The Mystery of Mortgagee Clauses Unveiled

Ever heard of a mortgagee clause and scratched your head, wondering what on earth it could mean? Let me break it down: a mortgagee clause is a vital component of a mortgage agreement that protects the lender’s interest in your property. Now, why should you care? Simply put, these little clauses can have big repercussions for both the lender, a.k.a. the mortgagee, and you, the borrower, or mortgagor.

When you’re sipping Joffreys coffee and mulling over mortgage agreements, understanding these clauses isn’t just reading the fine print—it’s safeguarding your financial future. For the mortgagee, it’s like having an insurance policy on their loan to you. For mortgagors, it’s crucial to know the rules of the game when you’re playing on the mortgagee’s turf.

The Untold Influence of Mortgagee Clauses on Insurance Policies

Mortgagee clauses are like the unsung heroes of property insurance policies. They’re the linchpin that ensures the mortgagee’s investment is protected, rain or shine—or, let’s say, fire or flood. Here’s the kicker: if your home gets hit by disaster, that clause means your lender gets their share of the insurance payout before you see a dime.

Think of it like a barbeque scenario. You may own the grill, but if your neighbor has a steak on it when things go south, they’re taking that steak off first. Real-world cases show that mortgagees with these clauses in place have walked away from property-razed disasters financially unscathed, while mortgagors had to navigate the rubble.

| Attribute | Details |

|---|---|

| Entity Type | Lender (e.g., bank, credit union, online lender) |

| Role in Transaction | Provides funds for real estate purchase |

| Counterpart | Mortgagor (borrower) |

| Collateral | Real estate property title |

| Financial Product | Mortgage loan |

| Purpose | Purchase or maintain homes, land, or real estate |

| Loan Repayment Period | Typically 15, 20, or 30 years |

| Monthly Payment Components | Principal, Interest, Taxes, Insurance |

| Origination Fee | Fee charged by lender for creating the mortgage loan |

| Mortgagee Clause in Insurance | Ensure lender receives payment in case of property loss |

| Financial Consideration | Opportunity cost of cash tied up in home ownership |

| Mortgage Definition Origin | Derived from Law French “death pledge” |

Mortgagee Clauses and Loan Transfers: The Hidden Dynamics

Fancy that! You’ve secured a loan with a mortgagee, but did you know that loan can change hands faster than celebrity gossip on Ann coulter twitter? Mortgagee clauses ensure that if your lender decides to sell your loan, the new mortgagee still enjoys the same level of protection.

So, here’s the plot twist: although your mortgagee might change as often as the queues at Costco burbank on a Saturday, your obligations remain steadfast. And for borrowers, this might feel a bit like being the last to know who’s coming to dinner. But fear not, savvy mortgagors should always keep a watchful eye on their loan’s journey – it’s your golden ticket in this real estate Wonka land.

The Unexpected Legal Power of Mortgagee Clauses

When it comes down to it, mortgagee clauses aren’t just words on paper; they’re like a suit of armor in the battleground of legal disputes. These clauses can turn the tides in a lender’s favor, as seen in historical legal battles where the inked words of a mortgagee clause proved mightier than the sword.

From the courtroom dramas to the mile-high club meaning of legal victory, mortgagee clauses have time and again shielded lenders from financial bruises. Recent interpretations of these clauses suggest they are only getting stronger, possibly impacting how mortgage agreements are drafted in the foreseeable future. The message is clear: underestimate the legal power of these clauses at your own peril.

Mortgagee Consent: A Complex Reality Often Overlooked

Here’s where it gets really juicy—mortgagee clauses can bind you tighter than post-game sports interviews with Greta Van susteren. They often require lender consent for changes to the insured property, and that’s a jigsaw puzzle you don’t want to piece together last minute.

