The History of Cyprus Credit Union: Establishing a Legacy in Utah

Nestled in the heart of Utah’s economic story is Cyprus Credit Union, an institution with a history as rich as the state itself. Since opening its doors in 1935, Cyprus has woven itself into the fabric of Utah’s community, evolving alongside the changing needs and fortunes of the local economy. Like a sturdy tree that has stood the test of time, Cyprus Credit Union’s roots run deep, tracing back to a humble group of Kennecott Copper Mine workers who pooled their resources to provide financial solutions for each other.

Not unlike the breathtaking expansion of the Utah landscapes, Cyprus has grown robustly, escalating from a small collective to a cornerstone of financial stability within the community. Let’s flip through the pages of this credit union’s journey. Key milestones pin the timeline – encompassing their first foray beyond the mining community, diversifying their membership, and embracing technological advances to cater to a more connected member base.

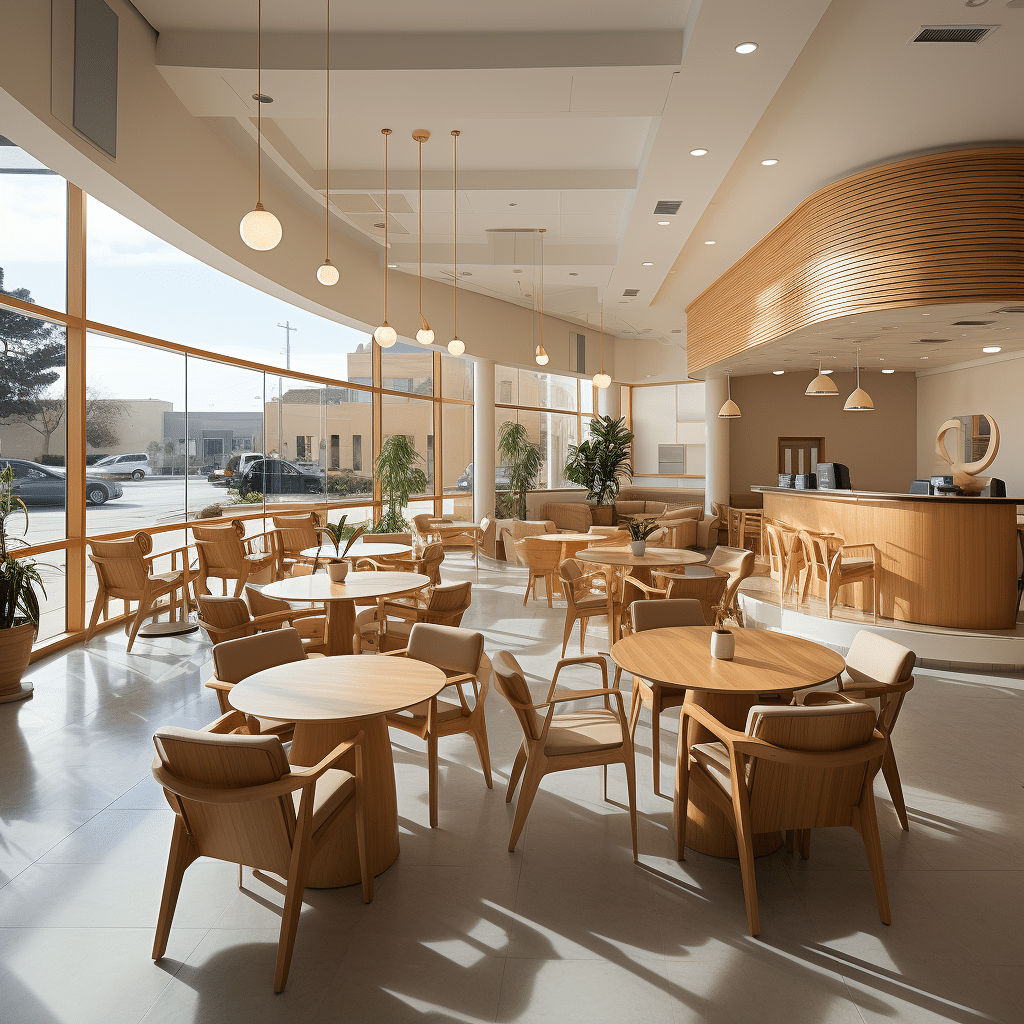

Today, Cyprus Credit Union is not just Utah’s longest-serving credit union, but a beacon of trust for over 134,471 members. Operating out of West Jordan, it stands as the 6th largest credit union in the state and the 275th nationally, propelled by an impressive team of 389 employees across 19 locations.

Cyprus Credit Union’s Member-First Approach to Financial Services

At the heart of Cyprus Credit Union is a philosophy that seems as clear as the Utah sky: members come first. This isn’t just feel-good rhetoric; it’s the compass by which they navigate every service they offer. Starting from decisions made by a volunteer board of directors who steer the ship with members’ interests at the helm, right through to the kind and knowledgeable staff that greet you at any of their branches.

