The housing market has been as unpredictable as a “homerun derby in 2024”, with unexpected swings and shifts that have left even the savviest investors on the edge of their seats. Now, as we peek into the crystal ball for 2024, it seems the unpredictability streak is set to continue. Brace yourselves – we’re about to uncover ‘housing market predictions’ that could turn heads and pivot plans.

Unveiling the Top 5 Housing Market Predictions for 2024

With the real estate terrain constantly evolving, spotting the next trend is like nailing jelly to a wall – tricky but not impossible. So, let’s dive into some jaw-dropping forecasts that could reshape your view of the future housing landscape.

A Surprising Shift Towards Rural Revitalization

Well, butter my biscuit, if it isn’t a fresh wave of city slickers turning country prospects into hot real estate potatoes! It’s no secret that people are yearning to stretch their legs, and what better place to do so than the great outdoors. We’re witnessing a trend where homebuyers are trading in their urban shoebox apartments for some rural repose.

It’s not all about the charm of countryside living; there’s a practical aspect at play too. Companies like Google and Salesforce are putting the ‘remote’ in ‘remote work’, allowing folks to log in from the most picturesque of pastures. Redfin and Zillow analytics are showing us that property sales in serene spots like the Hudson Valley and the Green Mountains are spiking harder than the caffeine in your morning brew.

Reasons for this exodus? How about avoiding the pack-’em-in-like-sardines city life while getting more bang for your buck out in the sticks? Let’s not forget the green fingers itching for a slice of sustainable living. It’s not just about fresh eggs on tap; we’re talking lower costs, better quality of life, and, hello, personal space.

The Rise of Climate-Influenced Purchasing Decisions

Here comes a twist sharper than a lemon squirt in the eye: buyers are getting picky with their postcodes, and it’s all thanks to Mother Nature. With climate change muscling in on purchasing decisions, we’ve got folks dodging disaster zones like it’s a game of real-life Frogger.

Let’s shovel in some hard truths: places getting cozy with hurricanes, like parts of Miami, are watching their property values take a nosedive. Meanwhile, areas that probably won’t have you building an ark any time soon are hot properties. The National Association of Realtors (NAR) shares that smart cookies are looking for climate-resilient nooks. And can you blame ’em?

Even insurance bigwigs like Allstate and State Farm have got their ears to the ground, tweaking their pricing to match these climate checks. It’s clear as day: folks are sick and tired of playing dice with the weather.

Technological Innovations Sparking New Real Estate Models

Bet you didn’t think you’d be touring homes in your PJs, virtually stepping into your future living room from a thousand miles away. Technology is knocking on real estate’s door, and boy, is it making an entrance. One name drops into the conversation like a hot potato: Matterport. These folks are making VR home tours the norm rather than a sci-fi daydream.

But wait, there’s more! Have you heard of blockchain real estate transactions? You have now, thanks to trailblazers like Propy who are cutting through red tape like a hot knife through butter. This isn’t just a fancy fad; it’s laying down the tracks for a whole new way of buying and selling bricks and mortar – securely and transparently.

A New Era of Regulation and Intervention

Hold the phone, we’re entering a regulatory rollercoaster that could make or break markets this year. Peek westward and you’ll see California’s SB-9, flipping the property game on its head by greenlighting duplex developments faster than you can say “housing shortage crunch.”

The housing market is about to get a jolt of availability, but hold your horses – it’s not just about more homes on the block. What’s this doing to prices? If you ask policy ninjas at Urban Institute, they’d tell you we’re in for a bumpy ride. Names like KB Home and Lennar are keeping a twitchy eye on this policy shift. Can they adapt? Only time will tell.

