Calculating your net worth is pivotal for anyone keen on ensuring financial stability and working toward financial freedom. Understanding how to calculate net worth is like having a compass in the unpredictable world of finance. It points you in the right direction, revealing your financial health in a glance. Ready to discover how your assets measure up against your debts? Let’s dive in!

How to Calculate Net Worth: A Step-by-Step Guide

The Formula for Net Worth:

Net Worth = Total Assets – Total Liabilities

This formula is your golden ticket, so take note.

1. Identify Your Assets:

Assets include everything you own that has value. Start with cash in your wallet, savings accounts, investments in stocks and bonds, retirement accounts, and tangible items like real estate or vehicles. The more diverse your assets, the stronger your wallet will be.

2. Calculate Your Liabilities:

Liabilities, on the other hand, are those pesky debts that drag you down, like mortgages, personal loans, credit card balances, and student loans. Pay close attention to interest rates as they can inflate your outstanding balance over time.

Understanding What Increases Your Total Loan Balance

When keeping tabs on your financial wellness, knowing what increases your total loan balance is crucial.

Consider the story of Jenny McCarthy, who managed to raise her credit score from 580 to 750. Through savvy debt management, she landed a mortgage with a lower interest rate, lessening her total loan impact. That’s what can happen when you know how to calculate net worth and manage your debts effectively!

The Interest Rate That Banks Charge Their Best Customers: The Impact on Borrowing

The interest rate you land on loans can make or break your financial future. Lower rates mean less money down the drain in interest payments.

1. The Best Rates:

Bank A typically gives the best rates—3 to 4%—to customers with stellar credit histories.

2. Comparing Options:

Take Wells Fargo for instance; they offer home loans starting at 3.75%, contingent upon qualifying criteria. For many borrowers, the average rate hovers around 7%, leaving a substantial gap that can impact how quickly you accumulate assets.

When Will Mortgage Rates Go Down?

Understanding the ebb and flow of mortgage trends helps in planning. Analysts in 2024 forecast minor fluctuations, suggesting an eventual dip as inflation levels off. This may very well be the time to reconsider your purchasing habits.

How to Price a Business for Sale: A Financial Perspective

Your business is a major asset that can significantly influence your overall net worth. Learning how to price a business for sale effectively could pave the way for maximizing your return on investment.

1. Business Valuation Methods:

An interesting case is Zoom Video Communications, valued at $113 billion during the pandemic. Its value soared partly due to being a market leader amid rising demand—showing just how lucrative a well-timed sale can be.

2. Professional Appraisals:

Marriage of expertise is valuable. Hiring a financial advisor could yield deep insights on pricing your business accurately, ensuring better negotiations during the sale.

Unlocking Financial Freedom Through Strategic Net Worth Management

Tracking your net worth is more than just a number; it’s a personal benchmark for your financial future. Comprehending what makes it up allows you to make informed choices around debt management, investment tactics, and savings plans.

Establishing a consistent routine for calculating your net worth can motivate significant lifestyle adjustments. By concentrating on boosting your assets while cutting liabilities, you step onto the pathway toward true financial freedom.

Imagine that feeling of power knowing your assets are climbing and your debts are dwindling. With a mix of diligence and strategic planning, calculating and managing your net worth is not simply a number game—it’s a powerful stepping stone to financial independence and a rewarding future.

Remember, understanding how to calculate net worth is crucial in today’s financial landscape. Don’t be shy—keep track of your financial wellbeing. Watching your net worth grow can be one of the most rewarding experiences of your adult life, leading you towards the financial freedom you’ve always dreamed of.

If you need something light for a break, check out what channel the chiefs game on today here. Or, for a culinary adventure, explore the wonders of a chinese village here. Dive into personal finance tips like how you can start with 500 down no credit check here and notice the impact it can have on your future.

Financial empowerment starts with knowledge—be proactive, do your research, and above all, stay informed! Let’s embrace those positive changes together!

