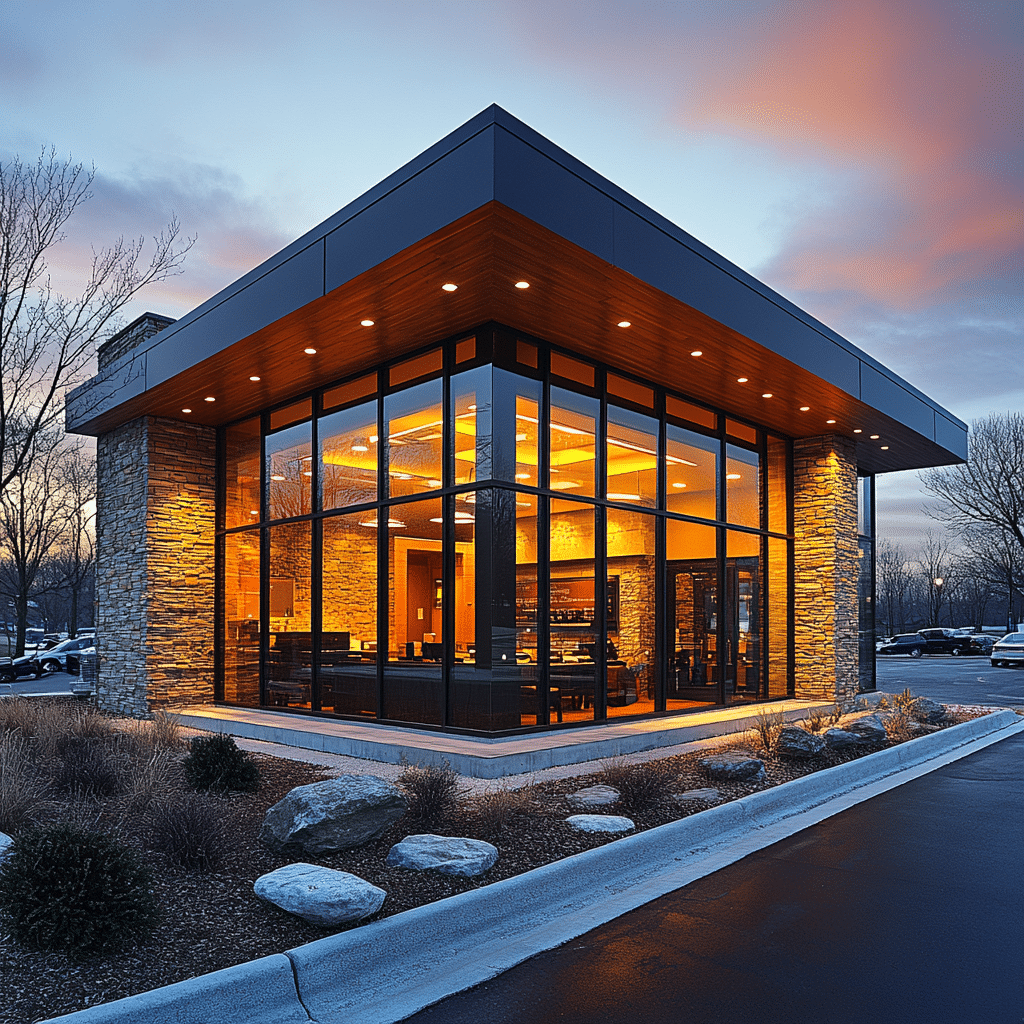

When it comes to Everwise Credit Union, they’ve garnered attention for their exceptional member benefits and services. With a focus on affordability and community, this credit union is reshaping how financial institutions serve their members. They’re not just about banking; they’re about creating value, enhancing financial literacy, and supporting local communities. So, whether you’re looking to save, borrow, or learn, Everwise Credit Union has something to offer.

1. The Diverse Portfolio of Everwise Credit Union’s Member Benefits

In the bustling landscape of credit unions, Everwise Credit Union shines brightly with its wide-ranging member benefits. Members gain access to competitive loan rates that help keep their finances in line. Interestingly, Everwise provides its members with exclusive discounts on personal finance workshops, aiming to improve financial literacy, an essential skill in today’s economy.

To paint a clearer picture, studies show that members taking part in workshops report enhanced financial knowledge. For instance, a significant percentage of attendees indicated they felt more confident about managing their budgets after these sessions. It’s this focus on education that sets Everwise apart from traditional banks, where such resources are often lacking.

Moreover, existing members often share glowing testimonials about their experiences, emphasizing how these benefits have tangibly improved their financial situations. From lower loan payments to better budgeting skills, Everwise Credit Union is clearly making strides toward member empowerment.

