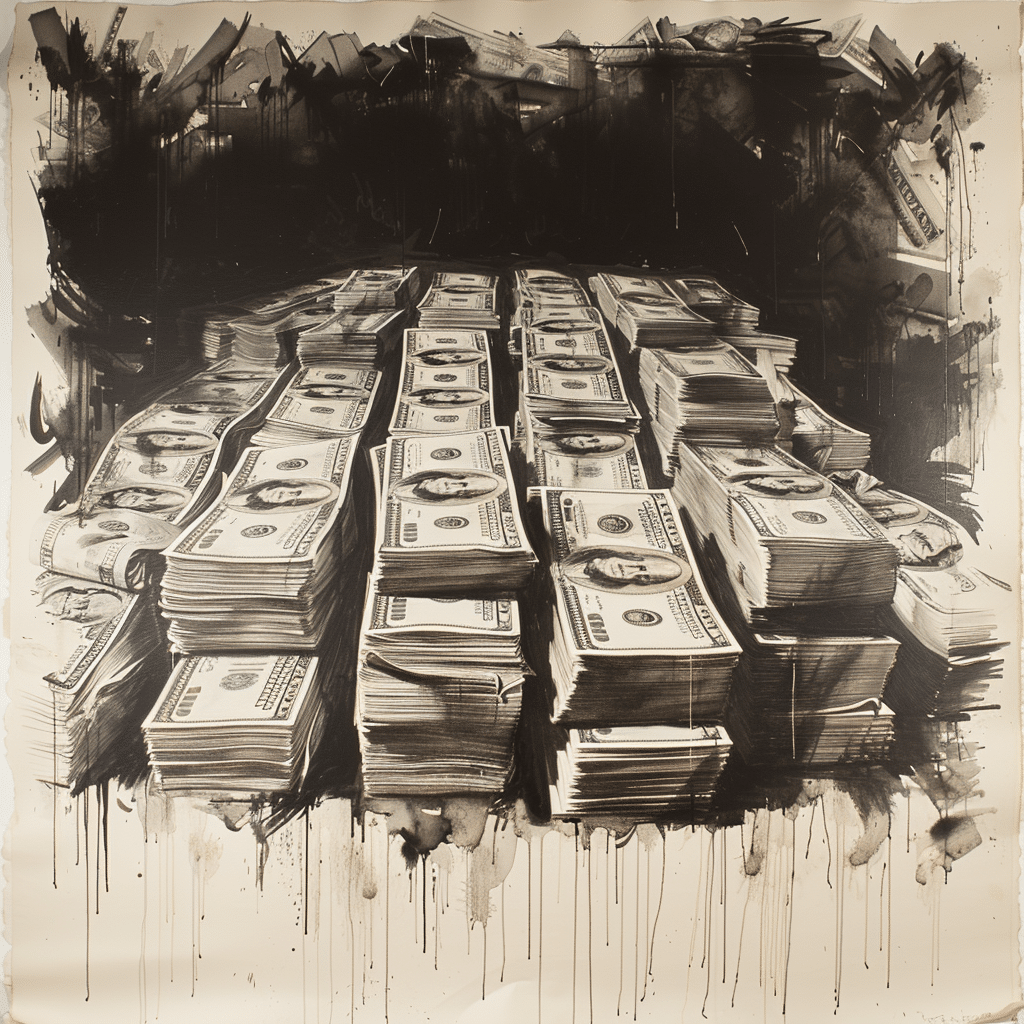

“Show me the money!” This thunderous cry, first belted out by Cuba Gooding Jr.’s character Rod Tidwell in the 1996 film “Jerry Maguire,” has reverberated through the halls of finance for decades. Much more than a catchy movie line, it encapsulates a raw financial hunger, a desire for transparent rewards, and has become a cultural touchstone, influencing behavior from Wall Street to the start-up garage.

