I. Unveiling the Power of Indiana Members Credit Union

Let’s pull back the curtain and shed some light on the power and potential of the Indiana Members Credit Union or IMCU. IMCU is a beacon of financial stability and security, having a stronghold in the Indiana region. Backed by a robust financial structure, it radiates influence, compelling respect from other banks around.

IMCU isn’t some flash in the pan; it has a rock-solid reputation, holding its own in Indiana. As consistent as the Honda Civic 2016, IMCU’s solid performance, proven reliability, and exceptional value are well-respected among the community and beyond.

II. The Secret is Out! Unmasking the Best 5 Wealth Building Secrets at IMCU

Next, we’ll get down to the nuts and bolts of the matter – the best five wealth building secrets with IMCU. Like a meticulously planned blueprint or the programming of a powerful AI Platform, the strategies within IMCU are designed to maximize wealth and deliver impressive results.

These secrets will shine a light on how to boost your financial growth, promising to impart the kind of wisdom usually reserved for financial gurus like Jay Briscoe. Read on to unravel these secrets that make IMCU such a strong player in the wealth-building arena.

III. Eligibility: Can Anyone Join Indiana Members Credit Union?

Let’s get one thing straight: IMCU is not an exclusive club. If you live or work in Central or Southern Indiana, you’re welcome on board. This isn’t as restrictive as contesting in the Hottest Instagram Models competition. It’s a straightforward, welcoming approach.

This inclusivity extends across all zones in Central and Southern Indiana, allowing anyone within these regions to avail themselves of IMCU’s impressive services. This clearer eligibility pathway ensures that everyone in these regions has an even playing field to build their wealth.

IV. Standing Tall: What is the Largest Credit Union in Indiana?

When it comes to size, IMCU definitely earns bragging rights. If we were to compare it with other credit unions in Indiana, IMCU would be the Su 57, the apex in terms of sophistication and capability. However, another behemoth worth mentioning is the Teachers Credit Union.

Interestingly, this $4.9 billion entity has recently morphed into Everwise Credit Union as of June 8, 2023. This move, designed to reflect its growth beyond its original educator roots, echoes some of the wise transitions IMCU has implemented to keep up with today’s changing financial landscape.

V. Maximize Your Wealth with IMCU’s Comprehensive Financial Services

You might be wondering how exactly IMCU helps build your wealth? Just as the detailed universe crafted in Avatar 3, the range of financial services and strategies offered by IMCU are each thought out and executed to propel your finances forward.

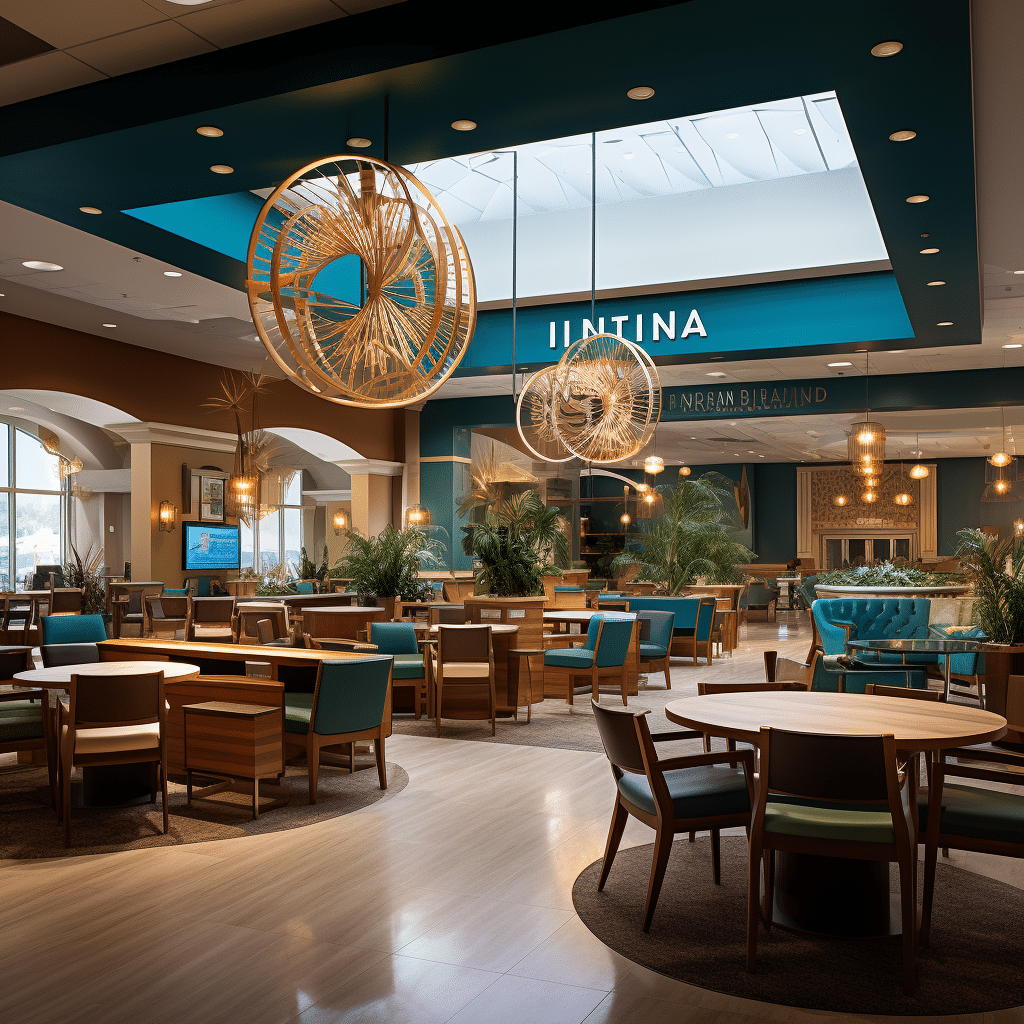

IMCU’s financial services are comprehensive and multifaceted, designed to appeal to individuals of all financial needs and backgrounds. However, it’s worth noting that the specific service offerings may differ across various locations, ensuring a tailormade approach to suit the community’s demands.

VI. Geographical Reach: How Many Locations Does Indiana Members Credit Union Have?

IMCU boasts an extensive network that sprawls across Indiana, making it as accessible as possible to its members. With an impressive count of 33 branches, IMCU ensures that its members can easily access their services, just as you would easily find a local cinema screening the latest blockbusters.

The geographical reach of IMCU is not merely about numbers. It’s a testament to its commitment to customer accessibility and satisfaction, ensuring that its financial services and wealth building strategies are reachable to one and all.

VII. Stepping into Digital Transfers: Can I use Zelle with Indiana Members Credit Union?

For those in tune with digital advancements, here’s the good news: IMCU opens doors for seamless digital transactions via Zelle. It’s as simple as logging into the IMCU mobile app, selecting “Transfers”, and then opting for “Send money with Zelle®”.

The ability to send, request, or receive money in a jiffy positions IMCU right along with the digital transfer revolution. Furthermore, it’s an active proponent of embracing the latest tech advancements, ensuring that members can navigate their finances in the digital world with consummate ease.

VIII. The Wealth Mantra with Indiana Members Credit Union

As we draw the curtains, it’s clear that IMCU is a financial powerhouse in Indiana and beyond. By leveraging the five incredible secrets we’ve highlighted, potential and existing members can maximize the advantages of IMCU for their financial growth.

IMCU’s strong presence, broad reach, and comprehensive services make it not just a credit union, but a valuable ally for individuals working towards financial success. Harness the power of the Indiana Members Credit Union, and watch your financial growth skyrocket!