2. Top 7 Member Services Offered by Everwise Credit Union

2.1. Competitive Interest Rates

One of the standout features of Everwise Credit Union is its competitive interest rates. For instance, in the final quarter of 2023, the average mortgage interest rate stood at just 3.5%. This rate significantly undercuts the national average, which floated around 4.1%. Members often find their mortgage payments lower, allowing them to allocate their funds more efficiently.

2.2. High-Interest Savings Accounts

Looking to save? Everwise Credit Union offers high-interest savings accounts that yield up to 2.25%. This move is designed to help members grow their funds more effectively compared to the typical banks, which may only offer rates as dismal as 0.05%. It’s an eye-opener for those wanting to maximize their hard-earned money.

2.3. Comprehensive Financial Education

Educational resources are not a side note at Everwise; they’re a core offering. With a series of informative workshops covering everything from budgeting to retirement planning, members can tailor their financial education journey. Recent surveys reveal that 85% of participants felt they gained better financial management skills following these workshops.

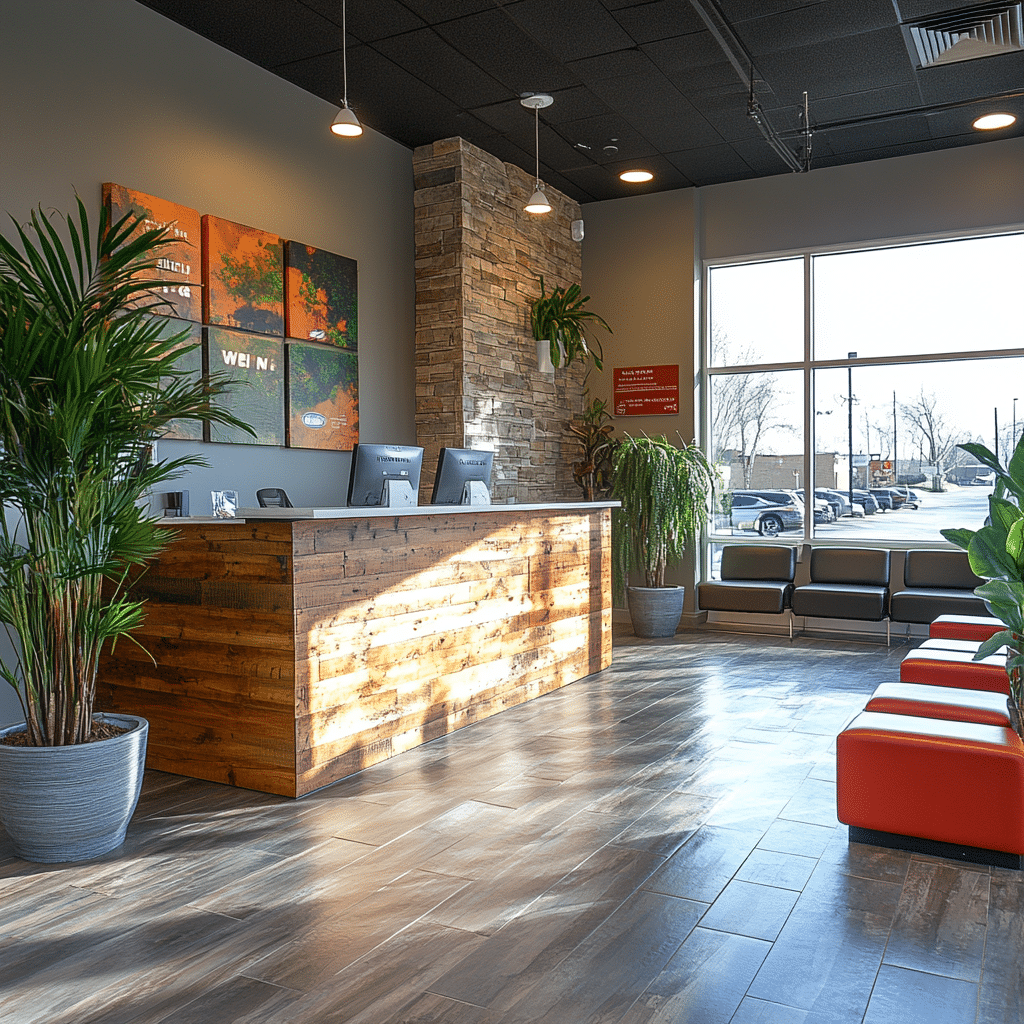

2.4. Personalized Customer Service

Forget long wait times and unhelpful representatives. Everwise Credit Union prides itself on an exceptional level of personalized customer service. Each member has access to tailored financial consultations aimed at addressing their distinct needs. In fact, 85% of members feel valued and understood, according to annual satisfaction ratings.