The Ongoing Echo of ‘Show Me the Money’ in Modern Finance

To scream “show me the money” is to openly acknowledge that brass tacks matter—candidly, loudly, and without an ounce of shame. This pronouncement isn’t just alive and kicking; it’s the heartbeat of modern finance.

Examining the Cultural Footprint of ‘Show Me the Money’ in Business Negotiations

Let’s face it, when power players pull up to the bargaining table, whether they’re renegotiating sports contracts or hashing out corporate mergers, the spirit of Rod Tidwell often sits shotgun. Remember when business magnate Elon Musk publicly laid down his financial expectations before acquiring a significant stake in Twitter? It was a moment that distilled a “show me the money” fervor. In a world where fortunes can change with a tweet, the clarity of this phrase has only magnified its potency.

Influential Financiers Who Embody Jerry Maguire’s Mantra

You don’t need to look further than the Oracle of Omaha himself, Warren Buffett, to find a financier who has danced to the tune of “show me the money.” Buffett’s approach, emphasizing value investing and long-term gains, may seem miles from Tidwell’s impassioned demand. Yet both share a common thread: an unapologetic drive for financial results.

Strategies for Making the Mantra Work: Show Me the Money in Personal Finance

Now, not everyone is wheeling and dealing billion-dollar buyouts. But the essence of “show me the money” can still ripple through the personal finance pool.

Investment Choices That Echo ‘Show Me the Money’

Risky? Perhaps. Rewarding? Potentially so. Look at the meteoric rise of companies like Tesla or game-changers in the cryptocurrency realm—these ventures scream “show me the money” opportunities. Meanwhile, rookie professionals like golf sensation Minjee Lee have shown that betting on emerging talent can pay off handsomely, much like a wise stock pick in a volatile market.