How to Calculate Net Worth

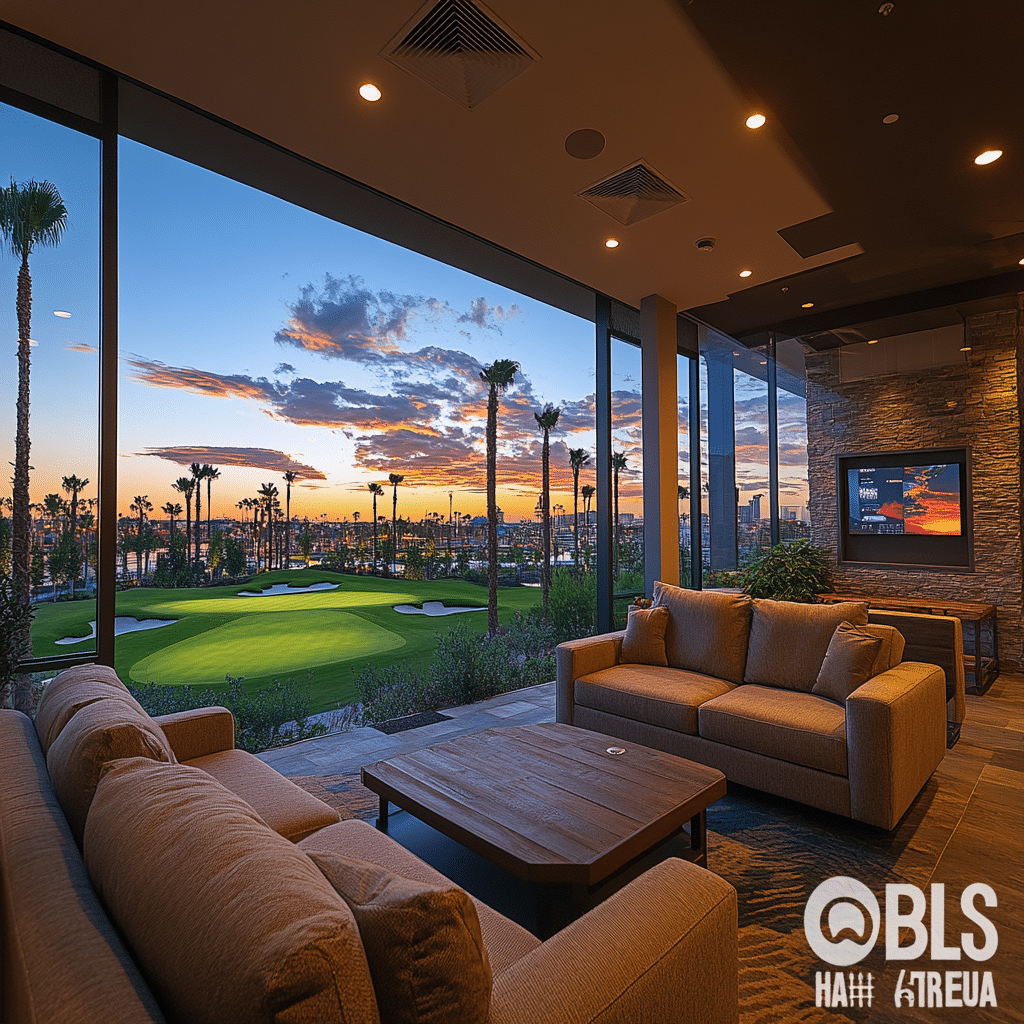

Calculating your net worth isn’t just about crunching numbers; it’s like piecing together a financial puzzle. To kick things off, grab a piece of paper, and jot down all your assets—everything from your house to savings accounts. Fun fact: the “Deadpool” franchise made a whopping $785 million at the global box office! That’s enough to buy a modest mansion in many places and highlights how valuable assets can escalate quickly. On the flip side, it’s essential to also list your liabilities, like credit card debt and loans, which often sneak up on you if you’re not careful.

Putting it All Together

Once you’ve got your list of assets and liabilities, it’s time for some simple math—subtract your total liabilities from your total assets. Voila! You’ve got your net worth. Interestingly, just like how “Flipped” captured the charm of young love and always keeps us on our toes, knowing how to calculate net worth can keep your financial goals alive and kicking. If you’re looking for a fresh start or a better financial direction, knowing your net worth can really flip the script on poor budgeting habits.

A Financial Snapshot

Did you know that Malcolm Jamal warner, a talented actor, also faced financial ups and downs? Similar to his journey, one’s net worth fluctuates over time. As life throws curveballs your way—like unexpected expenses or career changes—your financial standing can bob up and down. Staying updated on your net worth is akin to keeping track of updates in tech, like the latest version iOS 17.5.1. It’s all about being aware of where you stand and making informed decisions!

Now, don’t forget the importance of planning for future uncertainties. With the looming government shutdown deadline 2025, many are feeling the urge to get financially savvy. It’s a stark reminder that financial freedom requires vigilance and calculated moves. Understanding how to calculate net worth puts you in the driver’s seat, enabling informed choices and helping to gear up for whatever life throws your way—like the upcoming adventures of a dynamic gamer like xQc! Prioritize your finances today so that tomorrow’s challenges don’t catch you off guard.