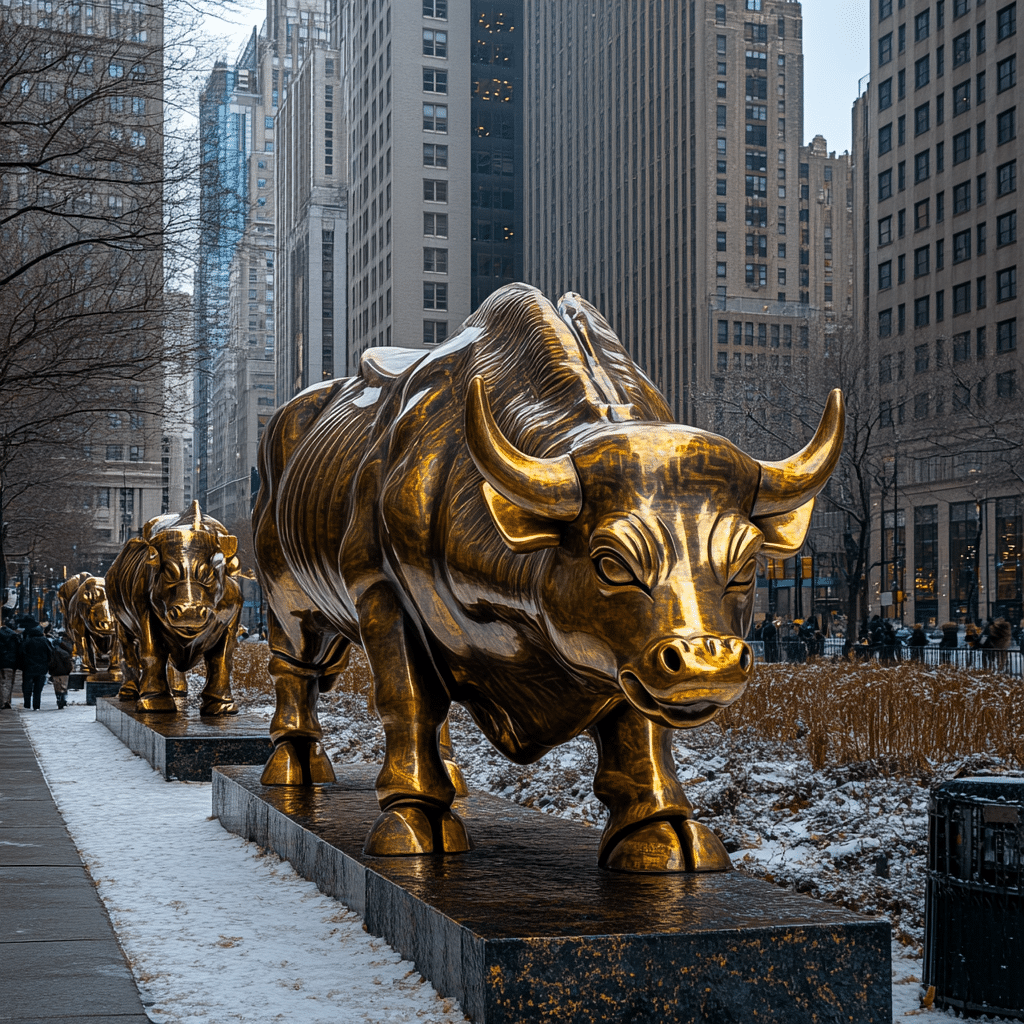

When it comes to investing in the NASDAQ-100 Transportation Index (NASDAQDJT), understanding its financials is key to unlocking remarkable growth. The NASDAQDJT offers valuable insights into a variety of transportation and logistics companies, including giants like Delta Air Lines and FedEx. Whether you’re a seasoned investor or just getting your feet wet, diving into NASDAQDJT financials can significantly enhance your investment strategy, especially as we gear up for 2024.

The beauty of NASDAQDJT financials lies in their ability to provide a snapshot of how some of the most critical transportation companies are performing. As we navigate through an increasingly dynamic financial landscape, let’s explore seven tips inspired by the latest NASDAQDJT financials that can revolutionize your investment approach.

Top 7 NASDAQDJT Financials Tips to Revolutionize Your Investment Strategy

1. Analyze Earnings Reports with a Critical Eye

Earnings reports are your financial GPS. Companies like Delta Air Lines and FedEx typically release these reports quarterly, and they can have an immediate impact on stock prices and investor confidence. In 2024, it’s essential to focus on metrics such as earnings per share (EPS) growth rates and profit margins, as they can indicate which transportation stocks are setting the stage for stability or growth.

A strong earnings report might show a rise in EPS, signaling a company’s adept handling of market conditions. Conversely, a decline can spell trouble, requiring investors to re-evaluate their positions. Make it a habit to read these reports closely; they’re treasure troves of information that can guide your investment choices.