‘Show Me the Money’ Budgeting: Managing Personal Finances with a Bold Flair

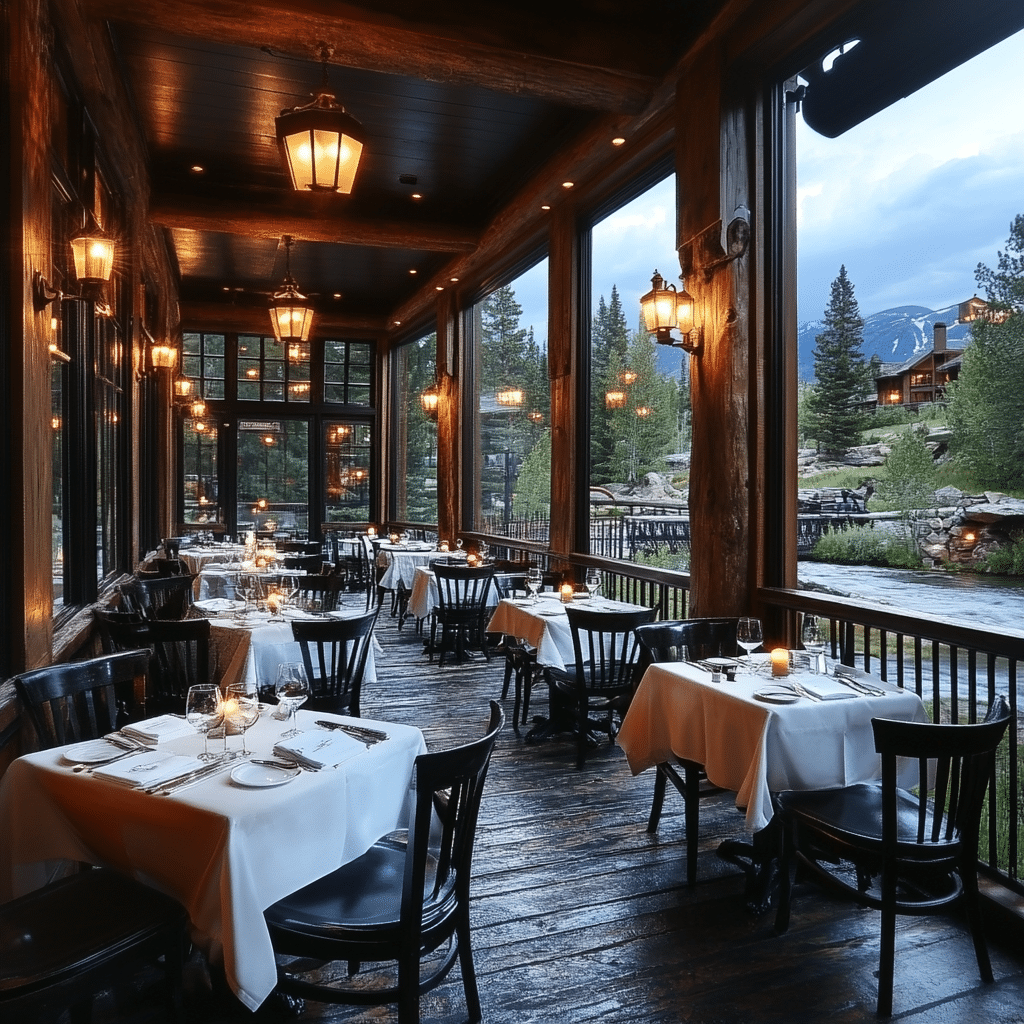

Savvy budgeting with a Tidwell twist means making each dollar holler. It’s not about penny-pinching; it’s about making your money scream success from the rooftops. Take the financial journey of a local dining gem, Husk nashville. By prioritizing both quality and savvy financial moves, the establishment has catered to both palate and pocketbook with aplomb.

| Key Strategy | Description | Potential Benefits | Key Considerations | Example |

| Budgeting & Expense Tracking | Monitor income and expenses to manage finances efficiently. | Helps prevent overspending, saves more money. | Time-consuming; requires discipline and consistency. | Mint, YNAB (You Need A Budget) software |

| Investment in Stocks | Buying shares of companies with potential for growth. | Can yield high returns through capital gains and dividends. | Market can be volatile; requires research or advisor. | Apple, Amazon, Google stocks |

| Real Estate Investment | Purchasing property to generate rental income or capital appreciation. | Provides stable income and potential property value increase. | Requires large initial capital; management and market risks. | Rental homes, REITs (Real Estate Investment Trusts) |

| Retirement Accounts (401(k), IRA) | Investing in tax-advantaged retirement accounts. | Compound growth, tax savings. | Limited liquidity; penalties for early withdrawal. | Vanguard, Fidelity retirement accounts |

| High-Interest Savings Accounts & CDs | Saving in high-yield bank accounts or certificates of deposit. | Risk-free return, FDIC insured. | Low returns compared to other investments. | Ally Bank, Marcus by Goldman Sachs |

| Starting or Investing in a Business | Creating or funding business ventures for growth and profit. | Potential for substantial returns and business ownership. | High risk; requires extensive time and capital. | Startup funding, angel investing, entrepreneurial ventures |

| Peer-to-Peer (P2P) Lending | Lending money to individuals or small businesses online. | Higher returns than traditional savings. | Potentially higher risk of default. | Lending Club, Prosper |

| Diversification & Asset Allocation | Spreading investments across various asset classes. | Reduces risk by not being overly exposed to one area. | Requires knowledge of different markets. | A mix of stocks, bonds, real estate, and commodities |

| Passive Income Streams | Income sources that require little to no effort to maintain. | Provides financial stability and freedom. | May require significant upfront investment or effort. | Rental income, dividend stocks, royalties from intellectual property. |

| Continuous Financial Education | Committing to ongoing learning about personal finance and investment strategies. | Better decision-making, keeping up with market trends. | Requires time and dedication. | Books, seminars, online courses in finance and investing. |

The Intersection of ‘Show Me the Money’ and Ethical Financial Practices

Yet, the pursuit of wealth must traverse the high road. Embracing “show me the money” is not a green light for greed without guidelines.