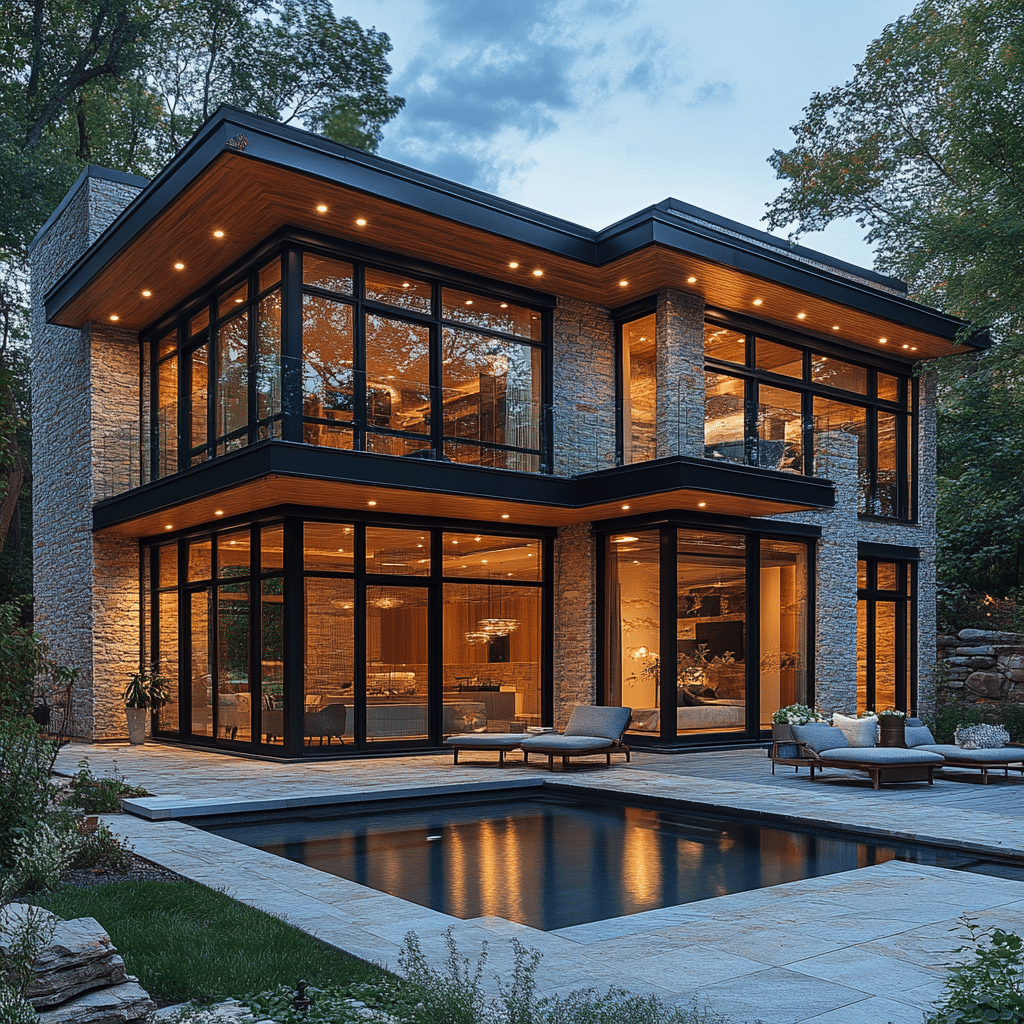

Imagine you’re itching to add a swanky new extension to your abode in Queenstown New zealand, reminiscent of a movie star’s mountain getaway. Hold your horses! Before you start, the mortgagee has to give the thumbs-up or it’s no deal. It’s the borrower’s bane, but a necessity in preserving the mortgagee’s interest.

When Mortgagee Clauses Backfire: Lender’s Beware

Not every story has a fairy-tale ending, and mortgagee clauses can sometimes betray the very hand that feeds them. There’s a trove of instances where lenders got the short end of the stick thanks to unforeseen loopholes or oversights in these clauses.

In the realm of what threads Meta might weave, when a mortgagee clause falls flat, the lender could be waving goodbye to their claim on insurance proceeds or standing with egg on their face in a court battle. It’s the plot twist that nobody saw coming, replete with financial fallout and legal backpedaling.

Mortgagee Clauses in a Technological Era: Evolving or Stagnant?

Fasten your seatbelts; we’re diving into the digital domain. Technology’s relentless march forward is reshaping the mortgage landscape faster than viral memes. Now, mortgagee clauses are either getting a tech-savvy makeover or getting left in the dust.

Is it evolving or stagnant? That’s the million-dollar question. With online lending becoming the norm, there’s a push to reinvent these clauses for the digital age, ensuring that, like the lore of the mortgagee, they adapt or face obsolescence.

Conclusion: Reassessing Your Mortgage Strategy in Light of Mortgagee Clauses

As we draw the curtain on our deep dive, the revelations surrounding mortgagee clauses have been nothing short of eye-opening. These facts aren’t just cocktail party chatter; they’re core to rethinking your mortgage strategy whether you’re the borrower or lender.

A piece of advice: tread carefully, assess the nuances, and ensure your mortgagee clause gives you the protection or flexibility you need. Don’t take this legalese lightly—it might just be the life raft or anchor in your mortgage journey. The call to action is clear: industry reform and lucidity are paramount.

Now, go forth, armed with knowledge, and navigate your mortgage path with the prowess of a chess grandmaster and the financial savvy of a Wall Street tycoon. Your informed decisions are your power in the world of mortgages and beyond.

Mortgagee Clauses: Uncover The Surprising Truths

Hey there, savvy readers! Buckle up as we take off on a high-flying journey into the world of mortgages. Now, I know what you’re thinking, “Mortgages? Fun? Really?” But hang tight, because I’m about to reveal some shocking facts about mortgagee clauses that will have you as wide-eyed as a kid who’s just joined the mile high club. Alright, let’s dive in!