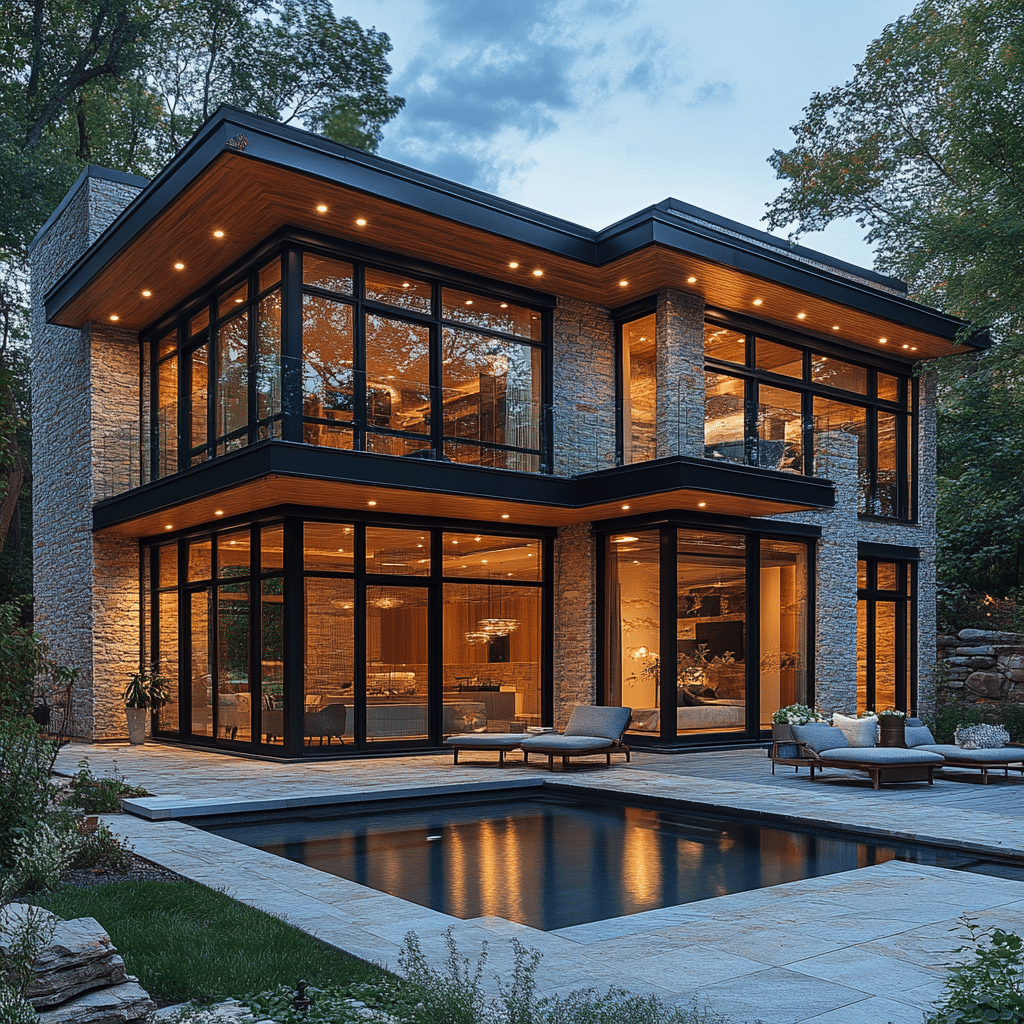

The Revival of the Suburban Housing Boom

Just when you thought it was curtains for the ‘burbs, they’re strutting back into the limelight like a rock star encore. Picture this: trees, tranquility, and a driveway bigger than your old apartment. Yes, folks, the suburban dream is rebooting and the crowd’s going wild.

Why the U-turn? Well, for starters, suburban living’s looking peachy next to the packed-like-sardines city scene. And with tech meccas like Austin and Raleigh rolling out the red carpet for home development, you bet your last dollar there’s growth to be had. The smart money – ahem, REITs like AvalonBay Communities – is already tuning into this suburban symphony.

Conclusion: Navigating Uncharted Territory in the 2024 Housing Market

Let’s stitch this tapestry of trends together, shall we? From country charm to tech triumphs and rule reshuffles, the property playground of 2024 is no child’s game. As we’ve spelunked through these crevices of ‘housing market predictions’, we’ve unearthed insights that connect in a mosaic as complex as it is captivating.

Each trend waves its own flag, signaling unique implications for homeowners, investors, and the gatekeepers of real estate. But it’s the harmonious blend of these shifts that truly frames the panorama of property prospects.

