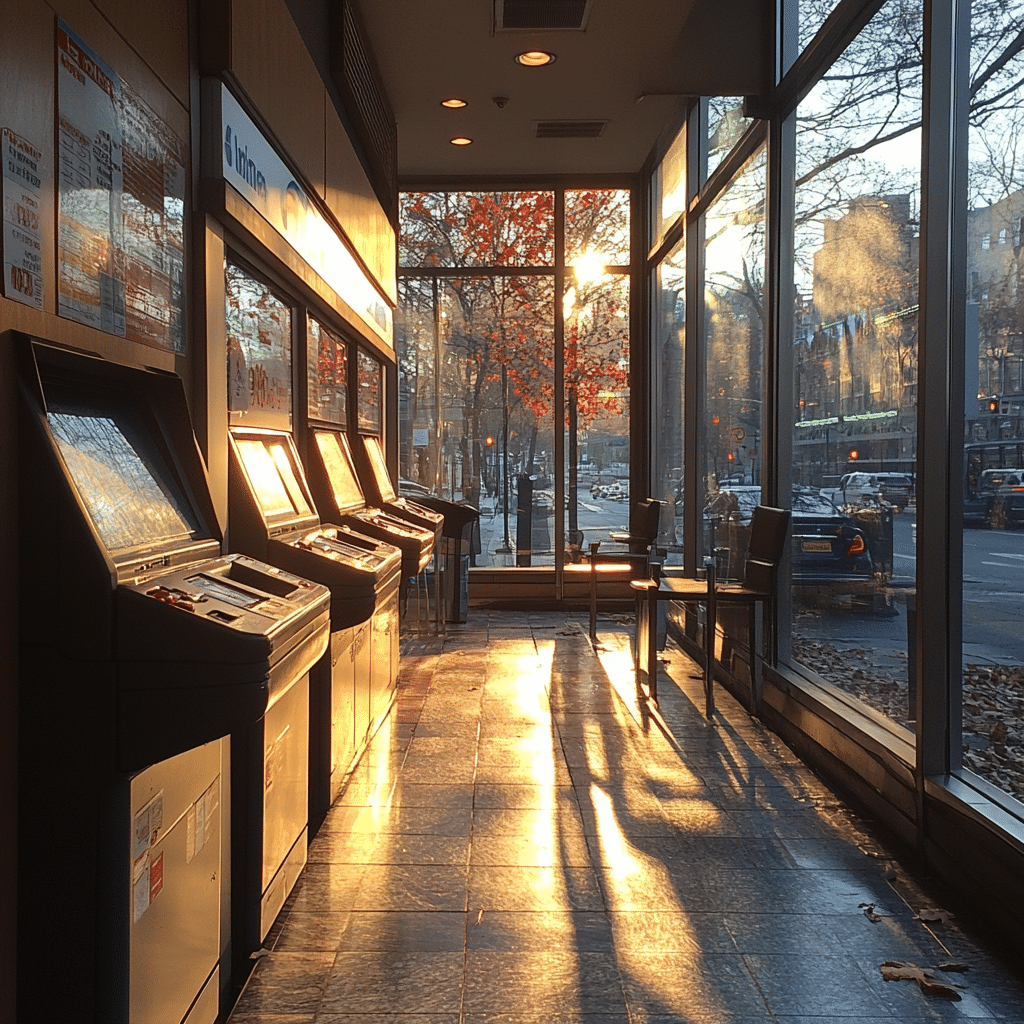

In our fast-paced society, having convenient access to your cash is more important than ever. Citibank ATM serves as a cornerstone for financial accessibility, making it a go-to for many customers. As digital transactions become the norm, the need for immediate access to cash is skyrocketing. Citibank’s robust network of ATMs stands tall among its competitors, including OneUnited Bank, CorTrust Bank, Intrust Bank, and MidFirst Bank. Whether you’re a local resident or a traveling business professional, Citibank ATMs offer a blend of reliability and accessibility that’s hard to beat.

In this article, we’ll dive deep into the top five benefits of using Citibank ATMs and explore how they stack up against other banking options out there. We’ll also take a peek into the exciting trends shaping the future of ATM technology. So, get comfy, and let’s unravel all that Citibank ATM has to offer!

