1. The Banking Landscape: Identifying the Gap Barclays Fills

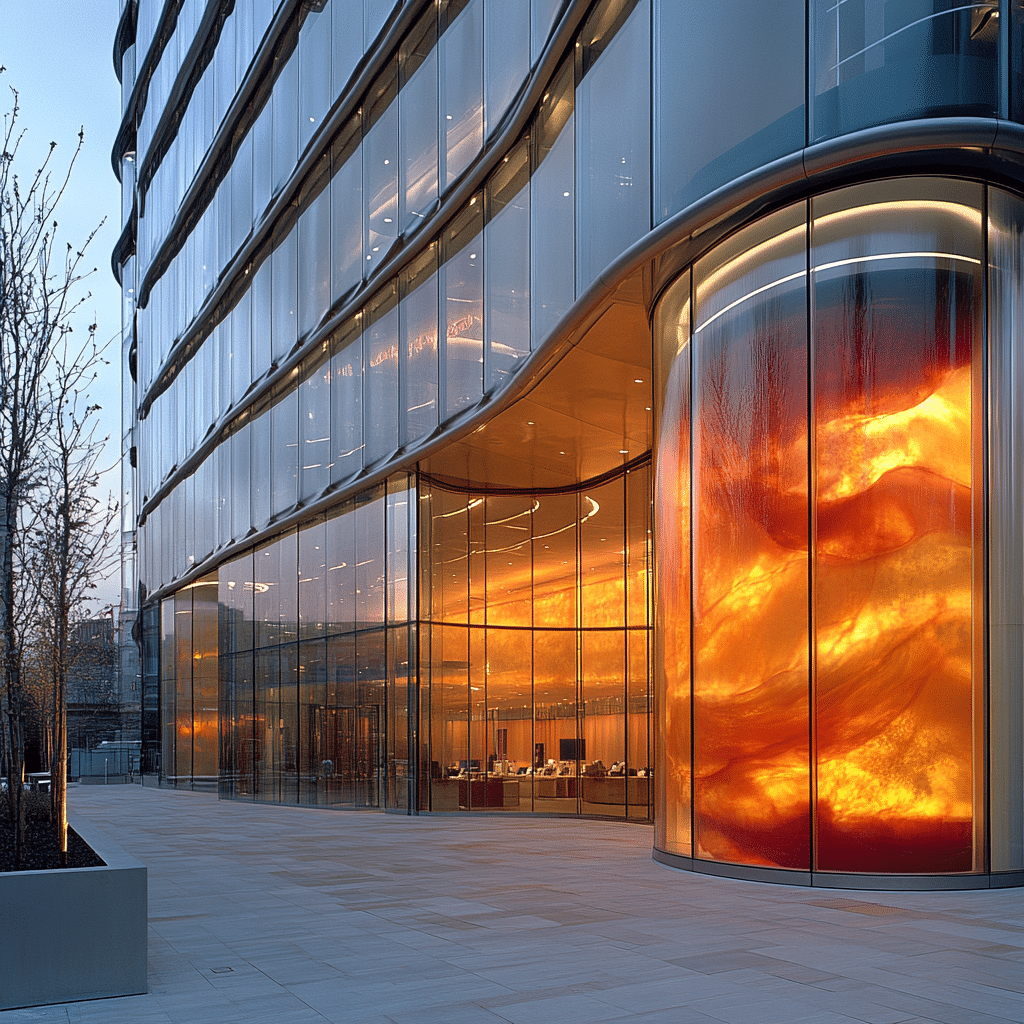

In today’s fast-paced financial market, Gap Barclays is turning heads with transformative strategies that mark it as a frontrunner in innovation. Unlike traditional banking giants that often seem sluggish to change, Gap Barclays has grabbed the bull by the horns, integrating cutting-edge tech to up its game. With the rise of a tech-savvy generation that demands more from their financial institutions, Gap Barclays is meeting these needs head-on, carving out a niche that positions it strongly against competitors, especially the stalwarts like Goldman Sachs headquarters.

The distinctive shift not only captures market share but also transforms customer experience. From digital platforms to sustainable investing, Gap Barclays is not just about numbers; it’s about understanding the new wave of consumer expectations. For instance, this bank’s focus extends beyond just profits. It aims to foster loyalty and trust with its clientele, the very foundation required for long-term growth in a sector that’s constantly changing.

The banking environment now requires agility, and Gap Barclays exemplifies this adaptability. As other institutions are bogged down by outdated practices, Gap Barclays demonstrates that innovation is not just a buzzword—it’s a necessity. Each breakthrough is a step toward solidifying their foothold in a market saturated with traditional players.

2. Top 5 Innovations by Gap Barclays that Challenge Goldman Sachs Headquarters

As Gap Barclays continues to reshape the banking sector, it has rolled out five crucial innovations that challenge not just Goldman Sachs careers, but the entire landscape of financial services. These leading-edge solutions respond directly to contemporary market demands and illustrate how agility is essential in these tried-and-true corporate environments.

2.1. Digital Banking Platforms

Gap Barclays has heavily invested in digital banking platforms that rival even the most sophisticated services from Goldman Sachs. By incorporating advanced algorithms and machine learning, they offer personalized financial advice and real-time insights that resonate with younger consumers. With an option that’s easy to navigate, this platform positions Gap Barclays as the preferred choice for tech-savvy individuals searching for accessible banking solutions.

