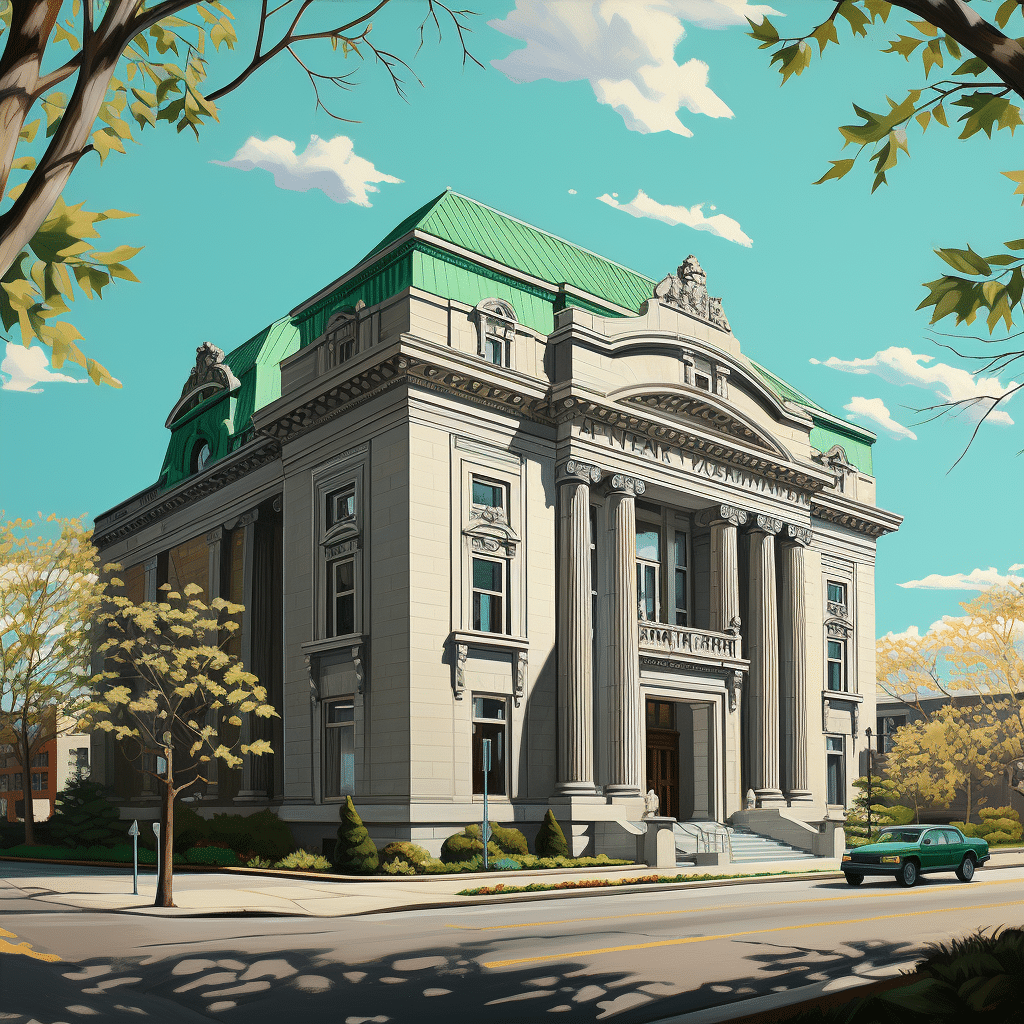

Landmark National Bank’s Path to Prosperity: Building a Robust Future

The trajectory of Landmark National Bank, not just a financial institution but a proverbial beacon of fiscal innovation, has been nothing short of remarkable. As we delve into the growth strategy of Landmark National Bank, we’ll dissect the steps that have catapulted this bank to the heights of banking prominence and what lies ahead as it continues to soar.

The Blueprint for Success at Landmark National Bank

In the hyper-competitive sphere of banking, Landark National Bank has etched its name through diligent market analysis and customer-focused solutions. They’ve got their finger on the pulse, and here’s how:

| Service/Product | Features | Benefits | Relevant Fees/Charges |

| Checking Accounts | – No minimum balance required – Free online banking and mobile app – Unlimited check writing |

– Ease of access to funds – No worry about maintaining a minimum balance – Convenient digital banking solutions |

– Overdraft fees: $35 – Out-of-network ATM fees: $2 |

| Savings Accounts | – Competitive interest rates – Automatic savings plan |

– Potential for higher returns on savings – Helps build savings habitually |

– Minimum balance fee: $10 (waived if balance is above $300) |

| Certificates of Deposit (CDs) | – Range of terms from 3 months to 5 years – Guaranteed return on investment |

