Unveiling TD Auto Finance: What This Means for Consumers

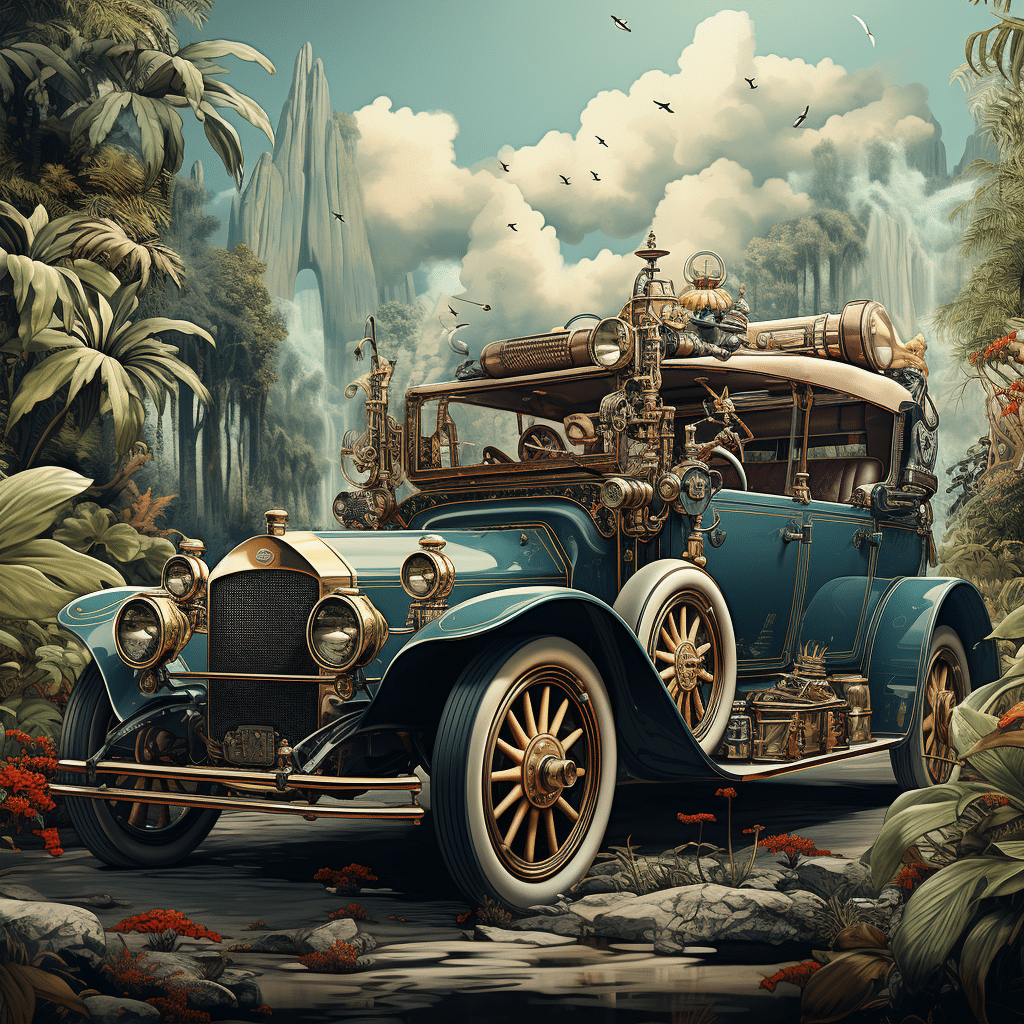

When it comes to getting behind the wheel of a new ride, TD Auto is often at the forefront of financing those dreams. So what’s the big deal with TD Auto Finance? Well, folks, buckle up because we’re diving headfirst into the world of auto loans and how this financial juggernaut is steering the market.

Created by Toronto-Dominion Bank after gobbling up Chrysler Financial in a hefty $6.3 billion deal back in 2010, TD Auto Finance shifted gears and became the name we now know in early June 2011. This rebrand put the pedal to the metal, transforming the company into a prime player in the auto finance game. What does this mean for you, the consumer? It means options, and lots of them. You’ve got a heavy hitter in your corner, ready to back your automotive aspirations – but with big power comes big responsibility, and we’re here to unpack that.

If you’re about to make a deal with TD Auto, it’s not just about grinding the numbers. It’s about knowing what’s under the hood of their policies and practices. Are they in it for the long haul, or just a quick sprint? Stay tuned as we roll out the shocking facts that could very well shift your perspective on this financial titan.