2. Monitor Freight and Delivery Data Trends

Trends in freight and delivery data are like market radar. Utilizing services like FintechZoom can provide acute insights into shipping volumes and freight costs, gauging how well companies like Union Pacific Railroad manage logistics efficiency. Consider that increases in demand for freight services generally correlate with enhanced profitability for transportation stocks.

Understanding these trends is crucial because they reveal not just the performance of individual companies but also the health of the economy as a whole. A spike in shipping activity might hint at a growing economy, which can lead to better stock performance across the board.

3. Leverage Technical Analysis Tools

Technical analysis is your investments’ secret weapon. The right tools allow investors to dissect stock trends, identify resistance levels, and explore moving averages specifically within NASDAQDJT constituents. Platforms such as FintechZoom.com NASDAQ enable you to analyze historical price movements and spot opportunities that others might miss.

Don’t underestimate the power of charts and graphs. They can visually represent patterns that may dictate when to buy or sell. With the right analysis, you get clearer insights into market behavior, allowing for smarter, more calculated decisions.

4. Assess the Impact of Regulatory Changes

Regulations can shake up the market. For instance, upcoming environmental regulations may affect the operational costs for transportation companies, including industry leaders like Tesla. Staying informed about such regulatory shifts is vital for anticipating how they will influence stock prices.

Regulations don’t just affect individual companies; they can reshape entire sectors. When a new rule comes into play, assess how it impacts the companies in your portfolio or those you’re eyeing. By staying ahead of regulatory changes, you position yourself to make better investment decisions.

5. Diversification: Beyond Transportation

Don’t put all your eggs in one basket. While the NASDAQDJT zeroes in on transportation stocks, integrating companies from allied sectors like technology or renewable energy can enhance your investment portfolio. The surging growth of electric vehicle manufacturers represents an innovative opportunity that ties back to logistics and transportation.

By branching out, you minimize risk while capitalizing on different sectors. This multifaceted approach helps you navigate market fluctuations and capture diverse growth potential.

6. Examine Dividend Yields and Share Buybacks

Dividends can be a steady source of income. Many companies in the NASDAQDJT offer attractive dividend yields, making them appealing for income-focused investors. Passover historical dividend yields from companies like Southwest Airlines; understanding their commitment to returning value to shareholders gives you insight into their financial health.

Additionally, look for signs of share buybacks. When a company buys back its shares, it often signals that management believes the company is undervalued. Pay attention; these moves can indicate stronger future performance.

7. Stay Informed About Global Economic Indicators

Global factors greatly influence NASDAQDJT financials. Economic conditions worldwide directly affect transportation stock performance. Particularly, the relationship between international trade dynamics, fuel prices, and currency exchange rates can dictate market trends.

By keeping a pulse on global economic indicators from sources like the International Monetary Fund, you can anticipate potential market shifts. This proactive stance can give you a leg up on your competition.

Take Charge of Your Investment Strategy with NASDAQDJT Financials

As you weave these insights into your investment strategy, you’ll find that a comprehensive understanding of NASDAQDJT financials can elevate your financial game. From focusing on earnings reports to diversifying your portfolio and grasping global economic indicators, each element enhances your decision-making process.

Remember, investing goes beyond just crunching numbers; it’s also about understanding the narratives behind those figures. Whether you’re exploring the latest trends in Minnie Mouse Trends or analyzing the implications of evolving sectors like electric vehicles, the dynamic world of NASDAQDJT is ripe with opportunities for those willing to dig deeper. Your financial future is waiting, so grab the reins and steer your investments toward success!

Exploring nasdaqdjt Financials: The Fun Side of Investments

Fascinating Insights About Nasdaqdjt Financials

Did you know that understanding nasdaqdjt financials can be as entertaining as binge-watching one of your favorite shows? For example, investors often overlook key indicators that can change the game. Just like the beloved animated show about math concepts, Peg And Cat, these indicators can make complex ideas accessible. Moreover, having a grasp on quality Mortgages can significantly impact your financial decisions, ensuring you’re not just throwing darts in the dark. Those who dive into the details usually come out on top!

Quirky Financial Facts to Boost Your Knowledge

Here’s a fun fact: the connection between market movements and astrological signs can be surprising! For example, if you’re born during Scorpio season, your traits like determination might align perfectly with investment strategies that best fit nasdaqdjt financials. Meanwhile, the gaming headset Astro A50x isn’t just great for immersive experiences; savvy traders use these for live-streamed trading rooms, ensuring they catch every market shift in real-time. It’s all about being tuned in, right?

Making the Most of Your Investments

Lastly, have you ever thought about how some financial tools can give you the upper hand? Take the 1-inch decentralized exchange as an example: it’s turning heads with its innovative ways to trade tokens smoothly. This is crucial in optimizing your portfolio’s return. Plus, there are some streaming options out there, which might be better than Netflix, especially if they keep you engaged and informed about your favorite investment trends. Ultimately, the world of nasdaqdjt financials has something for everyone; you just have to dig a little deeper!