Speak to any member and you’ll get the gist. “Cyprus took the time to understand my needs,” one member recounts. “They helped me through rough patches with more grace than any bank I’ve dealt with!” Indeed, this narrative rings familiar with many who have trusted Cyprus with their dreams and dilemmas over the years. Cyprus’s approach starkly contrasts the faceless algorithms and bottom-line pursuits one might associate with traditional banking models. Here, you’re family.

| Cyprus Credit Union Overview | Details |

|---|---|

| Founding Year | 1935 |

| Headquarters | West Jordan, Utah |

| Number of Employees | 389 (as of September 2023) |

| Number of Members | 134,471 (as of September 2023) |

| Number of Locations | 19 branches in Utah |

| Access to ATMs and Shared Branches | Over 30,000 surcharge-free ATMs and shared branches nationwide |

| Organizational Structure | Member-owned with a volunteer board of directors |

| Ranking in Utah | 6th largest credit union |

| National Ranking | 275th largest credit union |

| Products and Services Offered | Checking accounts, Savings accounts, Loans, Mortgages, Investment services, etc. |

| Benefits of Membership | – Localized customer service with nationwide account access |

| – Member ownership means profits may translate into better rates and services | |

| – Variety of financial services to cater to diverse membership needs | |

| Member Requirements | Membership is open to a range of individuals and families across Utah |

| Community and Member Support | Focused on developing relationships and supporting the financial needs of members |

| Financial Education and Resources | Provides educational resources for better financial management |

| Technology and Accessibility | Offers online and mobile banking solutions for account management |

| Commitment to Employees | Emphasizes placing the right people in appropriate positions at the right time |

Innovative Products and Services: How Cyprus Credit Union Stands Out

Cyprus Credit Union has not only matched pace with innovation but has often led the charge, particularly within the Utah financial landscape. They’ve hatched various products that tend to the unique contours of their members’ lives. Whether it’s a “Dream Home” mortgage scheme tailored for Utah’s evolving housing needs or a “Fresh Start” personal loan that provides a lifeline rather than a liability, Cyprus has crafted solutions with a personal touch.

For instance, their rewards checking account is not just another checking account; it bears the fruits of higher dividends and other perks such as free ATMs nationwide – a boon for the travel-keen Utahan. And for the financially savvy youth, their student checking accounts come with financial literacy tools that are more than just an afterthought. In these offerings, Cyprus doesn’t just stand out; it stands firm, reminiscent of the strong stance taken by a Charles Martinet-character in an old-school video game dialogue.

Cyprus Credit Union’s Role in Financial Education and Literacy

Imagine sitting down with Ray Dalio, picking his brain about financial strategy. While Cyprus may not offer that exact scenario, their commitment to financial education aims to empower their members similarly. Through workshops, one-on-one counseling, and online resources, Cyprus Credit Union works tirelessly to transform financial bewilderment into enlightened decision-making.

Reports from across the state vouch for their success. High schoolers who once blankly stared at the concept of compound interest now navigate investing basics with ease, and adults who broke out in a cold sweat at the mere mention of ‘budgeting’ are now prudent savers and spenders.

Other institutions have initiatives, sure, but Cyprus intertwines financial education with its product offerings, ensuring that members not only have the tools but also the knowledge to wield them wisely. A strategy akin to giving a map to a treasure-seeker, not just directions to the first landmark.

Cyprus Credit Union’s Commitment to Utah’s Economic Stability

Cyprus Credit Union’s roots in Utah bring a personalized insight into the local market, which transcends providing member services and extends into enhancing the state’s economic stability. An unwavering supporter of local businesses, Cyprus injects funds into ventures that know Utah’s heartbeat. This local investment strategy has shown to foster a thriving network, nurturing an ecosystem where both the businesses and the credit union prosper together in a harmonious cycle of growth and support.

Data and case studies pepper stories of businesses that, with Cyprus’s help, have turned ‘what if’ into ‘what is’. Thanks to tailored financing, these stories are rewriting Utah’s economic narrative, contributing to robust employment statistics and a more dynamic state economy.

The Digital Revolution: Cyprus Credit Union Embracing Technology

Warren Buffett once mused that adopting ambiguous new technology is like throwing feathered darts in the dark, not knowing the desired target. However, Cyprus Credit Union, rather than hesitating, marches confidently into the digital age, making bold technological strides while keeping their members at the core of every advance.

Their digital banking portals exemplify this — intuitive, secure, and rich with features that cater to both the digital native and the analog aficionado. Innovations like mobile check deposits, personalized alerts, and robust financial management tools reflect a balance between state-of-the-art and accessibility. Amidst their tech-savvy peers including larger banks, Cyprus positions itself not just as competitive but also as a leader, channeling a Technicolor movie in a world of silent films.

