Understanding the Shift: The Impact of No Tax on Tips

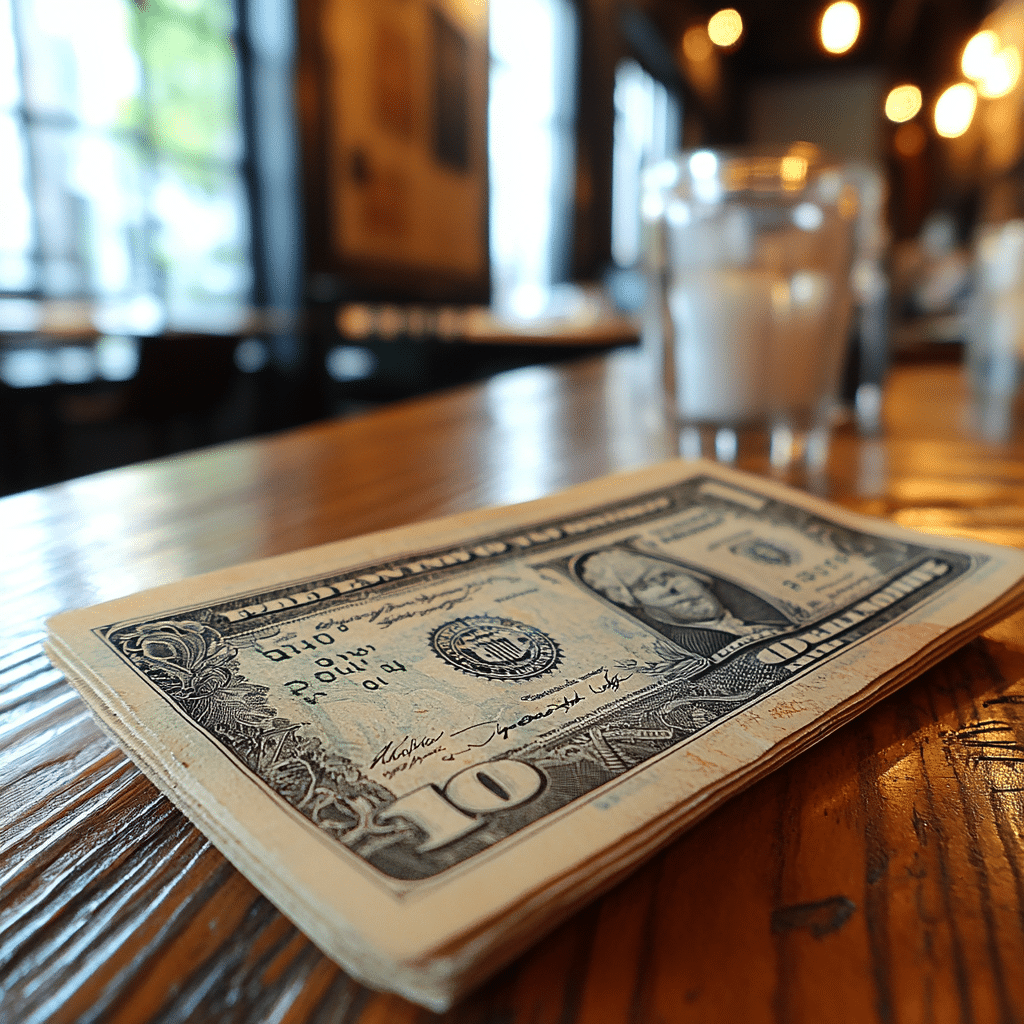

The advent of no tax on tips has set a remarkable precedent for service workers across America. This policy signifies a major shift in how tips are viewed, allowing hard-working employees in the hospitality and service industries to retain every dollar they earn. Previously, tips were often subject to taxation, diminishing the financial reward for challenging work.

So, what’s behind this change? Policymakers recognized that service workers play a vital role in boosting local economies. By removing the tax burden on tips, they’re enabling these employees to keep more of their hard-earned money, leading to increased disposable income. This initial adjustment brings immediate benefits that extend beyond individual earnings to the broader economic fabric.

With many servers and bartenders operating on tight budgets, the financial relief provided by no tax on tips embodies a crucial support system. This new reality allows individuals to save for emergencies, invest in their personal development, or simply breathe a little easier while making ends meet. The overall impact is a profound shift in workers’ financial landscapes.

Top 7 Advantages of No Tax on Tips for Service Workers

One straightforward advantage of no tax on tips is the boost in take-home pay. For instance, consider a bartender at a restaurant like the Four Seasons Hotel baltimore, who averages $250 a week in tips. By eliminating taxes on that amount, they could save around $30–$70 per month. This additional income acts as a financial cushion, allowing workers to build emergency funds or invest in skills that could help advance their careers.

Keeping all their earned income has made a real difference in job satisfaction for many service workers. Establishments like Starbucks and Denny’s report a noticeable uptick in loyalty and morale among employees when they know their tips are theirs to keep. Such appreciation not only motivates workers but also fosters a positive environment that can translate into better customer service.