Top 5 Benefits of Using Citibank ATMs

1. Wide Availability Across Locations

One of the biggest advantages of Citibank ATMs is their extensive availability in both urban centers and suburban communities. With thousands of locations nationwide, there’s a good chance you’ll find a Citibank ATM just around the corner. This availability is crucial for on-the-go individuals who might need cash during unpredictable hours.

Moreover, Citibank ATMs aren’t limited to withdrawals. Customers can also deposit money, check balances, and even transfer funds. Many smaller banks like CorTrust Bank and Intrust Bank may not offer a similar breadth of services or reach, making Citibank a clear winner in this category.

2. 24/7 Accessibility

In today’s world, people work around the clock, and the need for late-night cash access has become a real necessity. Citibank ATMs are available 24/7, meaning customers don’t have to schedule their lives around banking hours. Whether you’re grabbing late-night snacks or just need to cover an unexpected expense, you can rely on Citibank ATMs to be there for you.

In contrast, banks like OneUnited Bank may limit ATM services to certain hours, restricting access just when you might need it most. The ability to bank at your convenience is an essential feature that Citibank has nailed.

3. Advanced Security Features

Security is what’s on everyone’s mind these days, especially with increasing digital threats. Citibank prioritizes customer safety with state-of-the-art security measures. Features like card encryption and biometric authentication ensure that your transactions are safer than those at some smaller banks like Intrust Bank and CorTrust Bank, which might lag behind in adopting such technologies.

In an era where ATM-related fraud is on the rise, choosing a bank that invests in security can give you peace of mind. With Citibank, you’ll know your cash and personal information are well-guarded.

4. User-Friendly Interface and Smart Technology

Navigating an ATM should be a breeze, and Citibank ATMs excel in this area. Their user-friendly interface, complete with touch screens, allows customers to complete transactions quickly and efficiently. Need cash in specific denominations? No problem! Citibank ATMs have you covered, allowing for a tailored experience that leaves little room for frustration.

In comparison, some smaller banks like MidFirst Bank still use older ATM technologies that can be cumbersome. With Citibank, you’ll spend less time waiting and more time on what matters most.

5. Integration with Mobile Banking

In an age where smartphones dominate our lives, Citibank seamlessly integrates its ATMs with a cutting-edge mobile banking app. Customers can easily locate nearby ATMs and receive real-time updates about their account balances, making banking much more efficient. Imagine being able to find the nearest ATM after a night out, or checking your balance before a big purchase without any hassle.

Other banks might still be playing catch-up in this area, but Citibank ensures that its technology caters to the needs of modern consumers.

How Citibank ATMs Compare to Other Banking Options

Let’s break down how Citibank’s ATM offerings hold their own against other banks to give you a clearer picture.

Future Trends and Innovations in ATMs

What’s next for ATM technology? The future looks bright with several exciting trends on the horizon.

Contactless Withdrawals

Imagine popping your phone near an ATM and having cash dispensed without even touching the screen. This futuristic feature could soon become a reality with advancements in contactless withdrawal options. By enhancing speed and convenience, Citibank aims to lead the charge in this revolutionary development.

Cryptocurrency Integration

In an age where digital currencies are gaining traction, Citibank might consider implementing cryptocurrency transactions at their ATMs. This move could attract a growing demographic of investors interested in diversifying their portfolios into digital assets. Just like knowing how to cancel an Amazon Prime subscription can help you save money, adapting to these modern investment trends can offer new opportunities.

Personalized Services

With advanced analytics, ATMs could start offering personalized services tailored to customer needs. Imagine an ATM that remembers your usual transactions and prompts you accordingly, streamlining your banking experience. By anticipating your needs, Citibank could take user experience to new heights.

In today’s financial landscape, time is money, and the accessibility of Citibank ATMs positions the bank as a top contender. Their solid security features, extensive network, and innovative technology make Citi a smart choice for customers looking for easy cash access. As we continue to explore the future of banking, it’s essential to keep an eye on institutions that truly understand the evolving needs of their customers.

When you consider all these benefits, there’s no doubt that the Citibank ATM serves as your gateway to a more accessible financial future. So, the next time you’re in need of quick cash, remember that a Citibank ATM is never too far away! For those enjoying a movie night on the couch, thinking about financing their perfect home, or even wondering What Does Heb stand For, the right bank can help with more than just cash — it can support your entire financial journey.