And so, lovers of the ledger and maestros of mortgages, as we paddle into this stream of 2024’s housing market currents, remember: it’s the bold who will bank on these predictions and potentially cash in on tomorrow’s housing honey pots. So strap in, because the ride’s about to get real.

Bewildering Housing Market Predictions for 2024

Ladies and gents, strap in! You’re not gonna believe the twists and turns the 2024 housing market has in store for us. If you think the outcome of the Homerun Derby 2024 is unpredictable, wait till you hear these jaw-droppers. So, let’s dive into some trivia and intriguing facts that’ll knock your socks off. And no, I’m not gonna ask you if Andrew Tate hit the trillion mark – because, frankly, Is Andrew tate a Trillionaire ? Well, that’s a tale for another day.

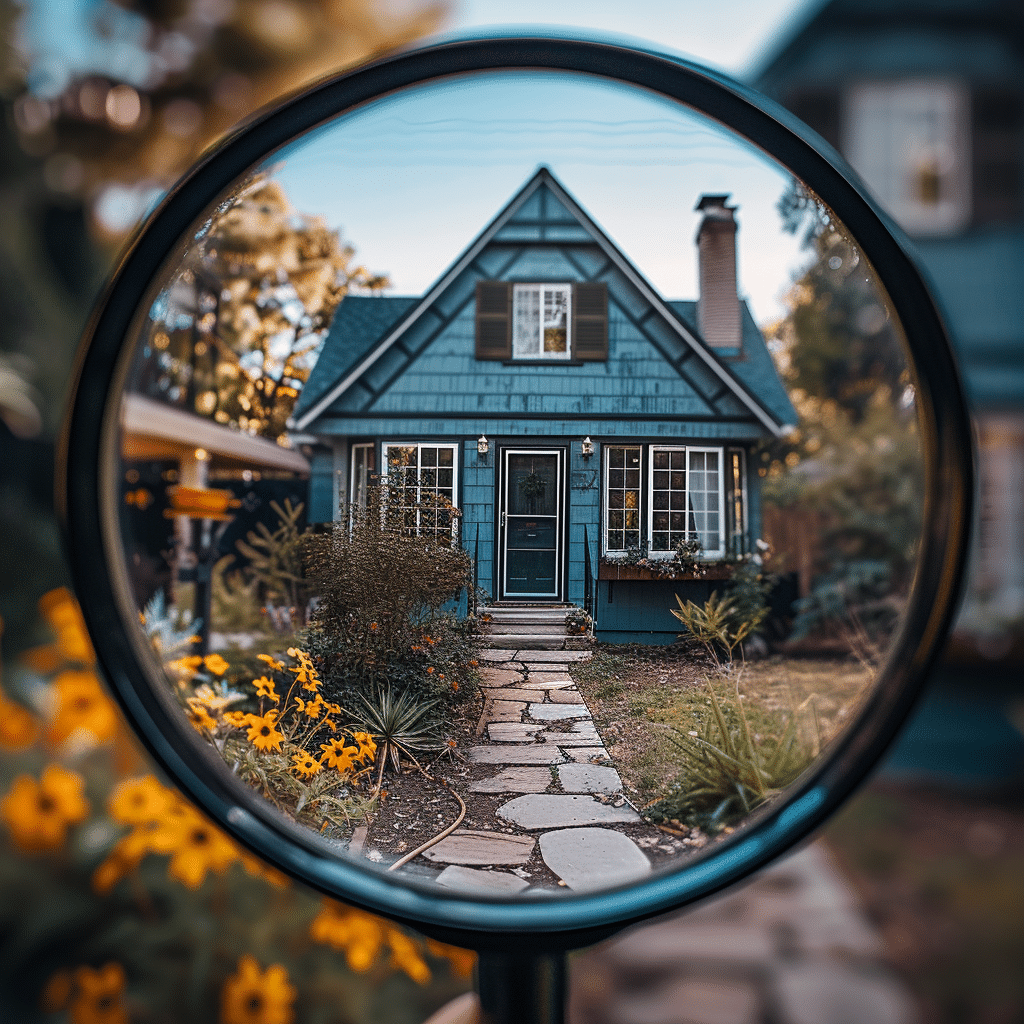

Say It Ain’t So: Austin’s Bubble Burst?