– Higher interest rate than savings accounts for the chosen term | – Early withdrawal penalty applies |

| Mortgages | – Fixed-rate and adjustable-rate options – First-time homebuyer programs – Online application and tracking |

– Stability of payments with fixed-rate – Potentially lower interest rates with adjustable loans – Support for those new to home buying |

– Loan origination fee: 0.5-1% of the loan amount – Closing costs: Vary |

| Auto Loans | – Competitive interest rates – No prepayment penalty – Flexible terms up to 72 months |

– Affordable financing for vehicle purchase – Freedom to pay off loan early – Tailored repayment plan |

– Late payment fee: $25 after 10-day grace period |

| Personal Loans | – Unsecured loans – Fixed repayment schedule – No collateral required |

– Funding for personal projects or emergencies – Predictable monthly payments |

– Origination fee: 1-5% of loan amount |

| Business Banking | – Business checking and savings – Merchant services – Small business lending |

– Solutions tailored for business needs – Support for transaction processing – Access to capital for growth |

– Monthly service fee: $15 (waived if balance is above $5,000) |

| Wealth Management | – Financial planning – Investment services – Estate planning |

– Personalized financial strategies – Long-term wealth building and preservation |

– Advisory fees: Typically 1-2% of assets under management annually |

| Online & Mobile Banking | – 24/7 account access – Bill pay and funds transfer – Mobile check deposit |

– Convenience of managing finances anytime – Saves time with automatic bill pay |

– Typically free for customers |

| Credit Cards | – Rewards programs – Balance transfer options – Security features like fraud protection |

– Earn points, cashback, or miles on purchases – Potentially lower interest rate on transferred balances – Protection against unauthorized transactions |

– Annual fee: $0-$95, depending on the card |

| Investment Services | – Brokerage accounts – Retirement accounts (IRA, Roth IRA) – Financial planning services |

– Platform for investing in stocks, bonds, etc. – Tax-advantaged retirement savings – Guidance in building a financial plan |

– Trading commission: $0 for online trades – Annual account fee: $50, waived with a minimum account balance |

Navigating the Competitive Landscape: How Landmark National Bank Stands Out

In a crowded marketplace, it’s survival of the fittest, and boy does Landmark National Bank flex its muscles.

Strategic Mergers and Acquisitions: Expanding Landmark National Bank’s Horizons

Mergers and acquisitions are Landmark’s bread and butter for growth, and they’ve been spreading it thick.

Transcending Traditional Banking with Innovations at Landmark National Bank

Landmark isn’t just keeping up—no, they’re setting the pace, leaving others struggling to keep up.

Exploring New Markets: The Geographic Expansion of Landmark National Bank

Like pioneers of old, Landmark has set its sights on new frontiers.

Tailoring Financial Solutions: The Customer-Centric Approach of Landmark National Bank

At Landmark, the customer reigns supreme.

Building Community Trust: Landmark National Bank’s Social Responsibility

Community isn’t just a buzzword for Landmark; it’s their bedrock.

Fortifying Financial Infrastructure: Landmark National Bank’s Technological Leap

To call Landmark’s tech innovations “cutting edge” would be an understatement.

Uniting Culture and Commerce: Internal Growth and Employee Engagement at Landmark National Bank

Happy employees make for a prosperous bank, and Landmark knows it.

The Future of Finance: Landmark National Bank’s Visionary Roadmap

Visionaries at their core, Landmark always has one eye on the future.

Reinventing the Wheel: Landark National Bank’s Next Big Leap

Get ready, because Landmark National Bank’s gearing up to revolutionize the financial sphere once again.