Several service workers face earning fluctuations due to shifting customer traffic. Without taxes on tips, they can more effectively manage their monthly budgets. This financial stability is crucial for those in part-time positions or seasonal roles, giving them some breathing room when it comes to planning their expenses.

Increased disposable income can significantly benefit local economies. When service workers have more money in their pockets, they’re inclined to spend it at local businesses. For example, regions rich in dining establishments, like New Orleans, have seen small businesses flourish since the no tax on tips policy was rolled out, amplifying the economic ripple effect throughout communities.

With tax relief on tips, some restaurants may tweak their wage structures to stay competitive. This could mean better salaries or enhanced perks for employees. For instance, Chipotle and TGI Fridays are already adjusting their employee benefit packages to attract top talent in a tightening labor market.

Not having to report tips as taxable income simplifies life for many service workers who dread tax season. This ease allows them to focus more on their careers and less on complicated tax obligations. As tax preparation becomes less burdensome, especially for younger workers, it leads to more effective financial planning.

Financial pressures are a common stressor among service workers. By doing away with taxes on tips, workers face reduced financial strain, which has a direct positive impact on their mental health. Studies suggest that less stress correlates with improved job performance – a fact well-understood at major chains where mental health initiatives are becoming standard.

The Connection Between Economics and No Tax on Tips: Fed Rate Cuts Influence

The no tax on tips policy aligns neatly with recent Fed rate cuts, creating an environment ripe for economic benefits for service workers. With interest rates falling, borrowing options like those offered through a Navy Federal personal loan have become more accessible for lower-income workers. The favorable lending conditions allow service employees to engage in investment opportunities without the burden of crippling debt.

This synergy between no tax on tips and favorable borrowing conditions creates a supportive financial ecosystem. A perfect example comes from Navy Federal’s initiative, which offers lower personal loan rates specifically for individuals in the service sector, enhancing their financial stability. This initiative illustrates a context where the removal of tax burdens allows workers to leverage opportunities for income growth.

The combination of keeping more of their tips and having access to affordable loans strengthens the financial footing of service workers. This empowerment leads to greater autonomy, which can fuel long-term economic mobility and sustainability within the workforce.

Future Implications of the No Tax on Tips Policy

The no tax on tips movement represents a larger acknowledgment of the essential role that service workers play in our economy. As this trend takes root, we can expect more advocacy for rights and benefits tailored to the service sector. This momentum may usher in crucial discussions around fair wages and comprehensive benefits.

As businesses adapt to this evolving landscape, many might rethink their compensation structures, aiming for more equitable pay models. This shift could help address longstanding wage disparities that have affected this crucial sector.

Given the current trajectory, service workers may experience greater financial autonomy in the years to come. As they embrace this newfound financial freedom, they’re likely to contribute more robustly to local communities and the economy at large. This evolution underscores a fundamental truth: when service workers thrive, everyone reaps the benefits, ensuring a healthier, more prosperous economy for all.

No Tax on Tips: A Game-Changer for Service Workers

With the recent news of no tax on tips, I bet you’re wondering how this will affect the everyday lives of service workers. These hardworking individuals have long relied on tips as a significant portion of their income, especially in bustling places like the Four Seasons Hotel baltimore, where a good service can make or break your experience. With tips now free of tax, employees can keep more of their hard-earned cash, which could mean more money for essentials or even a night out at the Mayflower Inn!

Did you know that the average tip can significantly vary across the globe? While in the U.S., tipping is often customary at 15-20%, other cultures have different customs. For example, in Japan, tipping might be viewed as rude! This shows how crucial it is for service workers to understand cultural contexts, much like remote workers navigating their own work habits are remote Workers working all day?). In a sector where every dollar counts, the no tax on tips law not only boosts take-home pay but also adds a layer of fairness.

Oh, and speaking of fairness, how many of you knew that certain jobs come with their unique trivia? Take the iconic theme of Pacific Rim 3, for instance; much like how that film dives into specialized roles, service workers too bring their unique talents to the table. This tax break can liberate them, allowing for a better work-life balance. Perhaps they’ll even splurge on that dream house, which averages a square foot cost that can boggle the mind! But now with no tax on tips, a more significant portion of their income can go towards making those dreams a reality.

As we witness these exciting changes, let’s keep an eye on the future. With bank Holidays 2025 on the horizon, it’s possible service workers will enjoy even more financial benefits during peak seasons. The fun doesn’t stop there; imagine how these changes could inspire creative betting ideas, like Super Bowl Squares at parties. As these workers embrace their newfound freedom, we can all celebrate the positive shift in their earnings landscape, especially as they navigate social and financial challenges, including those unexpected expenses that can feel like a river, like Leon Bridges often sings about. Here’s to hoping that this change on no tax on tips marks the dawn of even brighter days for our dedicated service workers!