Case Studies: Profit with Principles

Consider eco-conscious companies like Patagonia. Yes, the profits are there, but not without a steadfast commitment to sustainability. It’s a shining beacon of possible harmony between “show me the money” and “save the planet.”

When ‘Show Me the Money’ Goes Beyond the Dollar Sign

Are we chained to the cash? Hardly! “Show me the money” speaks volumes about value in numerous currencies.

The Intangible Returns on ‘Show Me the Money’ Investments

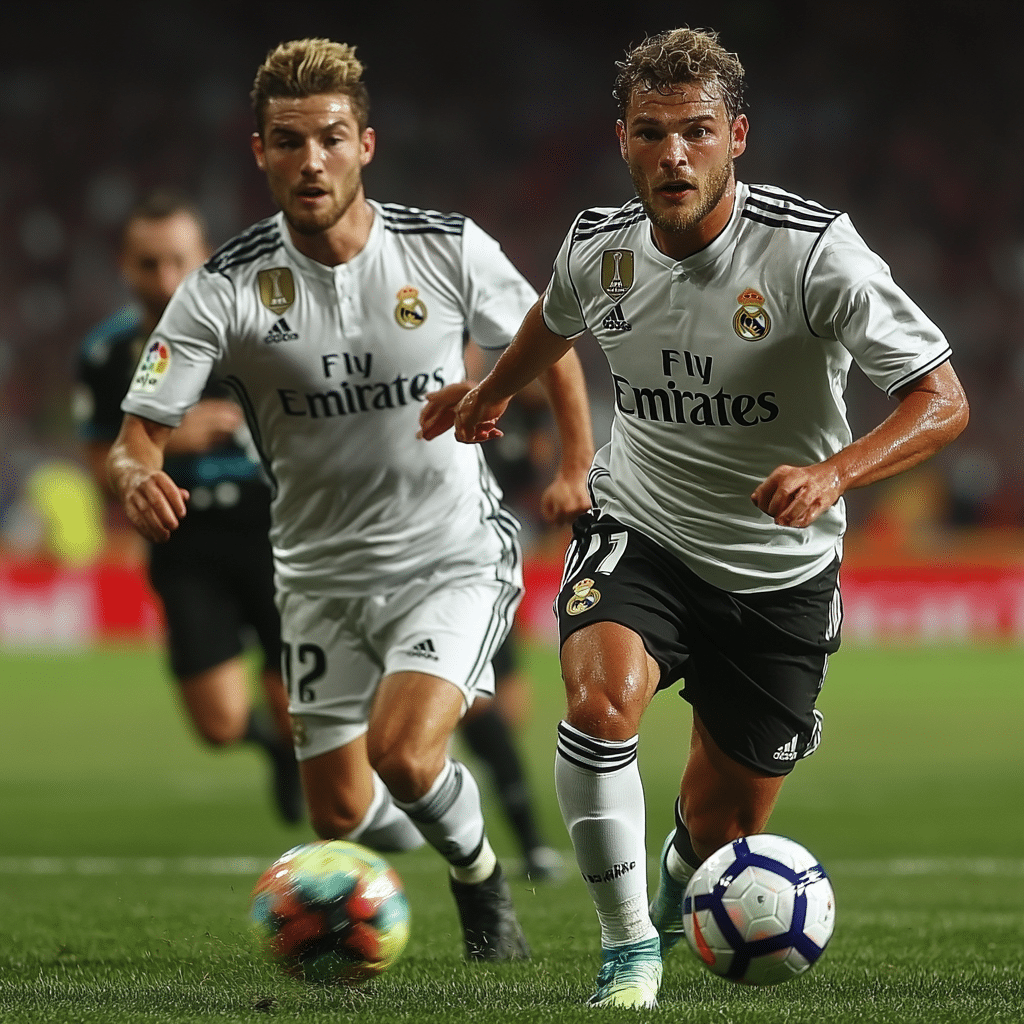

Take Goo Goo dolls iris, for example, a chart-topping song that yielded impressive cultural capital for the band—a clear example of an investment paying off with dividends that money can’t buy. Or ponder those spontaneous moments—like the charged thrill of South Korea vs. Brazil on the pitch—where passion and national pride bubble up, invaluable to the spectators.