Who’s The Boss? Well, the Mortgagee is!

You know that feeling when you’re the king of the hill? That’s how the mortgagee feels! A mortgagee is basically the big cheese, the head honcho—the lender in a mortgage situation. They’re the ones holding the deed, the ones with the power to say “yay” or “nay” to your home-owning dreams. So, when you’re signing on that dotted line, remember, you’re not just getting keys to a new house; you’re entering a relationship where the mortgagee calls the shots!

Your House, Their Rules

Let’s say you’ve picked out the perfect home, and it’s almost like the mortgagee is doing you a solid by loaning you the dough to make it yours. But here’s the kicker: the mortgagee has a bunch of rules you’ve gotta follow. If not, they can pull the rug right out from under you and take back the house. It’s like they’re silently sitting on your shoulder, whispering, “Make those payments, or else…”

Protecting Their Turf

Ever heard of a mortgagee clause? No, it’s not Santa’s lesser-known cousin. It’s this nifty little part of your insurance policy that’s all about protecting the mortgagee’s interests. It’s basically their safety net, making sure that if anything happens to your crib—like, say, a freak alien abduction or a surprise rave that crashes—boy oh boy, they’ll still get their cash.

Risky Business

Don’t think the mortgagee just sits back, relaxes, and watches the cash roll in. Oh no, they’re playing a risky game! They’re throwing the dice, betting on horses… okay, not literally, but they are taking a chance on you. If you hit a rough patch and start missing payments, they might have to say adios to the money they lent you. And nobody likes to lose money, right?

The Unexpected Twist

Now, get this — while you might think that once you’ve paid off your house, the mortgagee walks away, think again! These folks have their own sort of mile high club( going on. They’ve got a whole process for releasing the deed and saying goodbye to the property. It’s like a break-up where you have to go through your stuff to decide who gets what—only this time, it’s all about the paperwork.

Whoa, mind-blowing stuff, am I right? Who knew the world of mortgagees could be so full of intrigue and twists? Next time you’re eyeing that dream home, just remember: the mortgagee might just have more tales to tell than that dusty old attic you’re so keen on converting. Keep your wits about you and always read the fine print!

Who is the mortgagor and mortgagee?

Well, strap in, folks! The mortgagor is the homebuyer slash borrower, sweating bullets to make those monthly payments. On the flip side, the mortgagee is the lender, typically chillin’ as they collect the cash.

Is the buyer the mortgagee?

Nah, the buyer’s the mortgagor, not the mortgagee. The buyer’s signing their life away on the dotted line, not counting the dollar bills.

What is an example of a mortgagee?

For instance, think of a big-shot bank like Wells Fargo as the mortgagee. They’re the ones rubbing their hands together, eagerly waiting for your check each month.

Who is the mortgagee in a real estate transaction?

In the nitty-gritty of real estate dealings, the mortgagee’s the one with the money bags – that’s the lender’s title in this financial tango.

Is the mortgagee the lender or borrower?

Yep, you’ve got it! The mortgagee is the lender. They’re the ones with the gold, making the rules.

Is mortgagor a borrower?

Absolutely, the mortgagor is the borrower. They’re the ones with the dream of a white picket fence, signing up for years of mortgage payments.

How do you remember mortgagee vs mortgagor?

Remembering mortgagee vs. mortgagor isn’t rocket science! The mortgagee lends the ‘e’asy money, and the mortgagor’s got the ‘o’bligation. See what I did there?

Why is it called mortgagee?

Why’s it called mortgagee, you ask? Hmm… Cross a ‘mortgage’ with ‘ee’ as in ’employee’, and you’ve got the party getting paid!

Who is the mortgagee holder?

The mortgagee holder is the big cheese that owns the mortgage loan. They’ve got your IOU until that last penny is paid.

Can an individual be a mortgagee?

Sure thing, an individual can play the part of a mortgagee if they’ve got the dough to lend for a mortgage. Not just for the big banks anymore!

What is a synonym for the word mortgagee?

A snazzy synonym for mortgagee? Try “lender” on for size. It’s down-to-earth and straight to the point.

How do you pronounce mortgagee?

Don’t stumble on the pronunciation; it’s “mor-GAJ-ee.” Roll it off your tongue like you’ve said it a million times.

Is grantor and mortgagee the same?

Grantor and mortgagee are as different as chalk and cheese. The grantor is gifting you property rights, whereas the mortgagee is the one waiting for the monthly cha-ching.

What party is the mortgagee?

In the mortgage party, the mortgagee’s the one holding the financial reins. They’ve got the power of the purse in this shindig.

Who are the two parties to a mortgage?

Put simply, the two parties to a mortgage are the mortgagor – your regular Joe or Jane Homebuyer – and the mortgagee, a.k.a. the money-lending hotshot. It’s a financial duo that’s as classic as peanut butter and jelly.