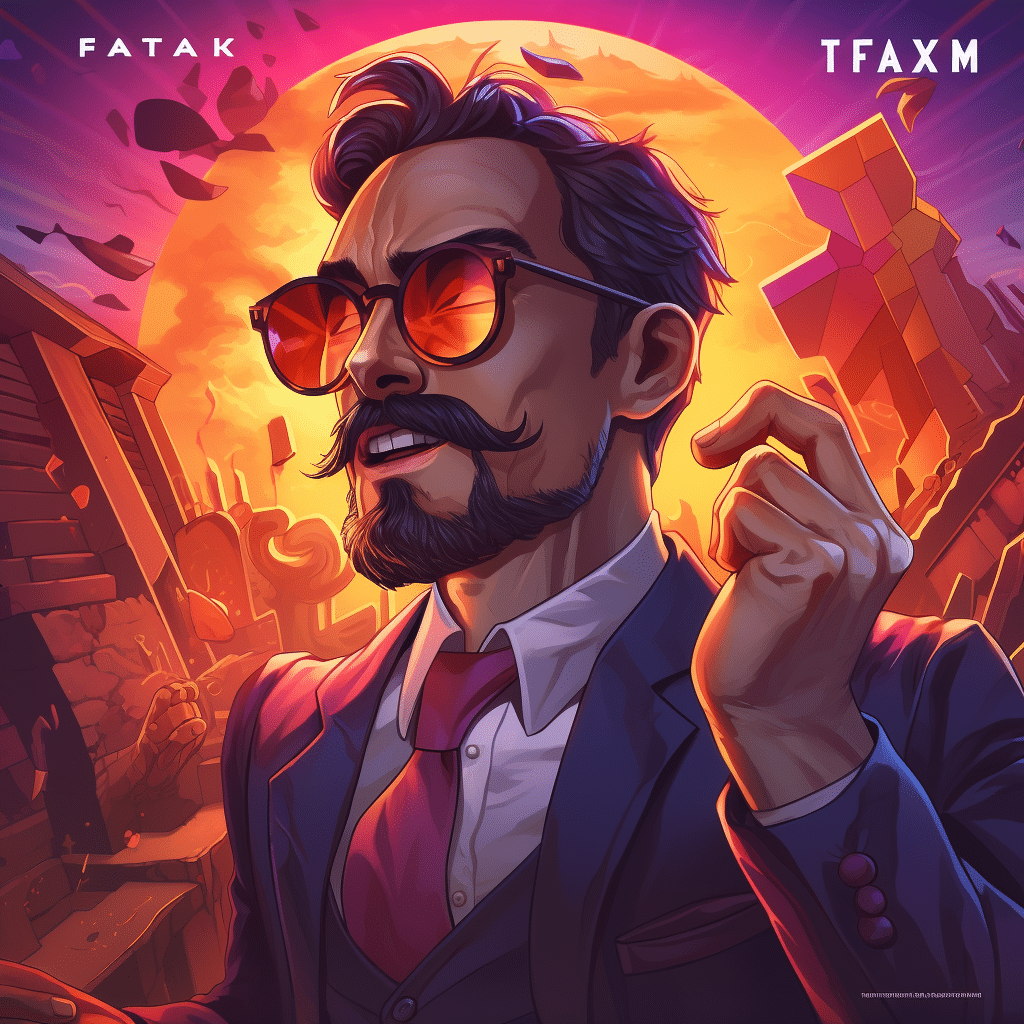

Ftx Crypto Sam Bankman Fried Deep Dive

The tale of FTX Crypto Sam Bankman-Fried is an odyssey of ambition, dazzle, and a precipitous descent that sent shockwaves through the financial world. Imagine a financial Icarus whose wings of crypto innovation soared too close to the sun, ultimately leading to a fall from grace as spectacular as his rise. It’s a narrative that’s as educative as it is enthralling, and one that’s pertinent for every investor to heed.

The Genesis of Sam Bankman-Fried’s FTX Empire

Just a few years ago, the FTX empire was little more than a twinkle in the eye of Sam Bankman-Fried, a relatively unknown figure before he claimed the crypto spotlight. His ascent to fame was an improbable saga marked by rapid innovation and strategic foresight.