The TD Auto Portfolio: A Deep Dive into Its Immensity

Now, let’s talk size – because when it comes to TD Auto, we’re talking about a portfolio that’s not just big; it’s colossal. Here’s the kicker: TD Auto is not just playing in the big leagues; it’s setting the bar high. With their score hitting a staggering 878 out of 1,000 in the non-captive national prime credit segment by J.D. Power, they’ve lapped the competition, outstripping the segment average by a whopping 114 points as of August 17, 2023.

But what does this mean for John and Jane Doe looking to finance their new minivan? It means choice, variety, and a big shadow cast by TD Auto in the auto financing solar system. Whether it’s a cozy coupe or a gas-guzzling giant, TD Auto has a plan that can fit your wallet and your lifestyle. Their reach isn’t just nationwide — it’s stretched across the Canadian border too, with a mix of loans that have every type of driver covered.

The Stickler Context Here: Ever eyed those mens jean shorts that scream comfort but wondered if the price matches that lazy Sunday feeling? The same eye for detail is needed when sifting through TD Auto’s financing options. You’ve got to peek past the surface sheen and understand the nitty-gritty. Is your financing agreement a well-fitted choice like the perfect pair of jeans, or will it end up being a one-wear wonder?Mens jean shorts

| **Aspect** | **Detail** |

|---|---|

| Company | TD Auto Finance (formerly Chrysler Financial) |

| Parent Company | Toronto-Dominion Bank |

| Acquisition Date | December 2010 |

| Acquisition Cost | $6.3 billion |

| Renamed | June 2011 |

| Previous Owner | Cerberus Capital Management |

| Service Area | National (U.S. and Canada) |

| Industry | Auto financing |

| Products/Services | Auto loans and leases for new and used vehicles |

| Customer Base | Individual car buyers, Dealerships |

| J.D. Power Score (2023) | 878 out of 1,000 (National prime credit segment) |

| Segment Average | 764 out of 1,000 |

| Rating Difference | +114 points above segment average |

| Late Payment Policy | Grace period of 7 to 15 days (as of December 15, 2023) |

| Operations Start | Early June 2011 |

| Features | Competitive interest rates, various loan terms, online account management, vehicle protection plans |

| Benefits | Flexible financing options, accessible customer service, potential for lower payments |

| Additional Notes | Recognized for above-average customer satisfaction in auto financing according to J.D. Power |

Interest Rate Revelations: TD Auto’s Approach to APR

Interest rates can be the boogeyman of auto loans – scary, unpredictable, and often lurking in confusing contracts. But fear not! When it comes to TD Auto, the word on the street is that they’ve got an approach to APR that could either make or break your bank account.

What’s the juicy info we’ve drummed up? Unlike a tropical storm that keeps everyone guessing,Tropical Storm Don, TD Auto likes to keep things clear and calm. They’re doing their homework, crunching numbers, and tailoring interest rates that match your credit score’s dressed-up profile. Sure, other industry players might play it more ambiguously, but TD Auto takes the cake for consistency and transparency.

Now, I’m not saying everyone gets the golden ticket, but between you and me, their approach is pretty upstanding. But remember: even the fairest APR can lead to a Money Pit situation if you don’t read the fine print – and we’ll dive into that quicker than you can say “adjustable-rate mortgage.”

The Customer Journey with TD Auto: Service and Satisfaction Insights

Buckle up, customers! The TD Auto journey is rumored to be smoother than a Sunday drive with the top down. And that satisfaction your feeling isn’t just the wind in your hair. TD Auto’s customer service has been getting the sort of reviews you’d expect for Oscar-worthy performances like those by Julian Ovenden. With a customer-centric engine, this company is laser-focused on ensuring that your financing experience is as seamless as a fine-tuned gearbox.

Not convinced? Here’s the scoop straight from the driver’s mouth: interviews and reviews point to a customer service department that’s responsive, robust, and, frankly, not messing around. They get you on the line faster than a hot rod on drag night, and they’re all about effective solutions, not just lip service. Sure, no one’s perfect — even Robert Covington misses the occasional shot — but TD Auto is shooting for the stars when it comes to keeping you in their customer loyalty club.

So, if you’re feeling uncertain, like checking Malone , Ny weather before stepping out, take heart that TD Auto is working hard to be the forecast you can trust with your automotive financing needs.