2.5. Community Engagement and Support Programs

Everwise Credit Union has its finger on the community pulse, too. They host charity events and support local businesses, demonstrating a strong commitment to community engagement. This not only fosters a sense of belonging but strengthens ties between members and the credit union.

2.6. Low Fees and Penalties

When it comes to costs, Everwise keeps fees low. The typical monthly maintenance fee is around $2, drastically lower than many banks, where fees can soar above $10. Adding to the appeal, members face no overdraft penalties for the first mistake, making banking less stressful.

2.7. Digital Banking Convenience

For the tech-savvy, Everwise Credit Union features an intuitive digital banking platform that allows seamless account management, card control, and even a budgeting tool. Surveys suggest that 92% of members regularly use their mobile app for everyday transactions, highlighting the platform’s efficacy and ease of use.

3. Innovation in Member Services: A Look Ahead

As the world progresses into 2024, innovation remains at the forefront of Everwise Credit Union‘s agenda. Plans are underway to enhance their digital capabilities further, introducing AI-driven personal finance chatbots. These chatbots will provide real-time advice and budgeting assistance, meeting the ever-growing digital expectations of members. It’s a smart move that highlights Everwise’s commitment to modernized financial services.

4. The Impact of Everwise Credit Union’s Services on Members’ Financial Health

A closer look at member feedback and financial outcomes reveals a direct correlation between Everwise’s offerings and improved financial health. Many members report higher savings rates and robust credit scores, a testament to the credit union’s lending policies and emphasis on education.

On platforms like Money Maker Magazine, members have shared their stories about the transformative power of Everwise’s services. These narratives often revolve around newfound financial stability and confidence, illustrating the profound impact of tailored financial interventions.

An Insightful Path Forward

When reflecting on Everwise Credit Union‘s array of member benefits and services, it is clear that their member-centric strategy not only nurtures a vibrant community but creates a solid framework for financial health. As they continue to innovate and adapt, the credit union keeps its ear to the ground regarding technological and community developments.

Members can anticipate a future rich with opportunities, especially as the financial landscape evolves. With unwavering dedication to the success of its members, Everwise Credit Union truly exemplifies what it means to prioritize community, education, and financial wellness. This is a place where aspirations flourish, much like a river, flowing steadily toward a brighter financial future—akin to the sentiment in “Like a River” by Granger Smith.

As we close this chapter on Everwise Credit Union, it’s worth noting that they embody the essence of modern banking, with a heart. For those in search of quality financial services, this credit union sets the benchmark high, ensuring that members are always at the forefront of their mission. It’s a smart choice for smart banking.

Don’t forget, just like the thrill of discovering the latest gear, whether it’s Nike Spikes for performance or the buzz around Meta smart glasses, having the right financial partner can amplify your aspirations. As the saying goes, “A penny saved is a penny earned,” and at Everwise Credit Union, that motto rings particularly true.

Everwise Credit Union: Fun Trivia and Interesting Facts

A Quick Snapshot of Everwise Credit Union

Everwise Credit Union isn’t just your average financial institution. It’s a treasure trove of member benefits and services that really stand out! Did you know that credit unions like Everwise often offer lower interest rates on loans compared to traditional banks? This could save you a bundle! Speaking of savings, let’s think about conversions. For instance, if you’ve been wondering how to convert 20 Euros To Dollars, Everwise provides handy resources that can assist members in managing their finances effectively.

Everwise Credit Union is not just about numbers and rates; it’s about community and connections. Members enjoy personalized services that help them achieve their financial goals. And speaking of personalization, just like Kakashis approach to teaching in Naruto, Everwise tailors its services to fit the unique needs of every member. With the right financial plan, you could zoom past your goals like Lewis Hall on his moped, leaving worries in your rearview mirror.

Events and Community Engagement

Everwise also hosts fun events that bring members together, reminiscent of the camaraderie you see at an art fight. These engaging gatherings do more than just entertain; they strengthen the community bonds that credit unions hold dear. Plus, let’s not forget about the smiles that come with it! Remember that legendary moment during the Grammy Award ceremonies when everyone was on their feet cheering? That’s the kind of vibe Everwise nurtures at its member events—it’s all about support and cheering each other on toward success.

Ultimately, Everwise Credit Union is all about more than just banking. It’s about fostering a community that empowers members through knowledge and engagement. Just like Granger Smith’s song Like a River, the flow of benefits and services can guide you to financial peace. So, if you’re seeking a friendly financial partner, look no further than Everwise!