Citibank ATM: Quick Cash Access Anytime

Fun Facts About Citibank ATMs

Ever wondered about the convenience of a Citibank ATM? It’s not just a robotic cash machine; it’s a gateway to financial freedom, available day or night! Did you know that the first ATM was launched in 1967 by Barclays Bank? Back then, it was just a simple device that dispensed cash, unlike today’s Citibank ATMs that offer a plethora of services. Just like meal delivery services have changed how we dine, Citibank ATMs have transformed how we access our cash, making our lives that much more convenient!

Switching gears, if you’re curious about where to watch the Dallas Cowboys vs. 49ers game, simply check your local listings while keeping an eye out for Citibank ATMs near your viewing spots. You can grab some cash for snacks without missing a beat! Plus, here’s a fun nugget: Citibank’s ATMs are equipped to handle multiple currencies. So, if you’re traveling abroad or feeling adventurous, you can easily withdraw cash in local currency—no need to scramble around looking for banks or exchange services.

Load Up with Knowledge

Moving on, did you know Patricia Blair, a famous actress from the golden age of TV, used to receive fan mail stuffed with cash? While the idea of carrying that much cash around might scare some folks, a Citibank ATM lets you keep your hard-earned cash safe and sound until you need it. And speaking of keeping things secure, most ATMs now come with enhanced security features, making it less likely for anyone to mess with your cash flow.

Don’t forget, if you ever feel overwhelmed with subscriptions, like how to cancel an Amazon Prime subscription, take a moment to evaluate your spending. A Citibank ATM can help you withdraw just what you need, keeping your budget on track. With the flexibility that comes along with every transaction, managing your finances doesn’t have to feel like navigating through the complexities of life! So next time you hit up a Citibank ATM, you’ll know you’re not just taking cash; you’re engaging with a piece of banking history while keeping financial control at your fingertips.

Which ATM can I use my Citibank card for?

You can use your Citibank card at any Citibank ATM for transactions, and you’ll also find surcharge-free access at most Costco, CVS/pharmacy, and Target locations.

What bank is associated with Citibank?

Citigroup Inc., the company behind Citibank, is a major American multinational investment bank and financial services firm based in New York City.

Can I deposit cash at Citibank ATM?

Yes, you can deposit cash at Citibank ATMs, in addition to making deposits at any Citibank branch.

Does Target have a Citibank ATM?

Yes, there are Citibank ATMs located in some Target stores, allowing you to access your cash easily.

Can I use Chase ATM with Citibank?

You typically can’t use a Chase ATM with your Citibank card without incurring fees, as they operate independently.

Which bank is taking over Citibank?

There isn’t a specific bank taking over Citibank; it remains part of Citigroup Inc.

Is Citibank owned by Chase bank?

No, Citibank is not owned by Chase Bank; they are separate entities in the banking industry.

Where can I pay my Citibank credit card with cash?

You can pay your Citibank credit card with cash at any Citibank branch or at participating retail locations that accept credit card payments.

What stores are affiliated with Citibank?

Affiliated stores include Costco, CVS/pharmacy, Target, Duane Reade, and many Walgreens, which allow surcharge-free ATM access for Citibank customers.

Where can I deposit money to my Citibank card?

You can deposit money to your Citibank card at any Citibank branch or ATM, along with select retail locations that support cash deposits.

Can I deposit cash at an ATM that is not my bank?

Yes, you can deposit cash at ATMs that belong to other banks if they allow it, but be aware of potential fees.

What is Citibank ATM withdrawal limit?

The standard withdrawal limit at Citibank ATMs typically varies, so it’s a good idea to check your account details for specifics.

What stores use Citibank?

Many stores, like Costco and CVS, use Citibank’s services for various financial transactions and ATM access.

What ATM machine does not charge a fee?

ATMs that provide surcharge-free access include those at Costco, CVS/pharmacy, and Target, among others.

Can I deposit cash at Allpoint ATM?

No, you cannot generally deposit cash at Allpoint ATMs; they are primarily for withdrawals and balance inquiries.

Can you withdraw money from a different bank ATM?

Yes, you can withdraw money from a different bank’s ATM, but be prepared to pay a transaction fee unless they have a partnership with your bank.

Does Citibank cover ATM fees?

Citibank does not cover ATM fees if you use other banks’ machines, so those charges will usually come out of your account.

Can I withdraw money from a bank that isn’t mine?

Yes, you can use your card at any bank’s ATM, but watch out for fees that may apply.