Personal Stories: Members and Their Experiences with Cyprus Credit Union

A mosaic of personal accounts paints a vivid picture of what it means to bank with Cyprus. Take, for instance, the young couple who, on a wanderlust whim, needed an urgent travel loan to scale the Utah’s Mighty Five. Cyprus turned their application around quicker than a Taylor Swift clean lyric hits the radio, with terms that felt like a breath of fresh mountain air. Or consider the retiree who found companionship in Cyprus’s personalized financial advice, leading to a golden age as secure and comforting as a favorite old cardigan.

These stories sing a similar tune: Cyprus does not just move money; they move with their members through life’s symphony, providing the crescendos and supporting through the diminuendos.

Strategic Partnerships and Community Involvement: Cyprus Credit Union Giving Back

Cyprus Credit Union believes that community strength grows through collective effort. This belief has led to a myriad of community projects, propelled by strategic partnerships that resonate with the authentic need for growth and support. From sponsoring local events to engaging in financial education programs for the underserved, Cyprus’s portfolio of community initiatives mirrors the vibrant patchwork of Utah’s own societal fabric.

These efforts are not mere ad-hoc endeavors but are infused with forethought and intention, akin to Masiela Lusha weaving a story that draws the reader intimately into the fold. The symbiosis between Cyprus and its community creates a cascade of benefits, feeding back into a more robust, interlinked society where growth is not an individual score but a collective high-five.

The Future Outlook for Cyprus Credit Union

Gazing into the crystal ball for Cyprus Credit Union unveils a determination to drive forward, guided by strategic insight and an unfading commitment to its members. Industry experts tip their hats to Cyprus’s agility in adapting to a rapidly evolving financial landscape, suggesting that this institution’s journey is poised for groundbreaking innovation and sustained expansion.

Future plans? They’re tightly held to the chest, but whispers of blockchain trials, expanded financial education platforms, and member-driven service expansions hang in the air, painting exciting prospects for both the credit and its beloved members.

Conclusion: Why Cyprus Credit Union Remains Utah’s Trusted Financial Partner

In an ensemble reflective of the best attributes a financial partner can offer, Cyprus Credit Union stands out as Utah’s compassionate confidant, robust ally, and innovative pioneer. By threading together a strong community focus with financial stability and technological innovation, all while centering on members’ narratives, Cyprus writes not only its own story but that of every member it serves.

Here lies an institution where warmth meets wisdom, tradition shakes hands with technology, and where the financial future beckons not just with promise but with partnership. Cyprus Credit Union remains a pillar, steadfast through generations, ever evolving yet timeless in its mission to empower every Utahan’s financial journey. On the horizon, it’s clear; Cyprus Credit Union is more than a name — it’s a promise of prosperity, shared strides, and a story that’s ever-unfolding.

Cyprus Credit Union: At the Heart of Utah’s Finance

Ever wondered what makes Cyprus Credit Union stand out in Utah’s financial landscape? Well, hold on to your hats because you’re about to dive into some engaging facts that’ll shine a light on this trusted financial partner.

Unearthing the Roots of Stability

Let’s start with a toast to longevity! Cyprus Credit Union has been a steadfast financial bulwark since its inception. Now, imagine instead of browsing through your tai Verdes playlist for investment inspiration, you could just tap into the legacy of an institution that’s seen Utah’s economy sway and swell like the tunes of time. Just think about it, a financial institution that’s equally familiar with the historical beats of Utah as it would be with taylor swift clean Lyrics.

But it’s not just about weathering storms; it’s about evolving to meet the modern needs of its members. While Sia face remains an enigma to many, Cyprus Credit Union prides itself on transparency and putting a friendly face to finance. So, you can bank with a smile, confident you’ll never need to decode enigmatic expressions when it comes to managing your moolah.

A Symphony of Services

Transitioning from the old to the new, Cyprus Credit Union stays in tune with innovations like an Ff7 rebirth power-up. Banking needs are dynamic, and keeping in step with the times is the equivalent of mastering an ever-changing melody. It’s about harnessing the power of progression to soar to new financial heights.

Now, let’s compare the institutions for a moment. Just as atomic credit union symbolizes strength and an inseparable bond within the financial community, Cyprus Credit Union mirrors this atomic assurance. It’s about providing that unbreakable commitment to its members, ensuring that every economic decision lands you on solid ground, no more wobbly than if you were watching a Shemale tube with all the steadiness of a Gibraltar rock.

Well folks, isn’t that something? From deep roots to dazzling services, Cyprus Credit Union sure has a lot to sing about. Have any quirky facts or stories about your experiences with Cyprus Credit Union? Don’t be shy—give your keyboard some love in the comment box below and share the wealth of your anecdotes. Who knows? Your tale could be the cherry on top of our financial fact cake!