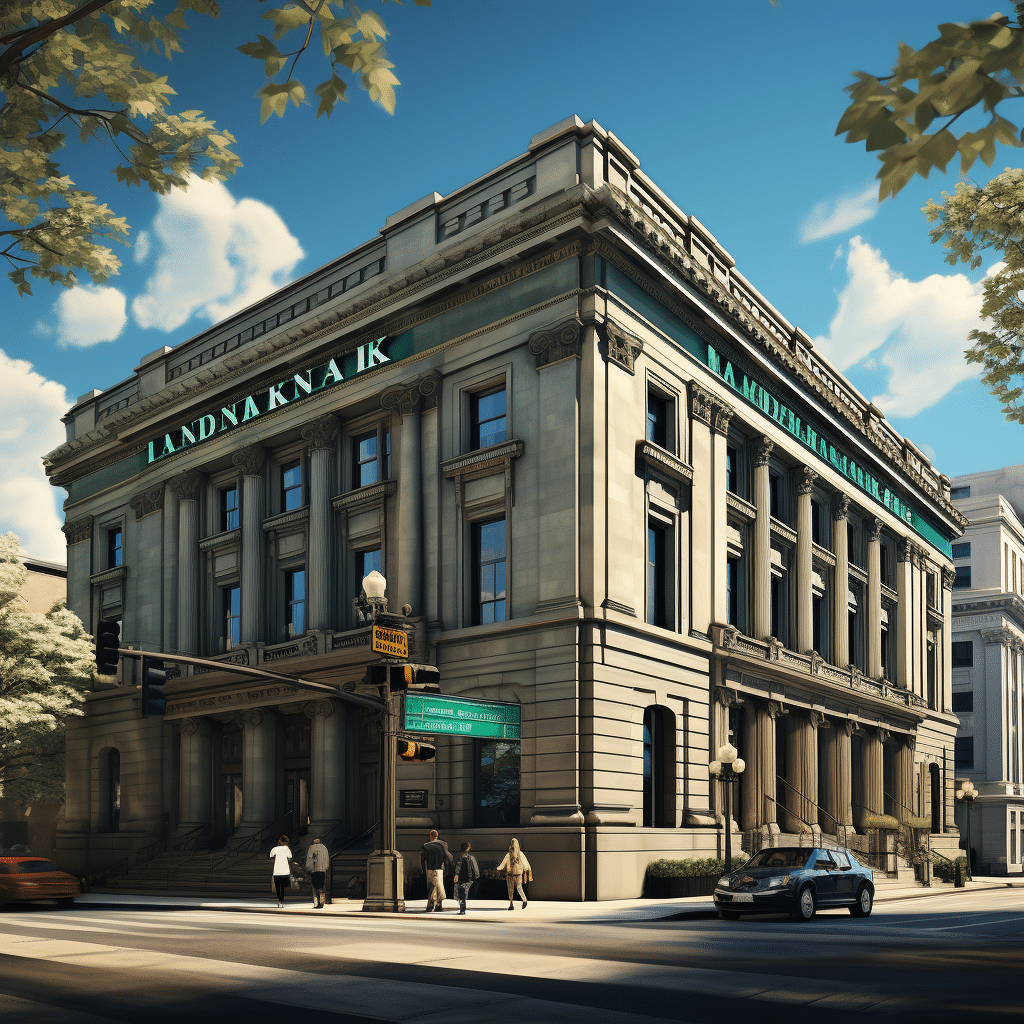

Steering Towards a Future of Financial Excellence

Reflecting on Landmark National Bank’s innovative leaps towards sustained growth, the picture is clear. They’re not just riding the waves; they’re making them. With an adaptive strategy that would put the most dynamic financial minds to shame, Landmark is prepped for the industry trends that are just appearing on the horizon.

So, if you’re placing bets on the future of finance, investing in Landmark National Bank wouldn’t just be shrewd—it’d be as close to a sure thing as you can get in this wily world of banking. Onwards to a future where Landmark doesn’t just participate but leads the charge towards a zenith of financial excellence.

Trivia & Fascinating Tidbits: Landmark National Bank’s Phenomenal Journey

Hey folks! Ready to dive into some juicy bits about Landmark National Bank’s climb up the financial ladder? Well, buckle up because this is not your average snooze fest of statistics. We’re talking about pure gold nuggets of trivia that’ll have you saying, “No way, really?” So, let’s get the ball rolling and delve into the curious world of banking with fun, and yes, some downright unusual facts.

When Banking Met Beach Vibes

Now, get this: Landmark National Bank’s growth strategy might not have an official soundtrack, but if it did, Beach Boys kokomo might just be the perfect fit. Why, you ask? Picture this: just like the laid-back, sun-soaked vibes of the tune where you want to get away and “go down to Kokomo,” customers are drawn to the sense of ease and security Landmark offers. Who wouldn’t want their financial journey to feel like sipping piña coladas on a beach, stress-free and well taken care of? And just in case you’re itching to get that song stuck in your head (you’re welcome), here’s a little melodic inspiration.(

Grow Big or Go Home

Alright, jumping right in—Landmark National Bank’s strategy has been like that one friend who just knows how to charm their way into any clique. By focusing on community-centric services, they’ve grown bigger than a bear before hibernation. And let’s be honest, in the banking world, unless you’ve got the moxie to grow, you’re as visible as a needle in a haystack.