Dissecting the Philosophy: A Deep Dive into the Mindset Behind ‘Show Me the Money’

What provokes this call for immediate monetary recognition? It’s a concoction of ambition, directness, and yes, a bit of Hollywood drama.

The Psychology of Financial Urgency in a ‘Show Me the Money’ World

This financial flashpoint creates a sizzling market atmosphere. It’s a symptom of our times, where the heartbeat of commerce is paced by instant gratification and real-time analytics.

Money Talks: How ‘Show Me the Money’ Influences Financial Communication

“Show me the money” is not a whisper; it’s a conversation starter, a statement piece in the wardrobe of financial dialogue.

Successful Negotiations Featuring ‘Show Me the Money’ Tactics

Consider Angie Everhart or similar success stories; their career movements mirror a certain financial forthrightness—there’s no mincing words when the stakes are your worth.

An Innovative Wrap-Up: The Currency of Confidence and Clarity

As we wrap up this deep dive, let’s tip our hats to the lasting lesson from Rod Tidwell’s mantra. Whether you’re splurging on that slick brown leather hat or meticulously mapping out your career trajectory, “show me the money” continues to be the north star of assertiveness and transparency in financial escapades. From boardrooms to living rooms, this rallying cry’s currency is timeless: it buys confidence and trades in the clarity that will keep it echoing through future generations of deal-makers and dreamers alike.

Show Me the Money: Behind the Catchphrase

You know, when Rod Tidwell shouted “show me the money” in ‘Jerry Maguire,’ it wasn’t just a call for a paycheck—it became a cultural phenomenon. It’s a bit like how a stylish, classic outfit can sometimes just click—I mean, pairing a swanky brown leather hat with the perfect ensemble could turn as many heads today as Cuba Gooding Jr.s iconic line did back in ’96.

But hold up, let’s pivot for a second. The “show me the money” sentiment isn’t all that far off from the enthusiasm displayed when unexpected underdogs steal the limelight. Take the South korea Vs. Brazil soccer match, for instance. Soccer fans around the world clamored to see whether the anticipated giant, Brazil, would take home the win, or South Korea would pull a Tidwell and scream victory from the rooftops. Talk about a nail-biter, right?

Throwing Around the Benjamins

Okay, transition! Did you know that despite “show me the money” being a pretty timeless phrase, its use in the pop culture lexicon has skyrocketed since 1996? Who’d have thought, huh? It’s like knowing that scene in your favorite gritty drama where the unexpected gets served up. Speaking of which, game Of Thrones Nudes scenes were also a bit of a shocker to audiences, weaving a mix of medieval intrigue with some very modern ratings magic. Just goes to show, whether it’s money or shock value, people love a good surprise.

But of course, money talks aren’t just for the silver screen or the fantasy realms. They echo through the halls of high schools just as loudly. I mean, if you caught wind of the scandal when teenage dramas slipped into too much risque territory, you’d get just how delicate the balance is—akin to the uproar over content like teens With Boobs, where the debate about appropriateness in media raged as fiercely as a cinematic monsoon. Boy oh boy, the things that can incite a crowd, am I right?

So there you have it—a little money talk, mixed with a touch of cultural flair. Whether it’s the almighty dollar or the shock of scandal, it’s clear that when we say “show me the money,” what we’re really asking for is a ticket to the show. And let’s be honest, who doesn’t love a good show?