Alright folks, word on the street – and by street, I mean the very legit analysis you can find in our own backyard – points to a bit of a kerfuffle in Texas. It’s whispered that the Austin housing market crash might just stir up a storm in 2024. Picture this: sky-high prices taking a swan dive and leaving Austin real estate aficionados with their jaws on the floor. We’re talking a scenario that could make watching paint dry look like a Quincy Isaiah dunk – talk about a “slam dunk” of a prediction!

Habitat Hysteria – Scams on the Rise!

Y’all, brace yourselves. It appears the scammers are at it again! No industry’s immune, and real estate’s the fresh meat on the block. The housing market predictions chatter includes a surge in what’s nastier than finding a worm in your apple – yep, Zelle Scams! So if you’re planning to buy or sell, you better watch out. It’s like playing financial hot potato, and you sure don’t wanna be left holding the bag. Remember, if an offer looks as tastefully scandalous as Charlie Puth’s clothes-free escapades, it might just be too good to be true!

Eclectic Estates: Celebs Stir The Pot

Get this: industry gurus reckon that the real estate market’s going to get a shot in the arm from the unlikeliest of places. Think along the lines of Quincy Isaiah( dribbling into the property scene. Now, that’s something you’d put your glasses on for, huh? With high-flying celebs eyeing real estate as their next playground, we could see a whole new ballgame in glitzy home purchases. And hey, maybe that’ll sprinkle a bit of stardust on market values.

Planning for the Inevitable: A Sober Prediction

Now here’s a sobering thought, folks. Sometimes life throws you a curveball harder than catching Charlie Puth naked on your feed. When tragedy strikes and we lose a dear parent, besides the emotional turmoil, we’ve gotta deal with properties and estates. The experts are predicting more people turning to guides on What To do When a parent Dies, seeking a roadmap through that rough terrain. It’s tough stuff, sure, but knowing the ropes could make a world of difference.

A Prayer for the Market: Divine Intervention

Last but not least, if you think all the above sounds like we’ll need a miracle, you might be onto something. There could be truth in the power of a little divine intervention, and who knows, maybe the Archdiocese Of Baltimore has a prayer or two to spare for the housing market’s fortunes. After all, if a player can get an edge by rubbing their lucky bat for the homerun derby, who says the housing market predictions couldn’t use a Hail Mary?

Don’t forget, these housing market predictions are just that – predictions. Keep your eyes peeled, your ears open, and maybe take these speculations with a pinch of salt. After all, it’s all fun and games until someone takes out a mortgage based on a horoscope! Stay savvy, folks.

Will 2024 be a better time to buy a house?

– Well, buckle up, homebuyers! According to the National Association of Realtors, y’all are in for a treat in 2024! Their chief economist, Lawrence Yun, let slip that with mortgage rates taking a nosedive, sales are poised to skyrocket by a whopping 13 percent. So, mark your calendars and start those vision boards—2024 just might be your year for snagging that dream home!

Are house prices dropping in Texas?

– Looking at the Lone Star State, it’s not all about cowboy boots and barbecues right now—house prices are feeling the pinch, too. After a wee bit of a tumble—1.5% between Q3 of 2022 and Q3 of 2023—your wallet might give a little sigh of relief. So if you’re hunting for a bargain, Texas could be flashing you the green light!

What is the outlook for Texas real estate in 2024?

– For those with their heart set on some Texas real estate, the horizon’s looking kinda like that famous flat Texas landscape—not too many ups and downs. Experts reckon that while sales might park themselves in the same spot as last year’s, with about 330,000 units changing hands, rents could be taking a bit of a tumble. But, fair warning, don’t expect prices to do a full 180—the average home’s gonna stick close to $340K.

Is it a good time to buy a house in Texas?

– You know what they say, timing is everything! And for those Texan homebuyers, the stars could be aligning. With prices taking a slight dip to $347,300 and almost a third of homes selling for less than asking, wrapping up the year might just be the cherry on top for your house hunt in the good ol’ state of Texas.

Why you should wait till 2024 to buy a house?

– Hold your horses before you go signing on any dotted lines! With predictions saying the housing market might just be playing it cool next year, waiting until 2024 could save you from buyer’s remorse. With interest rates cozying down and sales on the upswing, your patience could pay off in cold, hard cash.