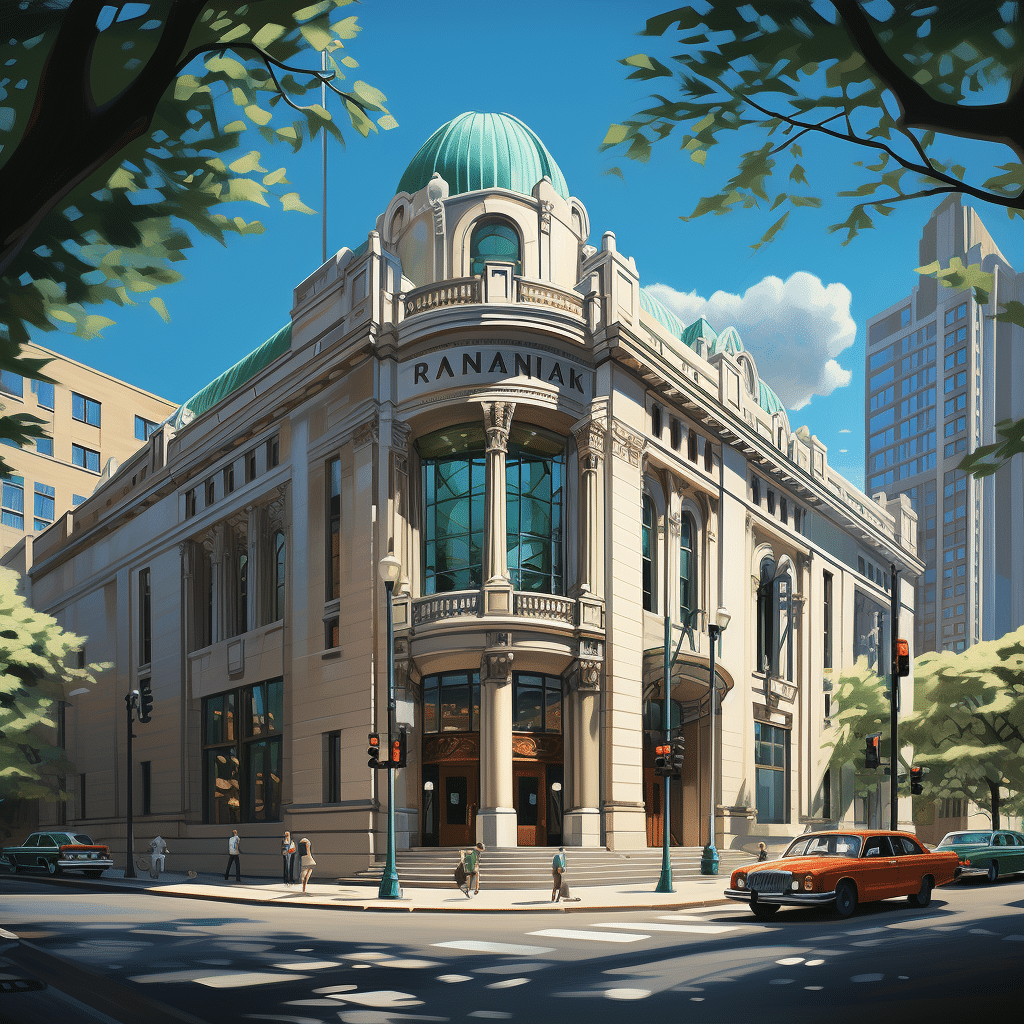

The Name Game

So, Landmark National Bank—ever wonder where that “Landmark” bit came from? Well, you can stop scratching your head because it’s not as mystical as you might think. The scoop is, they wanted a name that would stand out like a sore thumb (but in a good way). “Landmark” implies stability and importance—two things you definitely want from a place holding onto your hard-earned cash.

Expansion Extravaganza

Let me tell you, Landmark’s been expanding faster than my waistline after Thanksgiving dinner! With a knack for merging with smaller banks, they’ve been hopscotching across regions like a pro. Each merger is less “I’m the king of the castle” and more “Let’s join forces and become financial Avengers.” Can you imagine the superhero capes at those board meetings?

Tech-Savvy Bankers

Hold on to your hats, because Landmark’s not stuck in the Stone Age. They’ve been jumping on the tech bandwagon like there’s no tomorrow, offering digital services that’ll have you thinking you’re living in 3023. And the cool part? They’re balancing new-fangled tech with that old-school, shake-your-hand service. Talk about having your cake and eating it too!

The Personal Touch

In the end, what really makes Landbank, well, Landmark, is their personal touch. They’ve got that mom-and-pop vibe with the muscle of a banking Goliath. Customers aren’t just numbers; they’re the neighbor you lend your lawn mower to or the local barista who knows your order by heart.

So, there you have it, the buzz about Landmark National Bank’s growth that’s more gripping than the latest whodunit. From beach vibes to digital dives, they’ve got the recipe for success down pat. And that, dear readers, is the scoop from Money Maker Magazine—where finance meets fun, and every read’s a golden one. See you next issue for another round of mind-bogglers and jaw-droppers!