The Innovations that Catapulted FTX Crypto to Fame

FTX had a knack for pioneering ideas that seemed like fodder for financial fairytales, yet managed to captivate an audience seeking the next big thing in crypto.

| Category | Details |

|---|---|

| Name | Samuel Bankman-Fried |

| Role | Co-founder & Former CEO of FTX |

| Date of FTX Bankruptcy | November 11, 2022 |

| Cause of FTX Crash | Mismanagement of funds, lack of liquidity, unrestrained withdrawals |

| FTX Liquidity Shortfall | $8 billion exposed hole in FTX’s accounts |

| Binance’s Interest | Announced plans to buy FTX on Nov 6, 2023 |

| Binance’s Withdrawal | Bailed out of the deal due to mishandled customer funds reports |

| Legal Status (as of 2023) | Awaiting sentencing hearing slated for March |

| Impact on Crypto Industry | Cast a long shadow over the crypto industry; raised concerns about regulation and oversight |

| Additional Information | Bankman-Fried’s business empire collapsed within days in November due to a run on deposits |

| Historical Context | FTX was one of the largest cryptocurrency exchanges worldwide prior to collapse |

| Date of Collapse | Early November 2022 |

Navigating Through a Sea of Regulations: FTX’s Compliance Journey

Regulation is the specter that haunts the halls of crypto exchanges, and FTX had its fair share of spectral encounters.

FTX and Alameda Research: Synergy or Conflict of Interest?

The dynamic between FTX and its sibling company, Alameda Research, became a central plot point in the saga.

Sam Bankman-Fried: The Billionaire Philanthropist and Political Donor

Bankman-Fried’s wealth wasn’t just a stack of coins in the crypto vault. He spread it around, establishing a persona that blended finance with philanthropy.

The Red Flags Ignored: Early Warnings in FTX Crypto’s Operations

Looking back, there were plenty of bread crumbs leading to the gingerbread house of horrors that FTX would become. Yet, the trail went mostly ignored.

The Unraveling of FTX: From Liquidity Crunch to Bankruptcy

The fall of FTX played out like a Greek tragedy, its plot twist a shock to the system.

Unpacking the Allegations: Mismanagement and Deception at FTX

Mismanagement and deception became the twin albatrosses around FTX’s neck, weighing it down into the abyss of scandal.

The Ripple Effect: Consequences for Investors, Regulators, and the Crypto Industry

FTX’s meltdown sent ripples across the financial pond, affecting everyone from day traders to policymakers.

Rebuilding Trust: Lessons from FTX Crypto’s Implosion for Future Platforms

In the rubble of FTX’s collapse lay the building blocks for a new, more robust crypto industry.

Sam Bankman-Fried’s Legacy: A Cautionary Tale in the High-Stakes World of Crypto

Bankman-Fried’s legacy is a mélange of innovation, influence, and ignominy—a triptych illustrating a modern-day financial fable.

Conclusion

The rise and fall of FTX Crypto and Sam Bankman-Fried serve as a potent cocktail of caution and contemplation. This saga underscores timeless truths about financial hubris and the sobering reality that innovation, unmoored from ethical and fiscal prudence, can lead to downfall.

Through the lens of this narrative, we gain indispensable insights into the future of finance and technology. As the crypto market seeks rebirth and stabilization, the legacy of FTX and its erstwhile CEO stand as warning beacons on the treacherous seas of high finance. Let us navigate these waters with wisdom, deriving from this story the foresight to sail safely and succeed where others have foundered.

The Spectacular Saga of FTX Crypto’s Sam Bankman-Fried

The cryptocurrency world has had its fair share of nail-biting dramas, but nothing has quite matched the meteoric rise and staggering fall of Sam Bankman-Fried, the prodigious founder of FTX Crypto. Buckle up, folks! We’re about to ride through the twists and turns of this modern-day financial thriller.

A Shooting Star in the Crypto Universe

Sam Bankman-Fried, known as SBF to his followers, shot up to the stars like a rocket — a brilliant mind that seemed to crack the crypto code. It’s like the Prusa of the blockchain world, whose detailed designs catapulted it to stardom in the 3D printing industry. SBF’s savvy and knack for navigating the complex world of digital currencies saw FTX experiencing a whirlwind of growth that left onlookers in awe.

Alton Mason of Cryptocurrency?

Like how Alton Mason strides down the runway turning heads, SBF had a way of walking into any room, charming tech junkies and Wall Street giants alike. With a disarming smile and a casual wardrobe distinctly non-Wall Street, he was seen by many as the golden boy of fintech, strutting the high-stakes catwalk of global finance.

The Unraveling of a Crypto Tycoon

However, in a bizarre twist that no one saw coming, the empire began to crumble —and fast! It was as shocking as hearing that Alan Jackson Was Hospitalized. One minute on top of the world, and the next, folks were scrambling to make sense of what happened. Allegations started flying, and the crypto community was in turmoil.

From FTX to “Ford’s Garage”?