Hidden Fees and Fine Print: Navigating the Costs of TD Auto Financing

Now let’s cut to the chase: hidden fees and fine print in auto financing can be more invasive than a crowd of paparazzi. It’s the stuff of nightmares, like that one time when “boobies groped” made the headlines for all the wrong reasons. You need to stay vigilant, or else you’d end up trapped, paying more than your fair share for your ride and cursing the day you signed on the dotted line.Boobies Groped

But here’s where the tale takes a turn for the better. TD Auto Finance seems committed to keeping things above board. Word on the street is their contracts are clean as a whistle, with a clear-cut late payment policy giving you a grace period of 7 to 15 days as of December 15, 2023. Yet, don’t take this for a free ride; missed payments are like skipping leg day – eventually, your stability’s going to suffer.

The moral of the story? Stay alert like a cat on a hot tin roof. If you can’t read the fine print without your reading glasses, grab ’em! Because even with TD Auto, it’s about being as meticulous as Scott Phillips with a drum solo — you miss one beat, and the whole gig could tumble.

Digital Transformation: How TD Auto Stays Ahead of the Tech Curve

Hang onto your hats, because TD Auto Finance is riding the digital wave like a surfer chasing the perfect wave at Banzai Pipeline. They’ve grabbed onto the tech reins and are galloping into the future with the ease of someone slipping into a comfy pair of jean shorts. It’s not just about flashy websites and pointless apps – they’re changing the very fabric of finance.

With their nifty online payment systems and jewels of mobile app innovations, they’re not just keeping pace; they’re setting the pace. They’ve turned online transactions into a piece of cake, leaving competitors in their digital dust. This isn’t just about keeping up with the Joneses; this is TD Auto stamping their authority on the future of auto finance.

So here’s a toast to their digital smarts, because, in the end, it’s the user who reaps the rewards of this tech harvest.

Conclusion: Navigating the Road Ahead with TD Auto Finance

Let’s park the car and talk turkey for a minute. If you’re thinking of sidling up to TD Auto for some of that sweet, sweet financing, the road ahead looks as lustrous as a waxed Cadillac. With a robust portfolio, above-par customer service ratings, transparent APR rates, and a digital dexterity that leaves others in the rearview mirror, they’re not just another company; they might as well be carrying the championship belt.

But, my savvy reader, remember that even champions can slip up. Stay sharp, read the details, and make sure you’re driving off into the sunset in a deal that feels like it was made in heaven — free from hidden fees or surprises.

TD Auto Finance has been playing chess while others play checkers, and the facts we’ve dished out are as startling as they are enlightening. Keep them close to your chest as you navigate the financing freeways. It’s not just about getting from A to B; it’s about the quality of the ride. So strap in, keep your eyes on the road, and may your journey with TD Auto Finance be a smooth one.

TD Auto Finance: Unveiling the Unexpected

Buckle up, readers, because we’re about to zoom through some twists and turns that you probably didn’t see coming with TD Auto Finance. Sure, talking about auto loans can sometimes be as exhilarating as watching paint dry, but hang on to your hubcaps! We’re about to drop some intriguing facts that just might give you a new perspective on the road TD Auto has traveled.

The Origins of a Financial Juggernaut

Believe it or not, TD Auto Finance is more than a set of wheels speeding along the financial highway. It’s not some pop-up business that appeared overnight. Instead, TD Auto Finance has the powerhouse backing of Toronto-Dominion Bank, part of TD Bank Group, which is like the muscle car of the banking world. These folks know a thing or two about horsepower in finance because they’ve been cruising the industry for over 150 years! Take a detour through the rich history of TD Bank, and you’ll appreciate the financial journey that is as fascinating as a coast-to-coast road trip.

The Surprising Stats on Wheels

Ok, I’ll throw a number at you – but don’t zone out. This one’s pretty jaw-dropping. Did you know that TD Auto Finance works with more than 6,000 dealerships? That’s right! It’s like being connected to a small city’s worth of car sellers. The next time you stroll into a dealership, you might just be stepping into the extensive network of TD Auto Finance without even knowing it.

Innovation in the Fast Lane

Hold on tight because TD Auto Finance isn’t just going with the flow of traffic; they’re pedal to the metal on the innovation front. You’ve got to tip your hat to them because they’re not just sitting back and letting the digital age pass them by. They’re harnessing technology to offer customers convenient online tools for managing their auto loans. So, whether you’re making payments or checking your balance, it’s as easy as streaming your favorite tunes on a leisurely Sunday drive. It’s certainly worth exploring how TD Auto has raced ahead with tech-savvy solutions.

