lucky numbers for her, just the harsh reality of a giant fall from grace.

Who is Susan Elkin married to?

– Rubber-stamping that info for you: Susan Elkin was married to Mark Madoff, Bernie’s older son. After his tragic end, she’s kept a low profile, but she’s the one with the keys to the Connecticut estate where Ruth now resides.

Who bought Madoff’s house?

– Cash in on this: Madoff’s swanky beachfront mansion in Montauk, New York, was sold off by the feds to real estate mogul Steven Roth and his wife, Daryl Roth, in 2009. Their bid? A cool $9.41 million. That’s one pricey piece of the Madoff empire that didn’t end up underwater!

Who are Bernie Madoff children?

– Bernie Madoff’s progeny? Let’s break it down—he had two sons, Mark and Andrew, both of whom were in cahoots with him at his firm. Life’s been bumpy to say the least; they’ve both left us too soon, their legacies forever tangled in their dad’s notorious web of deceit.