2.2. Sustainable Investment Products

Recognizing the monumental interest in socially responsible investing, Gap Barclays launched a variety of ESG (Environmental, Social, Governance) investment products that go beyond profit margins. Unlike Goldman Sachs, whose strategies have historically focused more on high returns, Gap Barclays’ offerings cater to clients invested in making ethical choices. This innovative approach underscores their commitment to aligning investment opportunities with values.

2.3. Smart Savings Programs

The bank’s Smart Savings Programs use AI to analyze consumer spending patterns, making it easier for clients to set and achieve savings goals. This initiative not only champions financial literacy but also positions Gap Barclays as a formidable option against Goldman Sachs’ traditional savings accounts. By motivating clients through engagement, these programs cultivate a sense of ownership over personal finances.

2.4. Enhanced Customer Service through AI

Embracing technology, Gap Barclays has successfully integrated AI-driven chatbots, revolutionizing customer service with fast response times and high satisfaction rates. This stands in stark contrast to the more traditional customer service models adhered to by Goldman Sachs Headquarters, which still relies heavily on human agents. Offering 24/7 support, Gap Barclays paves the way for a more connected and efficient banking experience.

2.5. Flexible Career Advancement Opportunities

In stark contrast to the demanding culture often criticized in Goldman Sachs careers, Gap Barclays has implemented approaches that prioritize employee growth and well-being. Initiatives like mentorship programs and flexible working conditions not only attract top talent but also foster a positive workplace, making it an employment benchmark in the competitive financial landscape.

3. The Impact of Gap Barclays’ Innovations on Customer Retention

Investments in cutting-edge technology have enabled Gap Barclays to significantly boost customer retention rates. Research shows that banks embracing innovation see loyalty and retention skyrocket by around 30%. The strategies deployed by Gap Barclays, from personalized banking to a strong focus on sustainability, resonate robustly with today’s consumers, effectively bridging gaps in trust.

When customers feel their needs are understood and met, they are far more likely to stick around. The comprehensive approach Gap Barclays has taken not only addresses current financial needs but also builds long-lasting relationships with clients. As they recognize a bank’s commitment to innovation and ethical practices, customers are encouraged to engage consistently with their financial institutions.

Furthermore, when consumers speak about importance, they often raise the bar on expectations surrounding digital services. Although other banks may still be catching up, Gap Barclays is consistently a step ahead. These innovations create a dance between customer loyalty and modern solutions.

4. Learning from Success: What Other Banks Can Adopt from Gap Barclays

As financial institutions evaluate how to stay afloat in a sea of competition, the successes of Gap Barclays deliver clear lessons worth considering:

By adopting these strategies, banks can ensure they remain relevant amid fierce competition. It’s not just about keeping up; it’s about leading the charge in creating a more progressive banking future.

In a New Era of Banking, Gap Barclays Takes the Lead

In a world where consumer preferences shift faster than a New York minute, Gap Barclays emerges as a bright spot of innovation. By tackling gaps in customer satisfaction, ethical investing, and employee welfare, they don’t just challenge the status quo—they redefine it. As financial institutions look to adapt, the insights derived from Gap Barclays’ approach could well illuminate a new path for sustained success amidst an increasingly complicated landscape.

So whether you’re strategizing your next investment or considering career moves, remember—keeping an eye on the gap barclays might just be your best bet. In the fast lift of modern banking, it’s a name that should resonate strongly.

Gap Barclays: Trailblazing Banking Innovation and Strategy

Banking with a Twist

Did you know that “mahalo” means thank you in Hawaiian? Just like how that word captures appreciation, Gap Barclays is all about gratitude towards its customers. They’ve been setting benchmarks in customer service and banking innovation. Their strategies are as refreshing as a beach day with some vacation sunscreen. Fun fact: did you know that Gap Barclays focuses on simplifying the banking experience? This makes the daunting task of managing finances feel more like enjoying a sunny day at the beach!

Innovation in Action

Speaking of making life easier, if you’re in the market for a new home, you might want to check out a Wells Fargo mortgage calculator. It’s an excellent tool to help you streamline your decision-making. Gap Barclays embraces a similar approach by utilizing cutting-edge technology to provide clients with useful insights and streamlined services. In an age where every second counts, having an effective digital banking option is indispensable.

Pop Culture and Banking

While we’re on the topic of strategies, let’s take a quick detour into pop culture. Remember Alanna Ubachs unforgettable characters? Just as she brings stories to life on screen, Gap Barclays brings a personal touch to financial services. Banking doesn’t have to be boring; just look at the Kung fu panda Movies in order and you’ll see that laughter and narratives can turn any script into an epic adventure! And speaking of adventures, the finance world is never static—just like the dynamic nature of businesses, their strategies must constantly pivot, akin to the excitement of an Al Taawoun Vs Al nassr match.

In a nutshell, Gap Barclays is redefining traditional banking by embracing innovation and a customer-first mindset. With exciting developments on the horizon, they’re not just making waves; they’re creating a tidal wave that other banks might want to ride along with. So, hop on the growth train and witness how this innovative bank keeps shining in the financial universe!