Should I buy a house now or wait for a recession?

– It’s the million-dollar question with no crystal ball in sight! With talks of recessions and dips and peaks, the big decision to buy now or wait it out is like jumping rope—you want to hop in at just the right moment. So keep your ears peeled and your eyes on the prize; only time will tell if waiting will turn your investment into a gold mine or a money pit.

Why are houses in Texas so expensive now?

– Everything’s bigger in Texas, they say, and house prices are hitching a ride on that bandwagon. With the state’s living costs usually playing hopscotch with the national average, those price tags on homes are sure starting to feel heftier than a Texas-sized steak.

Is it a buyers or sellers market in Texas?

– It’s like a tug-o-war in the Texas real estate market nowadays. On one hand, prices are easing up a tiny bit, tipping the scales toward the buyers. But don’t go counting your chickens before they hatch; it’s still a bit of a scuffle out there, so keep those negotiation skills sharp!

Is Texas in a housing crisis?

– Crisis? Well, that’s a strong word, but Texas housing sure is riding a rollercoaster. With median prices dipping and homes selling for under list price, it ain’t exactly smooth sailing. So, while it might not be a full-blown crisis, the market’s definitely got its share of hiccups.

Will home prices drop in Texas in 2024?

– With wallets and piggy banks across the state of Texas heaving a sigh of relief, projections hint that home prices just might coast or dip a tad in 2024. So for all you bargain hunters out there, keep your eyes peeled—Texas might just serve up some real estate deals on a silver platter.

What are projected housing interest rates for 2024?

– For you number crunchers wondering about those housing interest rates in 2024, here’s the lowdown: whispers on the wind say they’ll be taking a little siesta from their recent climb, which means your mortgage might not bite as hard as you feared. But hey, as with any crystal ball gazing, take it with a grain of salt!

Is the housing market in Fort Worth in 2024?

– Down in Fort Worth, if you’re hoping the market’s going to be hotter than a Texas BBQ, you might be in luck. Even though there ain’t much chatter specifics, the regional forecasts suggest that things could be looking up—or at least, not nosediving—in 2024. So keep your Stetson on and watch this space!

What month is best to buy a house?

– Talk about timing! Turns out, playing the waiting game might actually pay off. Typically, December through February tend to roll out the red carpet for buyers, with cooler prices to match the weather. So if you wanna snag a home-sweet-home deal, winter might just be your wonderland!

Is buying property in Texas a good investment?

– Investing in Texas property? Might not be as easy as shooting fish in a barrel, but it’s got potential. With a steady stream of new folks setting up camp and a diverse economy, planting your money in Texas soil could sprout a tidy little profit. Just remember, no investment’s a sure bet, so go in with eyes wide open!

Is it harder to buy a house now than 30 years ago?

– Looking back 30 years, seems buying a casa was less of a wallet-war and more of a walk in the park. But with today’s prices, interest rates, and competition, let’s just say you’ll have to hustle harder and might need a bigger piggy bank to land that dream home.

Will US house prices go down in 2024?

– As for the whole U.S. housing scene in 2024, the tea leaves say prices might not be hitting the gas pedal as hard. Some forecasters are even betting on a price plateau or minor dip. So, if you’re saving up for that down payment, you might just catch the market on a chilled-out day.

Will mortgage rates drop in 2024?

– Mortgage rates dropping? Now wouldn’t that be nice? Well, good news may be on the horizon in 2024 with rates potentially taking a breather after their recent uphill sprint. However, don’t go betting the farm just yet—it’s a game of wait-and-see!

Are mortgage rates going to go down in 2024?

– Alright, don’t set your heart on it, but the word around the campfire is mortgage rates might be getting ready to tap the brakes in 2024. So, if you’re sweating over a high-interest loan, there might just be a silver lining coming up.

Will housing interest rates go down in 2024?

– Interest rates giving us a break? Fingers crossed, because that’s the murmur for 2024. With some chatter about climbing down from their high horse, your dream of owning a home might get a friendly nudge from the interest rate fairy. But hey, don’t take my word as gospel—we’re all just playing the guessing game here!