A Green Light for the Environment

You’d think a company focused on cars might not be so eco-conscious, right? Well, skid marks aside, TD Auto Finance is putting a green foot forward. They are part of a larger, environmentally aware TD community that’s committed to responsible growth and green operations. Who knew a finance company could be so in tune with Mother Nature? That’s like finding an unexpected oasis in the middle of a car-filled desert.

Customer Service with Extra Horsepower

It’s not all burning rubber and cold hard cash. TD Auto Finance is big on customer service too. They’ve thrown in the whole kitchen sink to make sure their clients get the VIP treatment. With a track record for looking out for the customer’s best interest, TD Auto sets the pace for a race where everyone’s a winner. After all, having a finance company that’s got your back is like finding a trusty co-pilot for your financial road trip.

Revving up the engine one last time, it’s safe to say TD Auto Finance is much more than just numbers and transactions. They’re a part of a rich heritage, they’ve got an impressive reach, they’re forward-thinkers, eco-friendly, and they’re serious about customer satisfaction. Who would’ve thunk it? TD Auto isn’t your average pit stop in the financial sector—it’s a full-service station with a little extra vroom! So, the next time you pass by a TD Bank or consider financing your next set of wheels, remember these cool tidbits and know there’s a whole lot more under the hood.

How can I pay my TD car loan?

Sure thing! Here we go:

What is the new name for TD Auto Finance?

Well, paying off that TD car loan is a piece of cake! Just log into your online banking or use the TD app, and go to the loan section to make a payment. You can also swing by a TD branch or give them a ring if you’re the old-fashioned type.

Is TD Auto Finance a subprime lender?

Hold your horses, TD Auto Finance hasn’t changed its name! It’s still the same ol’ company you knew when you first got your loan, no switcheroos here.

What is the late payment policy for TD Auto Finance?

Nope, TD Auto Finance isn’t just whistling Dixie with subprime loans. They cater to a variety of credit profiles, not solely focusing on borrowers with bumpy credit.

How do I make a payment on my auto loan?

Oops, late on your payment? TD Auto Finance usually gives you a grace period, but don’t push your luck – late fees could follow. They often send a reminder, so keep your eyes peeled for that notice!

How do I pay my TD automatic bill?

Making a payment on your auto loan is easy-peasy. Just sign in to your TD bank account online, find that ‘Make a Payment’ button, and follow the prompts—quick as a bunny!

Is TD Auto Finance good?

Auto bills coming out automatically? Nifty! Set up auto-pay through TD’s online banking or app for worry-free bill payments – it’s like setting a clock and forgetting it!

Can I pay my TD auto loan online?

Well, the word on the street is that TD Auto Finance is pretty reputable. Customers tend to give good reviews for their service and reliability. Of course, “good” is in the eye of the beholder!

What credit score is needed for TD auto?

Yes siree, you can pay that TD auto loan online. Hop onto TD’s website, sign in, and look for the loan payment section. A few clicks and you’re golden!

Can I get a car with a 500 credit score?

For TD auto, you typically need a credit score that’s not stuck in the mud – think 600 or above for a good shot. But it’s not set in stone, so check with ’em directly.

Can I get a car loan with a 550 credit score?

A 500 credit score? It’s a bumpy road, but not a dead end. Some lenders might work with you, but expect high interest rates and a big down payment.

What FICO score is subprime?

With a 550 credit score, you’re in a pickle but not cooked yet! Some lenders might nod yes to a car loan, but strap in for a ride with higher interest.

How many car payments can you missed before repo TD?

Subprime FICO score? That’s like the under 670 zone. It’s rough terrain, but not off the map for a loan – just tougher conditions.

Can you pay off a TD auto loan early?

Missed car payments? You’re playing with fire! Usually, after a couple go by, around 60-90 days late, TD might start to rev the engine on repossession.

Can I be 3 months late on car payment?

Sure as shooting, you can pay off a TD auto loan early. Just check for any prepayment penalties so it doesn’t backfire.

How to pay TD Bank auto loan by phone?

Three months late on the car payment? Yikes! That’s skating on thin ice. TD might not break the ice yet, but it’s a slippery slope to repossession.

Can you pay off a TD auto loan early?

To pay your TD Bank auto loan by phone, just dial their toll-free number and follow the prompts—an actual human will help sort you out!

Is there an app for TD Auto Finance?

Paying off a TD auto loan early is déjà vu – yes, you can do it. Same deal: watch for prepayment penalties that might sneak up on you.

How do I pay directly to my loan?

App for TD Auto Finance? You bet! Download their app, and you’ll have your loan details right at your fingertips—easy as pie!