The irony of SBF’s tale is almost like craving high-end caviar and ending up munching on comfort food at a roadside diner like Ford ‘s Garage. Once valued at billions, FTX filed for bankruptcy, and SBF’s status plummeted from a crypto guru to a cautionary tale about hubris.

The Sweet Aftertaste of Duvalin?

In the aftermath, some folks might be reminiscing the good ol’ days of FTX like a nostalgic treat, which could remind them of the sweetness of Duvalin, a beloved childhood candy. It’s an odd comparison, sure, but just like how one savors the layers of a duvalin, the layers of FTX’s story are being dissected to unravel the truth.

Cryptic Endings and Lessons Learned

Now, amidst the rubble, everyone’s on their toes, somewhat like the suspense around the notorious Pamela Hupp case. It’s a wait-and-see game as we figure out if SBF will mount a comeback or if the final chapter of FTX is already written. For the crypto world, it’s a stark reminder that even the mightiest can fall faster than a shooting star on a cloudless night.

Remember, folks, the story of ftx crypto Sam Bankman-Fried is a wild rollercoaster that’s still unfolding. So, keep your ears to the ground and your eyes peeled because in the zany world of cryptocurrency, anything could happen next!

What happened to FTX crypto?

Oh boy, FTX’s crypto saga? It’s like a soap opera with a techno twist. In short, this high-flying exchange crashed big time, ruffling feathers all over the digital coop. The fallout? Well, it’s traces back to risky business decisions and a whole lot of customer trust gone south. And just like that, FTX went from crypto darling to digital dust.

Which cryptocurrency did Sam Bankman found?

Sam Bankman-Fried, or SBF for short, is the whiz kid who cooked up FTX. While he didn’t mint a coin himself, he sure made waves in the crypto sea with his now-sunken ship, FTX. Talk about taking the plunge!

How much did Sam Bankman steal from FTX?

How much did he allegedly swipe from the cookie jar? It’s like trying to nail jelly to the wall, but reports are swirling that Sam Bankman might have ‘borrowed’ a cool $10 billion of FTX funds. Let’s just say it’s enough dough to leave your jaw on the floor!

How much money was lost in FTX collapse?

When FTX bit the dust, the numbers were astronomical! We’re talking a hefty $8 billion hole burnt into investors’ pockets. Ouch, right? Just goes to show—high stakes, high risks.

What caused FTX to crash?

FTX’s downfall? A classic domino effect—one mishap triggered the next. Started with a peek into Alameda Research’s books, revealing some shaky foundations. Mix that with customer panic, and you’ve got yourself a bona fide crash—boom, bang, and FTX’s house of cards came tumbling down.

What does FTX stand for?

Bet you’re curious what FTX stands for? Grab your decoder rings, folks—it’s Futures Exchange! Not as cryptic as you’d think, huh? Alas, the future didn’t look too bright for this exchange.

Who is the billionaire Bitcoin scammer?

Jeez, the billionaire Bitcoin scammer tag’s been flung around, but when you’re talking about big-time crypto controversy, Ruja Ignatova, the so-called ‘Cryptoqueen,’ turns heads. She might as well have a ‘Wanted’ poster in every cyber post office!

Who is the Bitcoin guy in jail?

The Bitcoin guy behind bars? Look no further than the Silk Road saga’s mastermind, Ross Ulbricht. He took a one-way ticket to the Big House for his online black market shenanigans. Talk about picking the wrong lane!

Why did Sam Bankman steal money?

Why did Sam Bankman pilfer the piggy bank? Well, if the walls could talk, they’d say it was a mix of mismanagement and a pinch of ‘robbing Peter to pay Paul.’ Court documents hint at risky maneuvers that sent his ship, filled with investors’ dough, into an iceberg.

Did FTX users lose their crypto?

Did FTX users lose their crypto? Yep, sadly, when FTX capsized, a whole bunch of folks’ virtual coins got swallowed by the sea. Talk about a digital Titanic.

Did people lose crypto on FTX?

People’s crypto on FTX—did it vanish into thin air? ‘Fraid so. When the storm hit, many users found their wallets lighter than a feather, proving even virtual loot can go poof!

Will crypto survive FTX crash?

Can crypto weather the FTX tempest? It’s been a wild roller coaster, but if history’s any teacher, it’s that cryptos have nine lives. This isn’t crypto’s first rodeo, and it sure won’t be its last. Buckle up!

Can FTX crypto recover?

FTX’s comeback—could the phoenix rise from the ashes? Well, in cryptoland, never say never. There’s chatter about restructuring, paybacks, and new paths forward. But let’s face it, that’s one steep mountain to climb.